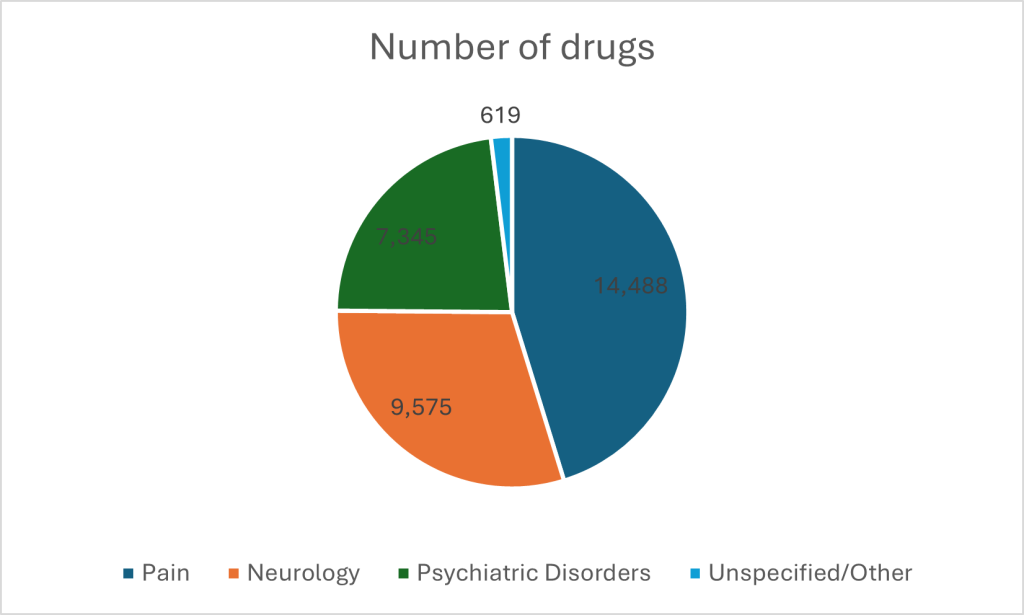

The field of central nervous system (CNS) drug development is awash with activity. Data from GlobalData’s drugs database, as of January 2025, highlights the major areas of action.

Pain management dominates the CNS therapeutic arena, with 14,488 drugs available for prescription or purchase over the counter. Neurology follows with 9,575 drugs; conditions like Alzheimer’s and Parkinson’s disease are driving the market. The next biggest hitter is psychiatry, with 7,345 drugs.

Against this backdrop, innovative new techniques are making their presence felt. New cell and gene therapies (CGTs) are entering the market for CNS disorders all the time, spanning gene therapies, gene-modified cell therapies and conditionally approved cell therapies. GlobalData predictions point to explosive growth; sales will soar from $1.5 billion in 2023 to $12.2 billion by 2029, a huge compound annual growth rate of 42.4%. This makes CNS the second-largest growth area for CGTs after oncology.

