AstraZeneca has signed a global exclusive licence agreement with KYM Biosciences for the latter’s Claudin-18.2 antibody-drug conjugate (ADC), CMG901.

KYM Biosciences is a joint venture (JV) established by Chinese biotechnology firm Keymed Biosciences and Lepu Biopharma.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUnder the licence deal, AstraZeneca will handle the research and activities related to the development, manufacturing, and commercialisation of CMG901 globally.

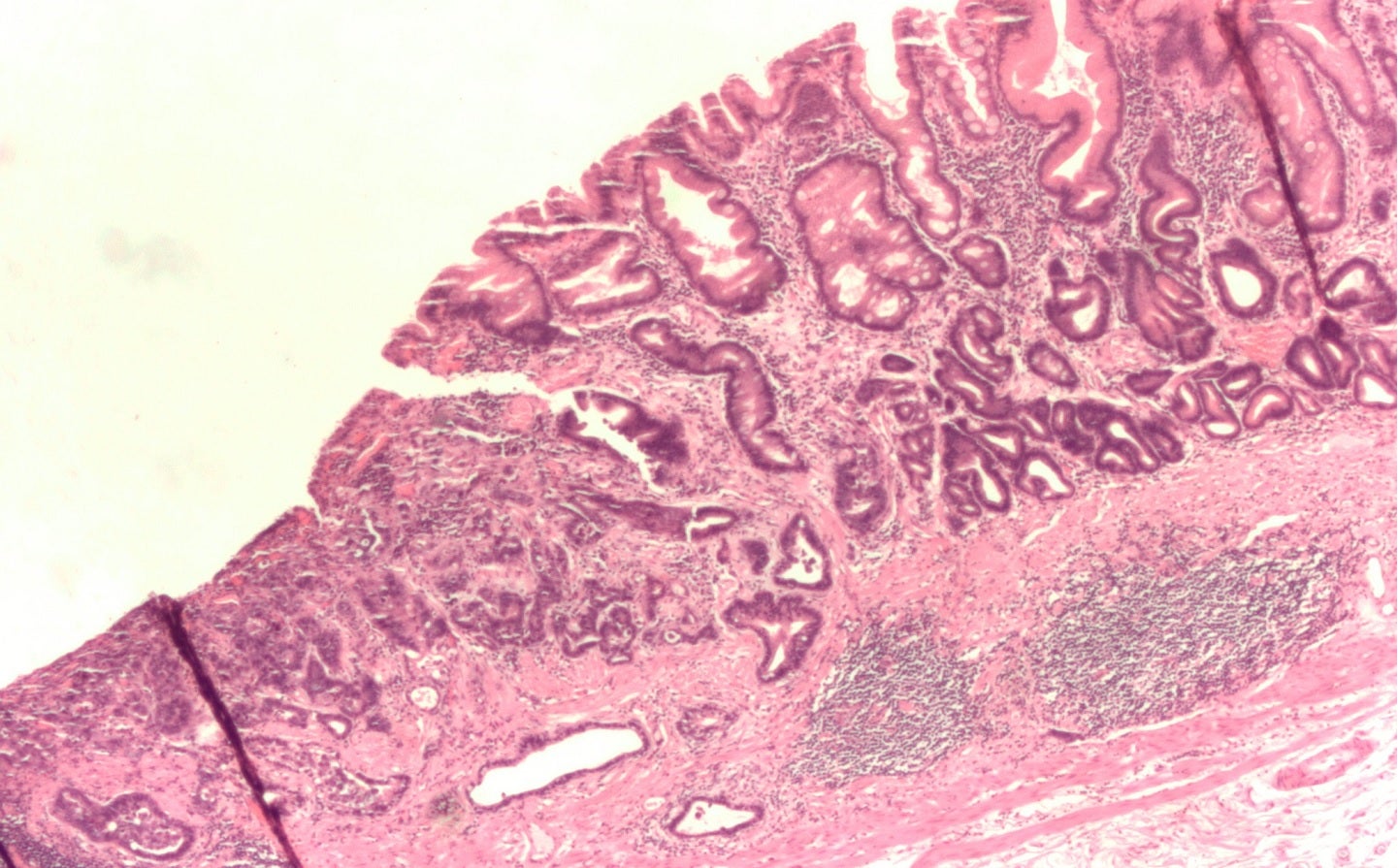

CMG901 comprises an anti-Claudin 18.2 monoclonal antibody, a cytotoxic small molecule monomethyl auristatin E (MMAE) and a protease-degradable linker.

It is being developed to treat solid tumours that express the Claudin 18.2 cell surface protein, including gastric cancers.

Currently, the ADC is being assessed in a Phase I clinical trial to treat Claudin 18.2-positive solid tumours, including gastric cancer.

According to the trial’s preliminary data, CMG901 was found to have a favourable safety and tolerability profile and encourage anti-tumour efficacy across the tested dose levels.

AstraZeneca Oncology R&D Biologics Engineering & Oncology Targeted Delivery senior vice-president Puja Sapra said: “We are excited by the opportunity to accelerate the development of CMG901, a potential new medicine for patients with Claudin18.2-expressing cancers.

“CMG901 strengthens our growing pipeline of antibody-drug conjugates and supports our ambition to expand treatment options and transform outcomes for patients with gastrointestinal cancers.”

According to the agreement, KYM Biosciences will receive $63m in upfront payment on the closing of the transaction along with up to $1.1bn in further development and sales-related milestones from AstraZeneca.

The company will also receive tiered royalties up to low double digits.

The transaction, subject to regulatory clearances and customary closing conditions, is anticipated to be concluded in the first half of this year.

Early R&D projects coverage on Pharmaceutical Technology is supported by Mimotopes.

Editorial content is independently produced and follows the highest standards of journalistic integrity. Topic sponsors are not involved in the creation of editorial content.