Global demand for drugs of all kinds is increasing. GlobalData’s drugs database forecasts global drug sales, from 2024 to 2030, to show consistent growth every year, with projected sales at $1.54trn in 2026 and $2.12trn by the end of 2030.

But drug shortages worldwide are worsening, leaving patients without essential medications and healthcare providers struggling. The Pharmaceutical Group of the EU (PGEU)[i] say that shortages are impacting both high and low value drugs alike, with GlobalData analysts predicting EU-level policy will not significantly improve the situation by the end of this year[ii].

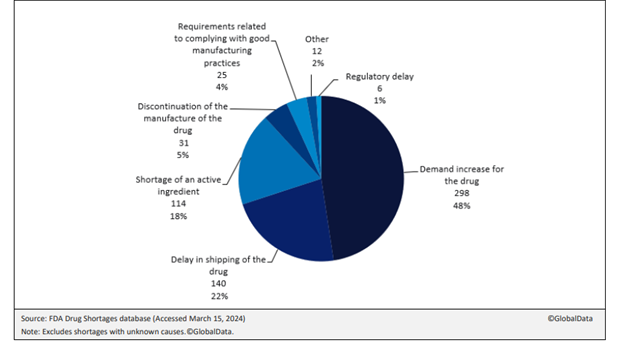

Reasons for these shortages are complex. GlobalData analysis of the FDA’s Drug Shortages database suggests that demand increases for drugs, shipping delays, active pharmaceutical ingredient (API) scarcity and manufacturing discontinuities are among the major drivers, as figure 1 shows. Together, these accounted for 88% of current drug shortages where a cause was known. Demand is especially high for complex drugs such as anaesthetics and oncology treatments.

To address these challenges, it is crucial to integrate sustainable solutions into the pharmaceutical supply chain. Emphasizing sustainability can help mitigate some of the underlying issues contributing to drug shortages. For instance, improving the efficiency of manufacturing processes, reducing reliance on scarce APIs, and enhancing the resilience of shipping networks through sustainable practices can create a more robust and reliable supply chain.

Two of the main challenges for drug supply are short timelines and temperature sensitivity. The main difference between specialty drug supply chains and traditional pharma supply chains is the level of complexity and specialised handling required for these drugs. Complex drugs, such as oncology products, often have short shelf-lives, needing ultra-cold temperatures or even liquid nitrogen storage – requiring seamless cold-chain capabilities and contingency workflows.

As well as temperature-controlled transportation[iii], these products require specialised packaging, enhanced security and unique distribution networks to ensure safe and effective delivery. Another challenge is the financial burden. Cell and gene therapies have high-value pricing due to their complexity, meaning robust mitigation is needed for any supply chain risks.

This shift from small to large molecules supports high-value, low-volume portfolios. High drug prices can also contribute to rising healthcare costs and have broader economic impacts on individuals and healthcare systems. According to research collated by World Courier, approximately 2% of the US population uses specialty drugs – accounting for 51% of total pharmacy spending.

To move forward and establish robust specialty drug commercial supply chains, key considerations must include revising arrangements to increase resilience, monitoring changing consumer consumption patterns, managing cybersecurity risks, and developing alternative distribution strategies.

The importance of prioritising collaboration and sustainability

The recent GlobalData survey shows that 18% of US drug shortages were due to shortages of APIs. The majority of APIs for drugs are manufactured overseas from the US, with India and China playing a crucial role. The pharma supply chain is complex and involves multiple locations, such as raw materials being shipped from Europe to India, where a contract manufacturing organisation (CMO) creates the API, processes it, and ships the intermediate product to another CMO in India for formulation. The intermediate product is then forwarded to the US, where another CMO completes the filling and packaging processes.

In this example, the importance of addressing the temperature range of intermediates during transportation is clear. For many complex drugs, any temperature deviation can cause material degradation, making the product unusable. This became increasingly evident during the Covid-19 pandemic, leading governments such as the US and EU to increase funding for nearshoring or onshoring activities. However, companies must be realistic about setting up manufacturing facilities closer to their target market, which can take years. Changing sourcing location is still more complex than changing a manufacturing location due to the high level of regulatory approvals, validations, and infrastructure adjustments required.