Obstacles Blocking Progress

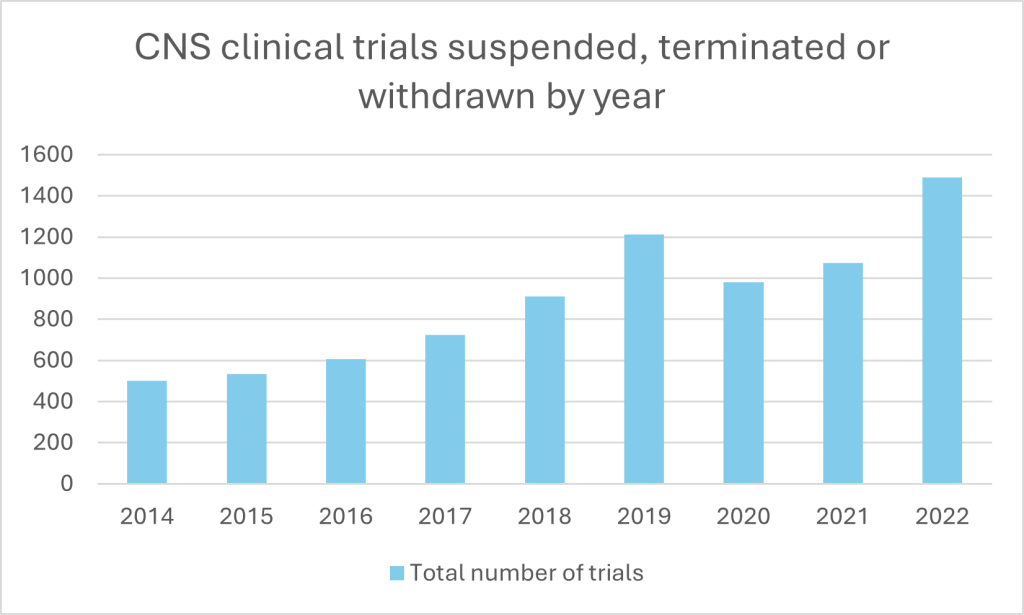

There are, however, pronounced difficulties in making the move from research to market. While scientific advancements have sparked hope for innovative treatments, the reality of drug development remains fraught with challenges. Data on clinical trial suspensions, withdrawals and terminations between 2014 and 2022 – the period for which complete full-year data is most recently available – reveal the steep barriers that continue to thwart progress.

The number of halted CNS trials has surged over the past decade, peaking at 1,488 in 2022. Phase II trials have borne the brunt, with terminations soaring from 204 in 2014 to 650 in 2022; later-stage Phase III trials, which carry the weight of regulatory approval, also face frequent halts, with spikes in 2019 (134 terminations) and 2022 (103). It highlights how significant challenges in scaling early success into clinically and commercially viable therapies still remain. Even Phase IV trials, typically a post-approval formality, showed a steady rise in terminations over the period.

This poses problems for niche CNS conditions where drug availability is starting from a relatively minimal basis, as reflected in figure 1. More trials to treat these conditions are urgently needed; just 2% of therapies currently on the market are targeted towards treating CNS complaints outside the major areas of pain, neurology and psychiatric disorders. The tiny size of smaller subcategories’ markets, such as encephalopathy (50 drugs) and nerve injury (14), only emphasises the problem.

What are the major causes of trial attrition in CNS therapies? According to GlobalData’s Clinical Trials Database, for trials where termination data was available, by far the biggest culprit behind failed trials is recruitment, with low accrual rates responsible for just over half (50.7%) of terminations. CNS studies often demand participants with specific disease stages or rare conditions, making recruitment a slow and costly process. Financial pressures also loom large, cited as the second most common cause of trial halts (15.2%). Even when recruitment succeeds and trials get off the ground, CNS therapies face unique hurdles. Lack of efficacy accounted for 10.6% of halted trials, highlighting the difficulty of translating preclinical promise into concrete benefits. Nearly the same number were attributed to business decisions. Adverse events, though less common (5.2%), present another persistent problem, with the narrow therapeutic windows of many CNS drugs meaning side effects can derail otherwise promising treatments.

