The Covid-19 pandemic did much to expose the inefficiencies in clinical supply chains, revealing inconsistencies in inventory management practices and long-established procurement processes. The resulting consensus among the industry was that changes were required.

Four years on, steps have been taken to strengthen the supply chain and ensure that the pharmaceutical industry has the necessary resources despite challenging circumstances. However, multiple factors must continue to be reviewed for the sector to remain as resilient as possible in future.

New technology, sustainability concerns, geographic inequality, and the question of diversity are all starting to change how the clinical supply chain functions. We take a look at four key industry trends and examine how they will help drive the development of the clinical supply chain going forward.

Embracing new technology

The use of new technology has the potential to help bypass logistical challenges that negatively impacted clinical supply chains during the pandemic, and more recently during the Ukraine-Russia war.

Artificial intelligence (AI) is increasingly being deployed to optimise various processes. One of these uses is to improve the performance of the manufacturing line through robotics. When enhanced with 5G, AI, and connected to the Internet of Things (IoT), manufacturing robots can be programmed to adjust their performance to achieve optimal productivity and efficiency.

Alongside this, IoT technology is set to fill other important gaps in the clinical supply chain moving forward. GlobalData analysis predicts that the total healthcare IoT market will be worth $60.6bn in 2027, doubling in size from $30.3bn in 2022 at a compound annual growth rate of (CAGR) of 14.8% over the five-year-period.

Tech can be leveraged to create a ‘digital twin’ of any supply chain, which can then be examined to identify inventory issues, manufacturing bottlenecks, and other areas for optimisation. In addition, AI is being used to determine the most efficient logistics routes according to the unique requirements of a shipment and can adapt in real-time amid changing circumstances.

Improving sustainability across the supply chain

The growing importance of sustainable practices is also central to the clinical supply chain’s evolution. Awareness of environmental, social, and governance (ESG) issues is increasing, as illustrated by GlobalData’s Q4 2023 ESG Sentiment Polls. This survey found that 35% of respondents cited pressure from consumers, and 30% pressure from investors, as the primary reason for establishing an ESG strategy.

According to GlobalData, 90% of a pharmaceutical company’s emissions are Scope 3 emissions, meaning those generated by their supply chains as opposed to the company itself (Scope 1) or purchased energy (Scope 2).

As governmental bodies across the globe, from the EU to the US, seek to enshrine sustainable business practice into law, ensuring a low-waste, low-emissions supply chain is becoming more important than ever for pharma companies wishing to retain investment and market access.

Introducing recyclable packaging, eliminating single-use plastic, and investing in carbon-neutral transport are all trends increasingly being adopted across the supply chain to reduce environmental impact.

Decentralised manufacturing in pharma

After the Covid-19 pandemic exposed flaws in the traditional clinical supply chain model, decentralised manufacturing is increasingly viewed as a means to boost security and ensure certainty of supplies.

According to a report by the European Medicines Agency, decentralised manufacturing has the potential to enable patients to have easier and faster access to novel therapies due to the production facilities being nearer.

For many in the pharma industry, decentralised manufacturing offers greater flexibility with clinical supplies, reducing the reliance on a single facility by spreading operations out across more locations. Furthermore, using facilities across different regions enables suppliers to focus on specific items or raw materials. For example, if there is a particular demand for a material or product in one region, it can be served more effectively from a manufacturing facility closer to where it is needed.

Another advantage of decentralised manufacturing within a region is that it provides faster access to supplies.

If a shipment is being transported to the other side of the world, it must undergo a series of necessary regulatory checks to enter a particular territory.

However, if a facility within a region is already manufacturing the required items, there will be far fewer

regulatory restrictions and potential delays at borders. Another important factor here is that the personnel working within these regional facilities will not only be well-versed with the regulations but also with how they are interpreted by authorities on the ground.

In addition, decentralised manufacturing supports greater collaborations between suppliers and manufacturers around the world, helping expand service offerings and capabilities.

Furthermore, decentralised manufacturing offers a significant advantage in areas such as biologics that may be particularly sensitive to environmental changes or unsuited to travelling long distances. Being able to transport sensitive clinical materials shorter distances more quickly is a substantial benefit for the clinical supply chain.

The need for diversity in clinical trials and the rise of Africa

Another factor set to influence the clinical supply chain is the increased diversity required for patient pools in trials to develop new treatments. Africa is one destination attracting particular interest for this purpose and holds immense potential.

Despite more than 18% of the global population living in Africa, GlobalData analysis reveals that there are currently only approximately 6,000 trials taking place there, which is less than 9% of the global total.

