DPx Holdings BV Secures Purchase of Gallus BioPharmaceuticals

DPx Holdings BV has announced that it has reached a definitive agreement to buy all the shares of Gallus BioPharmaceuticals, a leading contract manufacturing company specialising in biologics and current portfolio company of Ridgemont Equity Partners.

Following the transaction, Patheon’s biologic drug substance business, a unit of DPx Holdings, will span four facilities in Europe, Australia and North America and include 550 employees globally.

DPx Holdings is the parent company of Patheon, DSM Fine Chemicals and Banner Life Sciences. The Patheon pharma services business provides commercial manufacturing, pharmaceutical product development services for a full array of solid and sterile dosage forms, and biologic and chemical drug substance development and manufacturing.

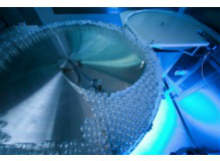

The addition of Gallus BioPharmaceuticals makes Patheon a leading provider of process development as well as clinical and commercial scale manufacturing of mammalian cell culture derived products. Patheon can offer its customers a broad array of disposable manufacturing technology, as well as commercial scale production, throughout its global network.

"We are pleased to expand our biologics business with the acquisition of Gallus BioPharmaceuticals," says Jim Mullen, CEO of DPx Holdings. "This transaction is in line with our strategy. We can now further support the needs of our customers with biologics projects by providing flexibility, leading technology solutions, commercial operations and an expanded footprint with two US sites."

Once the transaction is complete the two Gallus sites in St Louis, Missouri, and Princeton, New Jersey, will be the first Patheon biologic drug substance sites in the US and will complement the two existing sites in Groningen, the Netherlands and Brisbane, Australia.

Three of the four global sites each have nearly three decades of mammalian cell culture experience, while the fourth site in Brisbane was opened within the last year and is considered a facility of the future for biologics. Together these sites will support Patheon’s ongoing growth in biologics and will continue to support the needs of Patheon’s customers in this growing segment of the industry.

In addition, Patheon will be able to leverage its expertise in disposable technology to expedite manufacturing as well as expand its capabilities in mid-scale flexible manufacturing.

"This is an exciting time as we join a world-class company and expand our offerings as one global team specialising in biologics," says Mark R Bamforth, president and CEO, Gallus BioPharmaceuticals. "We have built deep commercial and clinical manufacturing and process development capabilities that are highly complementary to Patheon’s biologics organisation.

"We look forward to the ongoing success and growth by combining our knowledge, skills, technical expertise and capabilities to serve customers’ product needs."

Subject to receipt of regulatory approvals, the transaction is expected to close in the fourth quarter of 2014. Wells Fargo Securities served as lead financial advisor to Gallus, with William Blair & Company and Frontier Management serving as co-advisors.

Goodwin Procter LLP served as legal advisor to Gallus, the Gallus management team and Ridgemont Equity Partners. Skadden, Arps, Slate, Meagher & Flom LLP served as legal advisor to DPx Holdings.