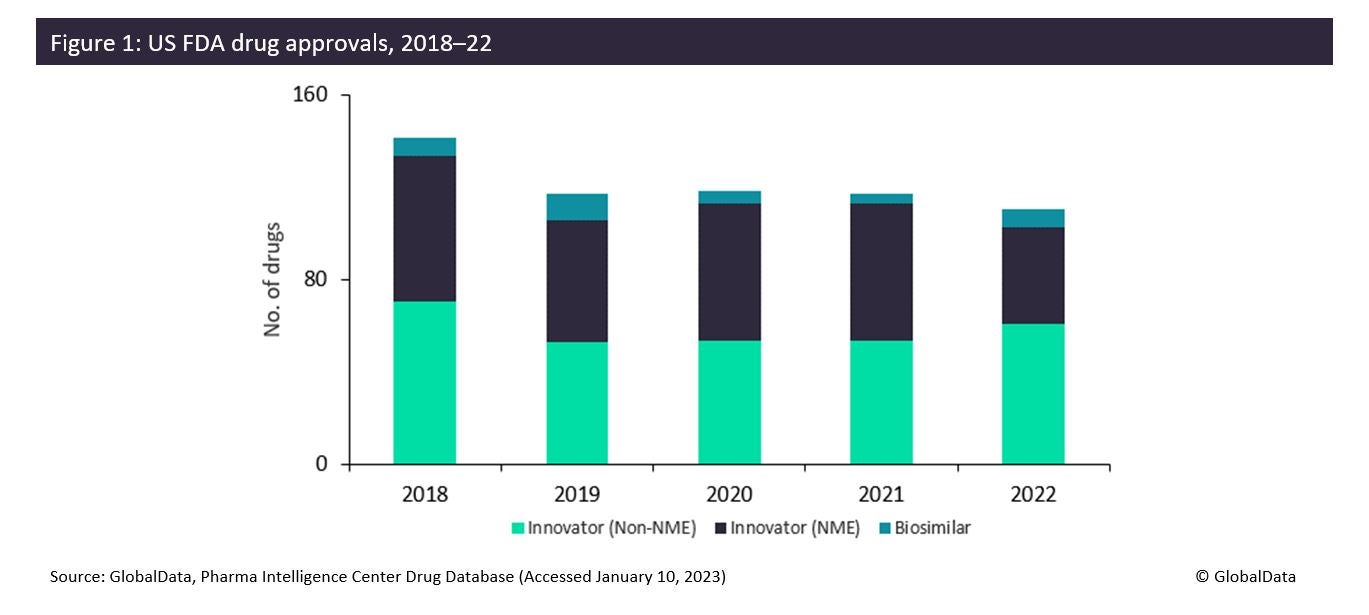

The FDA approved fewer innovative drugs, New Molecular Entities (NMEs), in 2022 than it did in 2021: only 42 drugs compared to 59 drugs. This is due to generally more stringent criteria on approvals in the wake of the Aduhelm scandal. However, non-NME and biosimilar approvals increased in 2022. This is mixed news for contract manufacturing organisations (CMOs), as large CMOs such as Thermo Fisher Scientific (Waltham, MA, US) and Catalent Inc (Somerset, NJ, US) are typically involved in the manufacture of the most innovative products. In 2023, there will be opportunities for a wider range of CMOs that can offer services for less innovative drugs requiring reformulation or biosimilar production.

Increased reluctance to authorise innovative and unproven drugs for use, stemming from the FDA’s experience with Aduhelm, reduced the overall novel approvals in 2022. In June 2021, the FDA granted accelerated approval of Biogen’s (Cambridge, MA, US) Aduhelm (aducanumab-avwa) for Alzheimer’s disease, despite there being questionable evidence of clinical benefit and the majority of an FDA advisory panel voting against the drug’s approval. The approval was based on claims that the drug led to a reduction in amyloid plaques in the brain. However, Alzheimer’s disease is a complex illness, and its cause and pathophysiology are poorly understood. Aduhelm is both costly and commonly produces side effects.

In September 2022, the FDA authorised another neurological disease drug for use, but it officially extended the review period by three months before approving Amylyx’s (Cambridge, MA, US) Relyvrio (sodium phenylbutyrate + taurursodiol) for amyotrophic lateral sclerosis (ALS)/motor neurone disease, following more conclusive trial results indicating that ALS patients survived 6.5 months longer on the treatment. There were only two other neurological NME approvals in 2022: Marinus Pharmaceuticals Inc’s (Radnor, PA, US) Ztalmy (ganaxolone) and TG Therapeutics Inc’s (New York, NY, US) Briumvi (ublituximab-xiiy) for CDKL5 deficiency disorder seizures and relapsing multiple sclerosis, respectively.

