The oncology market, already huge, is set for major expansion. According to analysis from GlobalData, it will generate trillions of dollars in sales from 2023 to 2029. Its growth reflects a global focus on the need for pioneering new cancer treatments. With age a primary risk factor – 60% of cancer cases occur in individuals over 65 – demographic shifts across the Western world mean demands for innovative therapies have never been more urgent.

Regulatory approvals for oncology drugs are steadily increasing, rising at a compound annual growth rate (CAGR) of 7.57% between 2013 (when there were just 16 approvals) and 2022 (43). The US, the largest market, is poised to capture 47% of sales. Other major markets include Europe and Japan; the former will see CAGR for oncology sales hit 8.4% in the runup to 2029 and the latter is projected to reach 8.9%, outpacing the estimated global figure of 6.9% over the same period.[1]

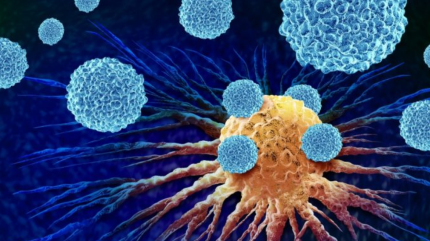

Enhanced understanding around cancer’s complexities has catalyzed the development of advanced biological treatments. There has been a significant rise in new oncology treatment modalities entering clinical trials over the past decade. These include innovative approaches such as mRNA vaccines, antibody-drug conjugates, radionuclide therapies CAR-T cell and CAR-NK therapies. Complexity is mirrored in the oncology-focused clinical development landscape, which faces novel challenges as these advanced therapies progress.

Worldwide demand for cancer therapies is set to soar – and biomanufacturers are in the spotlight. What are the main hurdles they face? Which R&D areas are headlining scientific agendas, and which are lagging behind? New data emerging from the industry is helping its leaders to answer these questions and prepare for the future of oncology.

Trends and challenges

A recent report coordinated by healthcare and clinical services multinational ICON – “Innovation in Oncology: Accelerating R&D in an Evolving Landscape” – surveyed 104 managerial level respondents, representing companies primarily focused on developing oncology therapies, to gauge their thoughts on major trends in the sector. It highlighted the dynamic and rapidly evolving nature of oncology drug development.

The report found that 85% of respondents are developing multiple therapies, and 68% have at least one combination therapy in development. Common therapeutic approaches include cell and gene therapies (30%), targeted therapies (24%), and immunotherapies (23%). mRNA-based cancer vaccines and gene therapies are each being developed by around 27% of respondents.

Key challenges cited include patient recruitment and site selection, with 50% of respondents citing difficulties in identifying experienced sites. Nearly as many respondents report managing complex logistics for therapy supply and manufacture as a significant roadblock.

Statistics from GlobalData’s clinical trial database support these findings. As of October 2024, a significant number of oncology clinical trials in the database – 19,252 out of just over 100,000—had either been suspended, terminated or withdrawn. The top known reasons for disruption were low accrual rate, lack of efficacy and financial difficulties, reflecting the high costs and risky nature of such trials. Other disruption drivers included business or strategic decisions, adverse events, product discontinuation and protocol deviations. Notably positive outcomes trailed the pack as a factor cited in trial pauses, reflecting the forbidding operational hurdles identified by respondents in ICON’s survey.

What about oncology therapies that do make it to market? GlobalData’s drugs database reveals the distribution of oncology drugs across various treatment areas, illustrating a broad range of therapies available. Hematological malignancy leads with 10,332 drugs, with breast cancer following as the second most targeted area with 7,220 drugs and lung cancer also featuring prominently with 6,660 active drugs in the database.

The “other/unspecified” category includes 6,496 drugs and encompasses smaller oncology segments ranging from papillary tumors to HPV-associated cancers. Comprising over a dozen therapy areas overall – including some where the number of treatments available is in single figures, like cholangiocellular hepatoma – it highlights the huge diversity in the kind of oncology treatments biomanufacturers are focusing on. Other solid tumors (4,980 drugs) and male cancers (3,684 drugs) also constitute substantial treatment areas, while skin cancer, bone cancer, and myelodysplastic syndrome (2,899, 1,017, and 899, respectively) represent major treatment areas with just a fraction of the number of drugs on offer compared with the top three.

