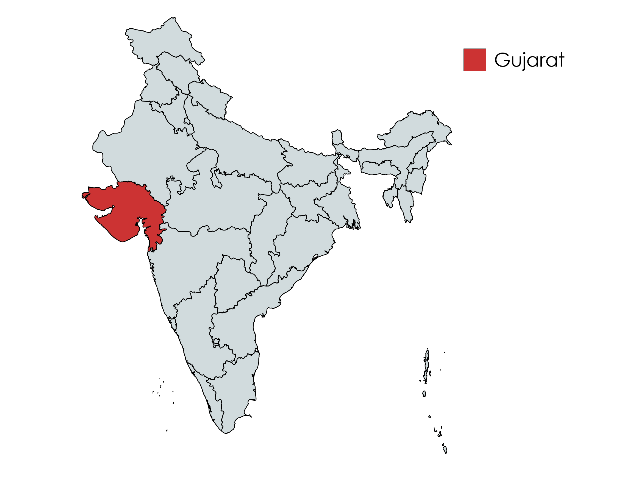

Gujarat has a long and established history as a significant contributor to India’s pharmaceutical industry; it is where the country’s second-oldest drug company, the Alembic Chemical Works Company Limited, currently known as Alembic Pharmaceuticals Ltd (Gujarat, India), in Vadodara, was founded in 1907.

In the modern-day, Gujarat’s pharmaceutical sector has become increasingly innovative. This is the fourth EMOR article in a series covering Indian manufacturing.

Indian tax havens such as Himachal Pradesh, Jammu and Kashmir, Uttaranchal, and Uttarakhand previously had an advantage compared with Gujarat as drug production was significantly less costly in those states, but after the Goods and Services Tax (GST) came into force on 1 July 2017, this was not the case, and Gujarat pharma production shares in India have been increasing ever since. A special economic zone (SEZ) is an area in a country that is subject to unique economic regulations that differ from other regions of the same country. In Gujarat, SEZs are established in Ahmedabad and Vadodara to encourage investment, which has worked as these cities have the most pharma facilities in the state.

The GST reform is designed to ease the complex multiple indirect tax regime in India. The GST is a comprehensive indirect tax levied on manufacture, sale, and consumption of goods as well as services at the national level. It has replaced all indirect taxes levied on goods and services by the Central and State Governments.

India is the largest provider of generic drugs globally and is establishing itself as one of the leading manufacturers of biosimilars. However, Gujarat is associated more with drug production for the domestic Indian market rather than the international market.

Domestic demand for medicines should also increase as the country develops and incomes increase, making healthcare more affordable to a larger proportion of the population. India currently imports nearly 80% of its APIs from China. This overreliance on China has made the pharma industry vulnerable in recent times, and the Covid-19 outbreak–induced lockdown of China’s Hubei province (a major API source) has resulted in India restricting the export of 26 APIs and formulations to prevent a shortage of drugs in India. Gujarat currently has 29 Covid-19 cases as of 23 March 2020 according to the Covid-19 India Dashboard and could be in the early stages of an outbreak.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of overall count of FDA- and/or European Medicines Agency (EMA)-approved manufacturing facilities, there are 124 related facilities in Gujarat, the third-highest of a single state covered so far in these articles assessing Indian states, only the central state pharma powerhouse of Telangana (173 facilities) and southern state Maharashtra (143 facilities) pharma powerhouses covered in the September 2019 and September 2018 EMORs having larger facilities count. However, it should be noted that the number of pharma sites without FDA or EMA approval in Gujarat is also high, so substantial domestic production is not represented in the figure of 124 facilities.

Gujarat’s major industries include agriculture, gems, jewellery, textiles, pharmaceuticals, and chemical. Vadodara, Gujarat’s third-largest city, has the biggest number of pharma manufacturing facilities with 29 in the western state, followed closely by Ahmedabad, Gujarat’s largest city, with 24. Ankleshwar, which has the third-largest number of facilities (19) in the state, is an industrial township. All of these locations account for 57% of all facilities in the state and are all east of the Gulf of Khambhat. There are a number of deserts in Gujarat located to the north and western parts of the state, reducing the potential area for industries and populations to locate to.

International pharma companies and CMOs such as Sanofi (Paris, France), Piramal Pharma Solutions Inc (Lexington, KY, US), Fisher Clinical Services Inc (Allentown, PA, US), Mylan NV (Hertfordshire, UK), and Sun Pharmaceutical Industries Ltd (Maharashtra, India) have manufacturing facilities in Gujarat, Ahmedabad, and/or Ankleshwar.

The majority of sites in Gujarat offer small molecule manufacture; however, API biologic manufacture is also offered. GlaxoSmithKline Plc (Middlesex, UK), Bharat Parenterals Ltd (Gujarat, India), Samex Overseas (Gujarat, India), and Bills Biotech Pvt Ltd (Gujarat, India) have facilities involved in biologic API manufacture (protein and peptide).

The majority of facilities (77%) in Gujarat belong to companies with a single site in the region, which indicates the large merger and acquisition (M&A) potential of the Indian industry.

There are four companies with five or more facilities in Gujarat: Cadila Healthcare Ltd (Gujarat, India), Sun Pharmaceutical Industries Ltd, Alembic Pharmaceuticals Ltd, and Intas Pharmaceuticals Ltd (Gujarat, India). Unlike other Indian states, a relatively high number of companies are heavily invested in Gujarat in terms of facility presence, with only half of these headquartered in the state. The four companies combined have five facilities in Ahmedabad, four facilities in Ankleshwar, three in Bharuch, five in Halol, and six in Vadodara. All companies are excess capacity CMOs; therefore, not all of the facilities may be involved in contract manufacture.

As the above figure shows, the largest number of facilities are only FDA-approved, more than double those that are only EMA-approved. A large number of facilities in the region surveyed (51 facilities) are approved by both regulators. This large reliance on US sales could be concerning to Indian pharma manufacturers given increasing US protectionism. Gujarat is a strong supplier for domestic demand too, with 129 facilities owned by 111 different companies not registered as either an FDA or EMA facility. As the state supplies a diverse array of markets, it is protected to a degree against protectionist policies or another country’s markets becoming less reliant on its supply.

This analysis primarily covers only FDA- and EMA-approved facilities and uses GlobalData’s Contract Service Providers database, which provides world-class insight into the contract manufacturing industry.