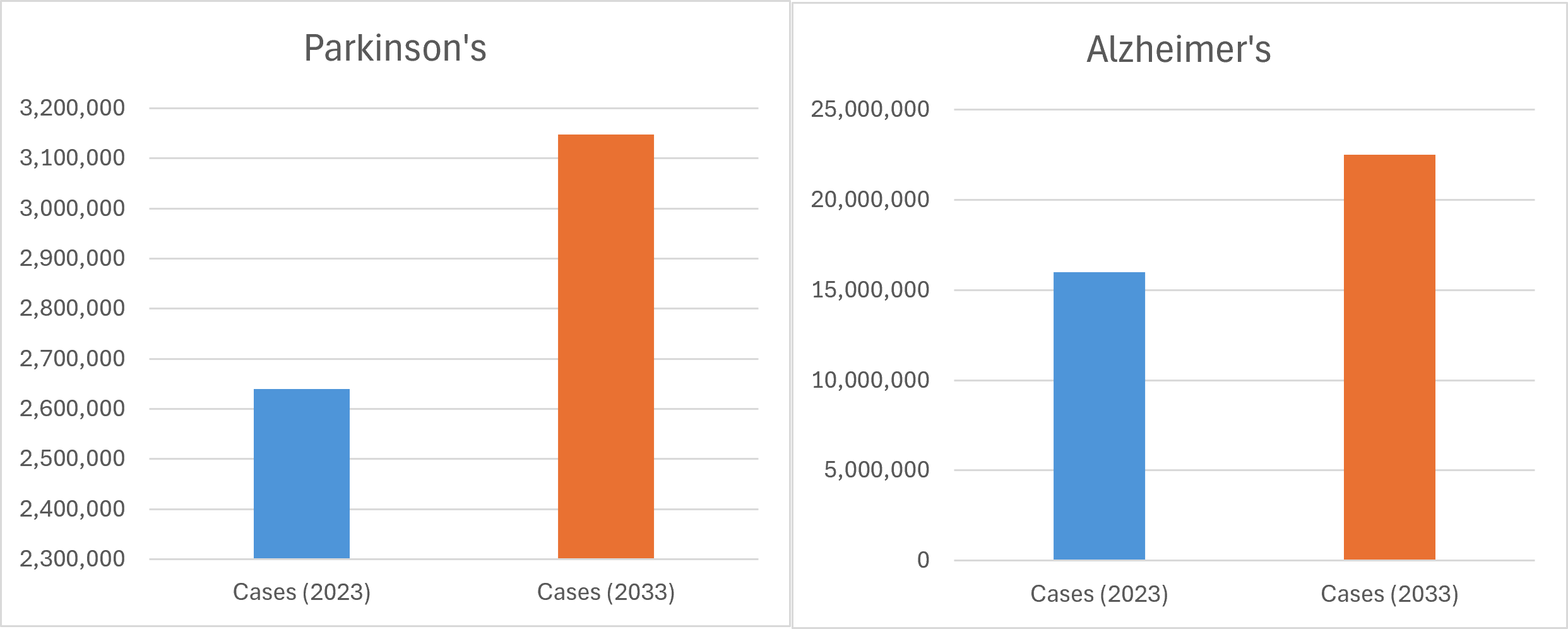

The need to get drugs to market has never been more pressing. The burgeoning burden of CNS disorders weighs heavily on the world’s major pharmaceutical markets. According to GlobalData analysis, Parkinson’s disease diagnoses are projected to increase by around 19% across a number of these markets by 2033,[1] while Alzheimer’s cases are expected to grow by over 40%.[2]

The mounting prevalence of neurodegenerative diseases, from Alzheimer’s to Parkinson’s, is a huge challenge to healthcare systems globally. And the current state of CNS drug development is mixed: massive opportunities from innovation exist on the horizon, but difficulties around managing the transition from research to market persist. How are those on the frontline reacting, and what should they do?

The state of play according to researchers

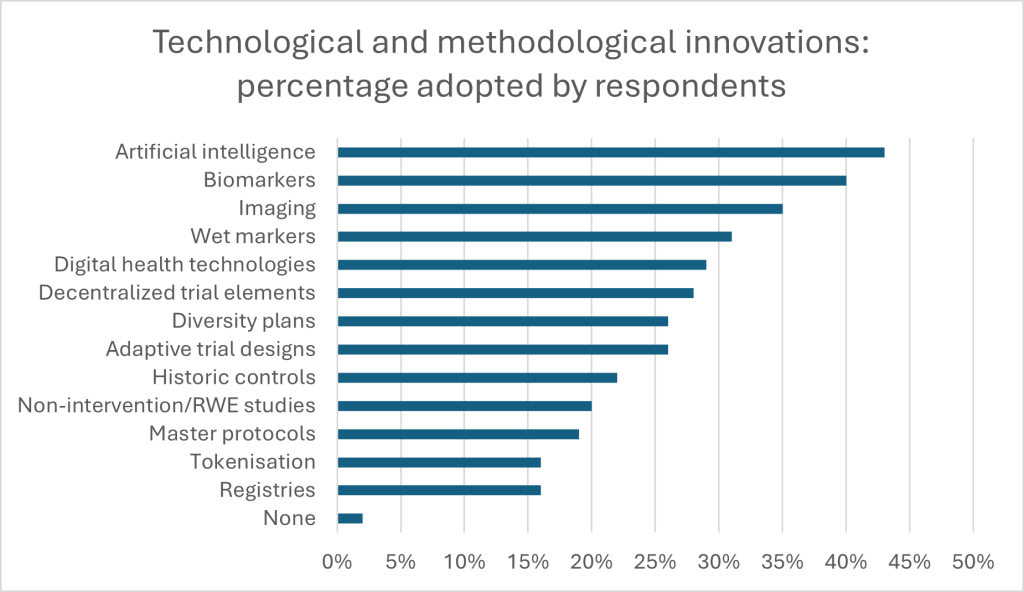

A recent survey of 129 CNS-focused clinical developers, orchestrated by clinical health research firm ICON, reveals a field both fraught with challenges and ripe with opportunity. From diversifying pipelines to adopting digital health technologies, the landscape is rich with lessons for biotech firms and pharmaceutical companies.

One key finding reflects the GlobalData clinical trials analysis: 91% of small businesses respondents cited issues with enrolling sufficient and diverse patient populations as a major hurdle. It highlights a persistent issue: access to representative samples of patients remains elusive, complicating efforts to produce generalisable results.

