Novartis is soaring high after a $1bn acquisition of the San Diego-based preclinical stage biotech DTx Pharma specialising in in small interfering RNA (siRNA) treatments.

Along with DTx’s Fatty Acid Ligand Conjugated OligoNucleotide (FALCON) platform, Novartis will also continue development of DTx Pharma’s lead candidate, DTx-1252, for the treatment of the rare disorder Charcot-Marie-Tooth Disease Type 1A.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNovartis will pay $500m up front, with a potential $500m in additional milestone payments.

The FALCON platform was developed by DTx Pharma to solve the limitations of delivering siRNA therapies to tissues outside of the liver. siRNAs are cleared by the kidney too quickly, and the FALCON technology harnesses fatty acids and combines them with siRNAs to improve biodistribution and cellular uptake.

“Every cell in your body has a mechanism to take up fatty acids. So, we thought, is there a way that we can use fatty acids to trick the cells into taking up the siRNA so t it can repress gene expression?” DTx Pharm’s CEO Arthur Suckow PhD told Pharmaceutical Technology.

“It’s not cell targeting, it’s a type of tuning so you get bias toward your preferred tissue.”

In a statement announcing the deal, Novartis said it will now use FALCON to explore delivering other drugs to extrahepatic tissues.

DTx Pharma’s DTx-1252 is aiming to become the first approved therapeutic that targets PMP22 – the underlying genetic cause of Charcot-Marie-Tooth Disease Type 1A. In June, The US Food and Drug Administration (FDA) granted orphan drug designation to the privately held company’s lead asset.

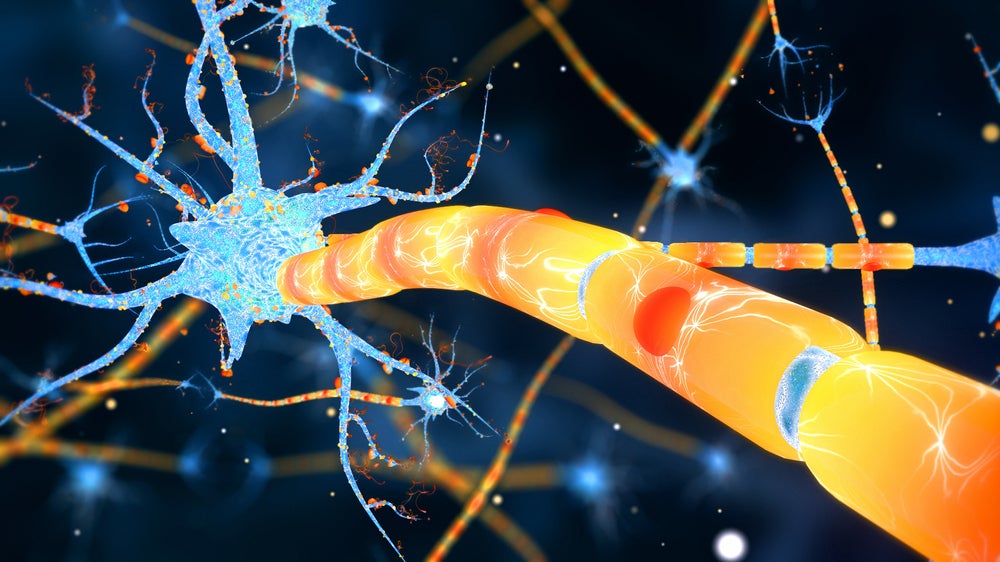

Kickstarted by the Charcot-Marie-Tooth Research Foundation, a patient advocacy group, the programme by DTx Pharma has demonstrated disease reversal in animal models. The therapy induces remyelination of axons, which are demyelinated in the disease, and improves muscle weakness.

Suckow said: “We’ve generated evidence that showed you could reverse the condition such that you could barely distinguish a wild-type animal from a DTx-1252 treated animal [that previously presented with replication of Charcot-Marie-Tooth disease].”

Novartis pulled the trigger after DTx Pharma generated a package of promising data in both rats and non-human primates, Suckow said. The pharma giant will now be eyeing Phase I trials that can show the drug can be delivered to the peripheral nervous system in specific dose ranges. Novartis might even look to accelerate the timelines DTx Pharma had set, with clinical trials in humans expected to start in late 2023 or early 2024, said Suckow.

As part of the acquisition, Novartis has also gained two other preclinical programmes from DTx Pharma which focus on the central nervous system and neuromuscular indications.