One of the biggest pharma manufacturing opportunities this coming year will be the surging demand for popular weight-loss drugs Ozempic and Wegovy. Obesity drugs are in such high demand in developed markets that there is a shortage of Novo Nordisk’s (Bagsvaerd, Denmark) Wegovy and Ozempic (both semaglutide), and Eli Lilly’s (Indianapolis, IN, US) Mounjaro (tirzepatide) and Trulicity (dulaglutide), all approved or now used off-label to treat obesity. These treatments are proving incredibly successful but insufficient volumes are limiting sales and expansion into new markets. Scaling up to meet manufacturing demand will require considerable time if it is done solely through developing internal capacity, meaning that there is an opportunity for CMOs to secure contracts for high-demand drugs. These medicines reduce appetite and slow down the movement of food in the gut, so patients feel full for longer. By 2030, the anti-obesity medicines market could grow to $30bn for the seven major markets (US, France, Germany, Italy, Spain, UK, and Japan), according to GlobalData’s Epidemiology and Market Size database.

The FDA and EMA have reported shortages of these drugs, and Australia’s Therapeutic Goods Administration (TGA) and Health Canada are advising doctors not to start new patients on them due to the global shortage. Novo and Lilly are building more internal manufacturing capacity to meet demand, but these plants will take years to build and will do nothing to ease shortages in 2024. In the meantime, pharma companies are turning to CMOs. Speaking on the firm’s Q2 2023 financial call, Novo Nordisk CFO Karsten Knudsen said the firm began 2023 with one contract manufacturing filling line for Wegovy and added a second in H1 2023. He told stakeholders a third CDMO filling line is on track going into 2024. “And then on top of that, we will be adding additional filling line capacity [in-house]. So a significant step-up in Wegovy capacity over time.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataKnudsen did not name the contract manufacturers of Wegovy, but they are widely rumoured to be Catalent (Somerset, NJ, US) (at its Indiana, US plant) and Thermo Fisher (Waltham, MA, US), with PCI Pharma Services (Philadelphia, PA, US) reportedly handling assembly and packaging. The addition of a second and third CMO followed GMP issues at Catalent’s site in Brussels, Belgium, which received a Form 483 in January 2022 with seven observations following an FDA inspection in 2021, and a second Form 483 with nine observations following a reinspection in August and September 2022. In April 2023, Catalent admitted in a company press release that it had “experienced productivity challenges and higher-than-expected costs at its drug product and drug substance manufacturing facilities located in Bloomington, Indiana and Brussels, Belgium, where the Company was unable to achieve anticipated productivity levels.” Additionally, in September 2023, Ypsomed struck a deal to manufacture GLP-1 autoinjectors (such as Wegovy and Ozempic) for Novo Nordisk. Ypsomed expects to begin delivering the devices in 2025.

In December 2023, Novo Nordisk announced a $2.2bn investment in Clondalkin, Ireland to expand Ozempic and Wegovy production. This is expected to be operational by 2026, assuming that planning permission is granted. The unit will include three filling and packaging manufacturing facilities, a warehouse building, and two assembly and packaging facilities.

In October 2023, it was reported that Eli Lilly hired CordenPharma (Baden-Wurttemberg, Germany) to produce the active ingredient for Mounjaro. Lilly announced in November 2023 plans for its own $2.5bn manufacturing site in Alzey, Rhineland-Palatinate, Germany, for parenteral drugs and devices, including its diabetes and obesity portfolio, to open in 2027. In September, Eli Lilly’s Japanese subsidiary announced plans for a Mounjaro production facility at its site in Kobe. Lilly expects to open the 2,600m² site in 2025.

Blockbuster success throttled by supply

With no sign of increased supply this year, the addressable market for these drugs is underserved, and sales will be throttled. Novo Nordisk expects the Ozempic shortage to continue into early 2024. Demand is meanwhile surging for Novo’s older obesity drug Saxenda (liraglutide). Eli Lilly has also announced lower supplies of both Trulicity and Mounjaro throughout early 2024. While supply for Wegovy is gradually being expanded, Novo has been restricting the lower-dose strength starter doses since May to limit new patients.

During a Novo Nordisk Q3 2023 earnings call on 2 November 2023, Doug Langa, executive vice-president, North America operations, stated: “In the US alone sales of Wegovy grew by 467% [in the first nine months of 2023].” In the same call, Anat Ashkenazi, chief financial officer, noted that the company’s Q3 revenue grew 32% versus 2022, driven partly by Mounjaro. The “net price [of Eli Lilly’s drugs] in the US increased 13% for the quarter driven by Mounjaro access and savings cards dynamics”. GlobalData’s Pharma Intelligence Center’s Sales and Forecast database states that the combined sales of Wegovy, Ozempic, and Mounjaro in 2022 equate to $9.8bn. GlobalData forecasts that obesity drug Mounjaro will surpass Ozempic’s sales, by rising to $27bn in sales by 2029.