Air transport is often the only viable route for the shipment of APIs due to the time-sensitive nature of pharmaceutical logistics. However, air cargo is a significant contributor to global carbon emissions. Based on today’s technology, the most effective way to mitigate these emissions is through investment in sustainable aviation fuel (SAF), which can reduce carbon emissions by up to 80% (versus standard jet fuel)[iv]. This makes SAF the only current method capable of achieving science-based carbon reduction targets. A wider adoption of SAF by the logistics industry is imperative, as increased investment and research and development will make it more affordable over time

Strong partnerships can help to secure pharma supply chains. Many companies are now recognising the value of early engagement between R&D and manufacturing teams to streamline the development and manufacturing process. However, some pharma companies still tend to view manufacturing logistics from a transactional point of view, which can lead to less attention in adopting a consultative approach.

This collaborative approach allows logistics providers to establish strategic partnerships and go beyond basic transportation. By actively identifying and addressing logistical challenges, providers can develop innovative solutions. Consultative logistics providers often invest in acquiring deep pharma industry knowledge, staying up to date on market trends, regulatory changes, and technological advancements. Such knowledge can provide valuable insight, guidance, and recommendations.

Packaging innovation is another area where partnering can drive improvements. The focus on sustainable packaging is a priority for improving quality assurance within supply chains. As businesses worldwide seek ways to reduce their carbon footprint, it is crucial to focus on improving supply chains, particularly in the pharmaceutical industry, which has historically accepted an average loss on shipments of products spoiling due to temperature deviations.

The pharma industry has been slow to adopt reusable packaging solutions, often due to regulatory considerations and the need for cost-effective solutions. A pragmatic approach to the qualification process can accelerate approval processes and benefit the best fit for purpose, especially for life-saving medications. Consistency is another important factor to consider. For example, APIs shipped as part of manufacturing logistics can put business continuity at risk if they deviate from mandated temperature ranges; ensuring shipments reach their destination in optimum condition remains the priority.

Packaging innovation has demonstrated significant environmental benefits by reducing waste and carbon emissions. Reusable solutions can and have replaced single-use Styrofoam boxes and dry ice, leading to smaller warehousing requirements, reduced packaging preparation time, and enhanced health and safety by eliminating hazardous dry ice.

Ensuring a reliable and efficient supply chain

Specialty drug supply chains are more complex than traditional models. Specifying procurement requirements within tenders requires clearly defining specific criteria and expectations for potential suppliers.

The tender process starts with a needs assessment, which determines the basic critical requirements for the logistics project, such as the launch of the drug or the supply of an established drug throughout the product. Evaluation criteria are established to assess suppliers, followed by information requests (RFI), request for proposal (RFP), and request for quotation (RFQ).

This assessment phase is crucial for risk mitigation, cost considerations, and determining a realistic budget. It is essential to create a level playing field for potential suppliers and conduct fair and objective evaluation processes to ensure equal opportunities. However, gaps in the assessment phase can hinder the tender process and mean the right suppliers are not selected.

It is imperative that the tender process includes clear submission requirements, including deadlines, documentation, format, and pricing. Surcharges can make a significant difference when comparing prices. Therefore, specific instructions should help ensure a standardised and fair evaluation process.

There is a need to expedite the procurement proposal and quotation stages, improve onboarding of new logistics and distribution partners. For this purpose, it is vital to share a detailed understanding of the product’s requirements and organisational needs. Involving stakeholders internally – such as R&D, logistics department or legal and seeking external support from established logistics partnerships – can provide valuable insights. It is essential to understand that every tender process is unique and there is no one-size-fits-all solution.

When it comes to handling cold-chain, World Courier stands out as an experienced logistics partner, protecting the commercial supply chain for drug products due to their efficient temperature control solutions, ensuring that products arrive at their destination on time and in the optimum conditions.

To learn more about how a partnership with World Courier can help you achieve your supply chain goals, download the free paper below.

[i] https://www.pgeu.eu/publications/pgeu-press-release-european-doctors-and-community-pharmacists-discuss-solutions-to-combat-shortage-crises/

[ii] https://www.iata.org/en/programs/sustainability/sustainable-aviation-fuels/#:~:text=What%20is%20SAF%3F,waste%20and%20non%2Dfood%20crops.

[iii] https://www.pharmaceutical-technology.com/sponsored/finding-the-right-solution-and-partner-for-your-drug-products-commercial-supply-chain/

[iv] GlobalData: Bio/Pharmaceutical Outsourcing Report, March 2024.