Despite the barriers, innovation is thriving. A massive 97% of respondents have integrated biomarkers into their CNS trials, with 81% using them for patient screening or outcomes assessment. Digital health technologies, employed by 96%, are revolutionising everything from trial compliance to symptom tracking. Early-stage developers lead in adopting digital biomarkers, with 73% utilising them compared to 35% in late-stage development.

Artificial intelligence (AI) is also gaining traction, particularly in Europe, where 68% of respondents reported using AI for biomarker assessment. The potential of AI to enhance clinical study design and dose optimisation is evident, with 59% employing it for biomarker detection and assessment. And developers are responding to challenges by diversifying both pipelines and methodologies. Approximately 61% of respondents are pursuing multiple therapeutic areas, with 87% investing in CGT and biological products. Notably, early clinical developers are nearly 20% more likely than their late-stage counterparts to invest in CGT.

Overall sentiment in the industry points towards ambivalence about the role of innovation in the future of CNS therapies: 66% of respondents are deterred by upfront implementation costs of novel technologies, while 71% express concerns about the long-term value of novel methodologies (for example due to uncertain evidence of impact, or the threat of intensifying regulatory scrutiny). Biotech respondents, often at the forefront of innovation, are disproportionately affected by these barriers, highlighting the need for cross-industry collaboration and risk-sharing initiatives.

But, the survey suggest, there are ways of navigating an uncertain future: nearly 89% of respondents identified cross-industry partnerships as critical to accelerating CNS R&D. Within this, 43% pointed to standardisation across regulatory requirements as a key opportunity for firms and lawmakers to work together. By fostering collaboration, investing in diverse pipelines and addressing barriers to implementation in regulation elsewhere, industry leaders appear optimistic that they can continue to push the boundaries of what is possible in CNS therapeutics.

The path forward

There is a need for new thinking around major CNS illnesses. Between 2003 and 2022, nearly every phase 2 and 3 Alzheimer’s trial faltered – a grim reality in a field desperate for breakthroughs. But the potential of technologies like biomarkers, digital health and AI is clearly exciting researchers. The recent approval of three amyloid-targeting monoclonal antibodies, including Lecanemab and Donanemab, heralds a new era in neurodegenerative therapeutics.

Disease-modifying therapies owe much to advancements in clinical trial design and execution, and offer a template that biomanufacturers can follow. By leveraging sensitive biomarkers, trials could identify Alzheimer’s patients earlier in their disease progression, when intervention has the greatest chance of success. It is an approach that both enriches study populations and enhances the reliability of trial outcomes. And it paves the way for broader applications across other neurodegenerative disorders

While big biotech companies have proven particularly successful in implementing decentralised technologies, smaller organisations have proved more agile, utilising artificial intelligence for hypothesis generation and biomarker assessment. Both can learn from each other to solve intractable therapeutic barriers. For example, tools like ADAS-Cog, designed for moderate Alzheimer’s stages, lack sensitivity in detecting subtle changes in preclinical populations. Digital biomarkers – such as gait analysis via wearables or voice-based cognitive assessments – offer a promising alternative. By providing continuous, real-time data, these technologies enable more precise and patient-centred evaluations. The capital commanded by large firms and the agility sported by small firms can combine to roll out these technologies more widely. Data can be distributed to push therapeutic boundaries in new directions. It all affirms why collaboration will be pivotal in the future of CNS therapies.

Obstacles in neurodegenerative research are formidable, but the potential rewards could transform the field. Recent developments demonstrate that even long-underassessed therapeutic targets, such as amyloid-beta, can yield success when paired with the right methodologies and technologies. Similarly, the ongoing exploration of combination therapies and preventative approaches offers hope for diseases like Parkinson’s and Huntington’s, which still await their first disease-modifying treatments.

The prevalence of neurodegenerative disease shows no signs of slowing; neither can the urgency with which new solutions are rolled out. The progress made in Alzheimer’s research provides a blueprint for tackling the broader spectrum of CNS disorders. With the adoption of biomarker-informed designs, adaptive trials and patient-centric technologies, the field is poised to turn past failures into future successes. The key lies in collaboration and a willingness to embrace risk.

ICON can help sponsors manage this risk, boasting years of experience in guiding successful CNS therapeutic development, positioning therapies effectively and getting new therapies into clinics. Download the report on this page to understand how researchers are grappling with new challenges in CNS disorders and to learn more about how ICON could help you.

[1] GlobalData report, “Parkinson’s Disease: Epidemiology Forecast to 2033,” November 2024.

[2] GlobalData report, “Alzheimer’s Disease (AD): Epidemiology Forecast to 2033,” December 2024.