Numerous drug approval applications to the FDA failed in 2022, including oncology monoclonal antibodies (mAbs) such as Eli Lilly and Co’s (Indianapolis, IN, US) sintilimab, Y-mAbs Therapeutics Inc’s (New York, NY, US) omburtamab, and Coherus BioSciences’ (Redwood City, CA, US) toripalimab. In a Complete Response Letter to Eli Lilly in March 2022, the FDA indicated that the Oncologic Drug Advisory Committee voted overwhelmingly in favour of requiring more research to support the approval of sintilimab with pemetrexed and platinum-based chemotherapy for nonsquamous non-small cell lung cancer. The FDA even suggested that the company should conduct a multiregional clinical trial, as the drug’s pivotal trial was conducted only in China, where it is currently marketed for multiple oncology indications. In omburtamab’s Complete Response Letter, the FDA recommended meeting with Y-mAbs to design a trial that could highlight evidence showing the drug’s efficacy for neuroblastoma. Although Complete Response Letters are not always made public, the rejections of these drugs suggest that standards have become more stringent in the wake of 2021’s events.

Most lucrative approvals from 2022

Among the FDA approvals in 2022, three drugs are projected to produce blockbuster revenues in 2023 and generate sales of more than $1bn in their first year: Moderna’s (Cambridge, MA, US) Spikevax, Eli Lilly’s Mounjaro (tirzepatide), and F. Hoffmann-La Roche Ltd’s (Basel, Switzerland) Vabysmo (faricimab-svoa). Moderna’s Covid-19 vaccine is well known and widely used, both for the original and Omicron variants, has been required in large volumes, and provided manufacturing contracts for at least seven CMOs, according to GlobalData’s Drugs by Manufacturer database. Spikevax was granted an Emergency Use Authorisation in 2020, and finally gained FDA market approval on 31 January 2022.

Lilly’s Mounjaro was authorised as a treatment for improving glycemic control in adults with type 2 diabetes. It is a GIP and GLP-1 receptor agonist indicated as an adjunct to diet and exercise. The drug increases insulin synthesis and release. Lilly has disclosed only in-house manufacturing locations for the drug. However, given the high prevalence of diabetes, Mounjaro’s predicted success, and the high volume of product required, it would represent an ideal contract for any CMO. Since December 2022, Eli Lilly has had difficulty in supplying the drug at the required volumes. Mounjaro heavily relied on CROs during its development, as evidenced by the fact that it has an associated 36 clinical research agreements recorded on GlobalData’s Deals database, suggesting that it may also turn to contractors for manufacturing.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn early 2022, the FDA approved Vabysmo as a treatment for two eye diseases that are leading causes of vision loss, diabetic macular edema and age-related macular degeneration. It is a humanised, bispecific immunoglobulin G1 antibody that is administered through the intravitreal route of administration. The drug’s vascular endothelial growth factor (VEGF) and Ang-2 inhibition helps slow or stop the damage from eye edema. Roche manufactures the drug in-house at sites located in Germany, Switzerland, and the UK.

There were 38 innovator and biosimilar orphan drug approvals for the US in 2022. Legend Biotech Corp’s (Somerset, NJ, US) Carvykti (ciltacabtagene autoleucel) and Bristol Myers Squibb’s (New York, NY, US) Opdualag (nivolumab and relatlimab-rmbw) are forecast to be the most commercially successful orphan drugs approved in 2023. Both are oncology treatments; Carvykti was authorised as a treatment for refractory multiple myeloma, and Opdualag was authorised as a treatment for metastatic melanoma. The Phase II/III RELATIVITY-047 trial compared Opdualag against Bristol Myers Squibb’s Opdivo (nivolumab) and determined that patients receiving Opdualag lived twice as long, without melanoma spreading, compared to patients who only received Opdivo. Opdualag combines Opdivo’s active component nivolumab with relatlimab. Based on the results of RELATIVITY-047, Opdualag is likely to steal a significant proportion of Opdivo’s market share for melanoma.

For a greater level of analysis related to drugs that were marketed in 2022 and their manufacturing arrangements, please refer to the upcoming PharmSource New Drug Approvals and Their Contract Manufacture – 2023 Edition report.