This discrepancy is especially pressing given that Africa has the highest disease burden of all the continents, including serious conditions such as HIV/AIDS, malaria, and tuberculosis – which all have high mortality rates. Populations across the continent that could benefit hugely from clinical research have typically been disproportionately underrepresented in the processes that produce life-saving medicines and vaccines.

Given that many diseases investigated by clinical trials most seriously impact countries in Africa, bringing the studies closer to patients will improve assessment outcomes and ultimately the quality of pharma products reaching the market. This also ties in with the trend of decentralised manufacturing.

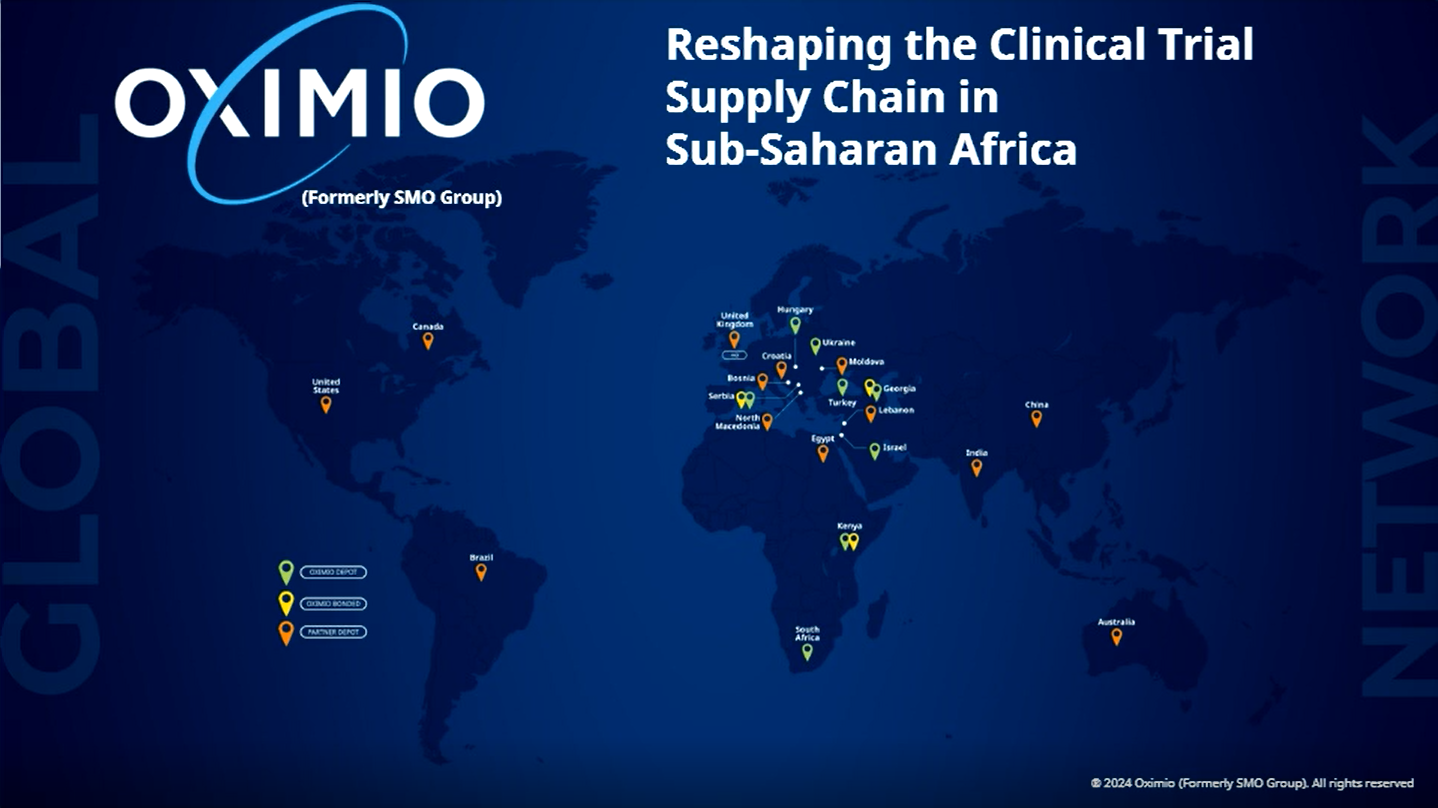

The Oximio Group are global experts in the clinical supply chain industry and have rapidly improved their logistics capabilities across Africa by creating strong supply chains and risk management strategies. With continued development, the continent’s diverse population and increasing resources will provide all that is required to become a major player in the clinical supply chain in the years ahead.

To learn more about how the clinical supply chain is being reshaped in sub-Saharan Africa, register for the exclusive webinar on the link below.