Change, however, is on the horizon. Historically, drug development has followed a one-size-fits-all model. But advances in precision medicine heralded therapies tailored to specific cancer physiologies and genetic profiles, reshaping the oncology landscape. Emerging therapies and biomarkers now offer hope for hard-to-treat cancers, enabling treatments to be personalized to individual patients and their cancer’s biological characteristics. Furthermore, once a therapy’s efficacy has been validated, these successful drugs can be adapted for additional indications or combination treatments, significantly enhancing their clinical and commercial potential. This is especially relevant in oncology, where targeted approaches are being explored for cancers sharing molecular-genetic traits, rather than traditional tissue-specific categorizations. While precision oncology also introduces new challenges – only a fraction of screened compounds will ever reach approval – the focus on biomarker-driven therapies and tumor-agnostic approaches has the potential radically address unmet needs in the smaller or harder-to-treat cancer segments, comprising the “other/unspecified” category in GlobalData’s drug database.

GlobalData’s deals database reveals regional variations in the value and volume of oncology-related deals in 2024. North America dominates the landscape with a deal value of over $2 trillion across 21,127 deals – 56% of the global total – despite a year-on-year volume decline of 17%. This reflects the region’s continued leadership, particularly in advanced therapeutic areas like cell and gene therapies (CGTs). The CGT market is valued at around $8 billion in 2024, with expectations for significant growth; GlobalData research suggests it could reach $76 billion by 2030 at a CAGR of 45.3%. Oncology is set to account for 44% of the CGT market at the end of this period, driven primarily by cell therapies. This growth trajectory aligns mirrors growth in oncology funding as investors recognise the substantial potential of CGTs. Ongoing research and high level of collaboration, especially in the US, will continue to position the country as a leader in these advanced therapies.

Elsewhere, Europe follows with a deal value of just under $1 trillion and 7,768 deals. Like North America, it faces a decline in deal volume by 22%, highlighting the competitive yet challenging environment for oncology investments there. Asia-Pacific, while having fewer deals (6,155) and a smaller deal value (around $350 billion), has shown a significant year-on-year growth of 65% in deal value, indicating rising interest and investment in oncology, particularly in China and Japan, which are hot on the heels of the US for pioneering cancer vaccine research. Smaller markets like South and Central America and the Middle East and Africa, despite fewer deals (511 and 986 respectively), have shown substantial growth in deal values (111% and 176%), suggesting investor focus on these emerging regions is rising.

Where next?

Huge diversity is evident in the fast-evolving oncology research landscape, from the challenges faced by biomanufacturers to the therapy areas leading the market. Amid this diversity, discerning the market’s future direction is challenging; what do those on the frontline think the key trends will be?

According to ICON’s findings, the future of cancer treatment will lean heavily towards personalized approaches. Nearly half (49%) of respondents believe that personalized therapies, tailored to molecular and genetic characteristics of individual patients, will be the major focus in oncology. This trend reflects a growing emphasis on precision medicine, which aims to increase the effectiveness of treatments by targeting specific genetic markers and mutations within tumors. Just under a quarter of respondents still see a role for universal therapies – like radiation therapy, chemotherapy and surgery – indicating that, while personalized treatments are gaining traction, there remains a place for broader, less specialized interventions. Individualised treatments are expected to be a focus for 13% of respondents; the same proportion foresee a combined approach, integrating elements of both universal and personalized therapies.

Other findings from ICON’s survey indicate an emphasis on growing roles for stem cell therapies, targeted antibodies and gene therapies – with a plurality of respondents optimistic that the result will be improved outcomes for patients. Biomanufacturers should take note. With experts united on the thesis that innovation in oncology will only accelerate, picking the right clinical partners will be critical for those hoping to stay up to speed in a rapidly changing industry.

ICON has the experience and expertise to help sponsors in overcoming the challenges associated with oncology research and clinical trials in order to advance oncology therapeutic development, competitively position therapies in their pipeline, and successfully translate emerging precision therapies into the clinic. Download the report on this page to get the full lowdown on changes coming in oncology, and to learn more about how ICON could help you.

[1] https://www.globaldata.com/media/pharma/globaldata-forecasts-oncology-drug-sales-to-generate-2-2-trillion-between-2023-and-2029/