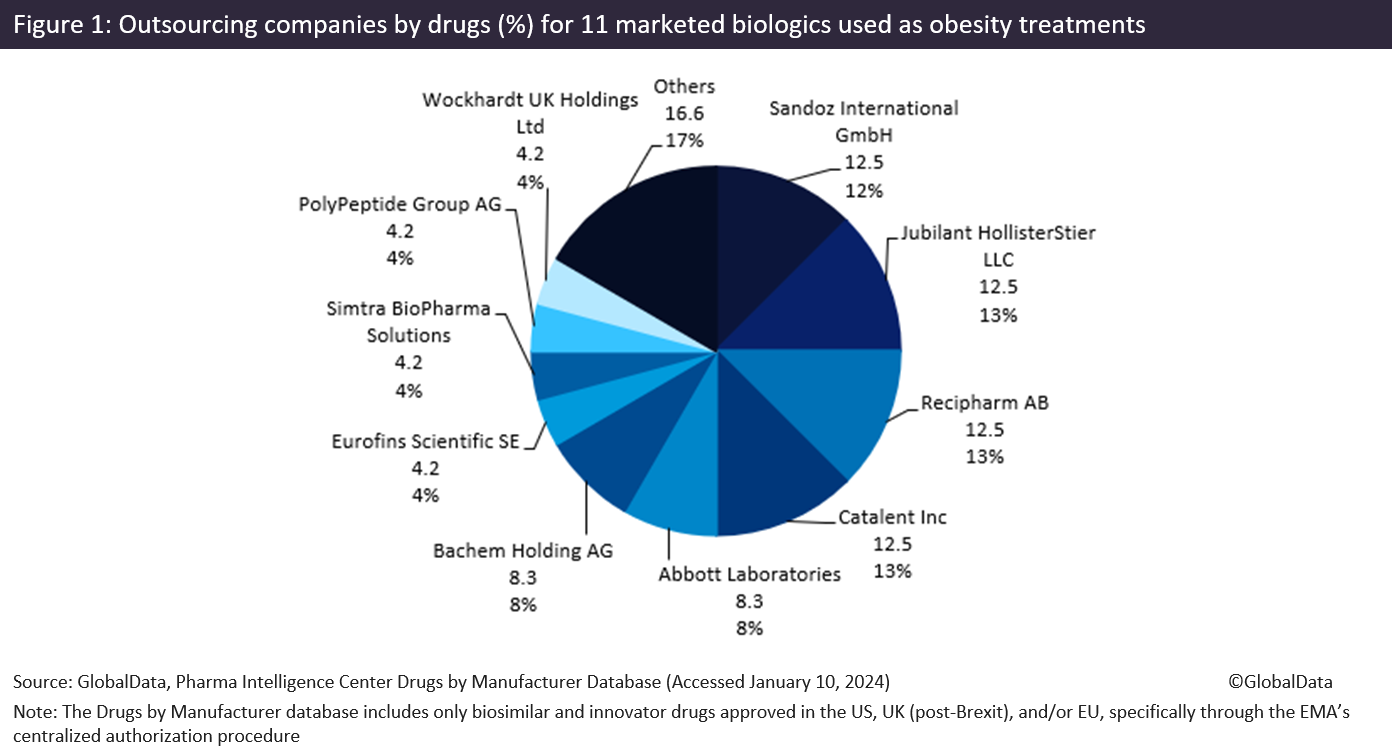

Less-popular obesity treatments rely more heavily on CMOs, including large CMOs such as Jubilant HollisterStier LLC (Spokane, WA, US), Recipharm AB (Stockholm, Sweden), and Catalent Inc. Figure 1 (above) shows there is a range of CMOs producing 11 obesity biologics. These drugs include some other Novo Nordisk blockbuster drugs, Victoza and Saxenda, both liraglutide products, liraglutide is a recombinant peptide and glucagon-like peptide 1 receptor (GLP1R) agonist that acts as an anti-obesity agent. GLP-1 is a physiological regulator of appetite and food intake, and the GLP-1 receptor is present in several areas of the brain involved in appetite regulation.

Table 1: Manufacturing sources for Wegovy, Mounjaro, and Ozempic