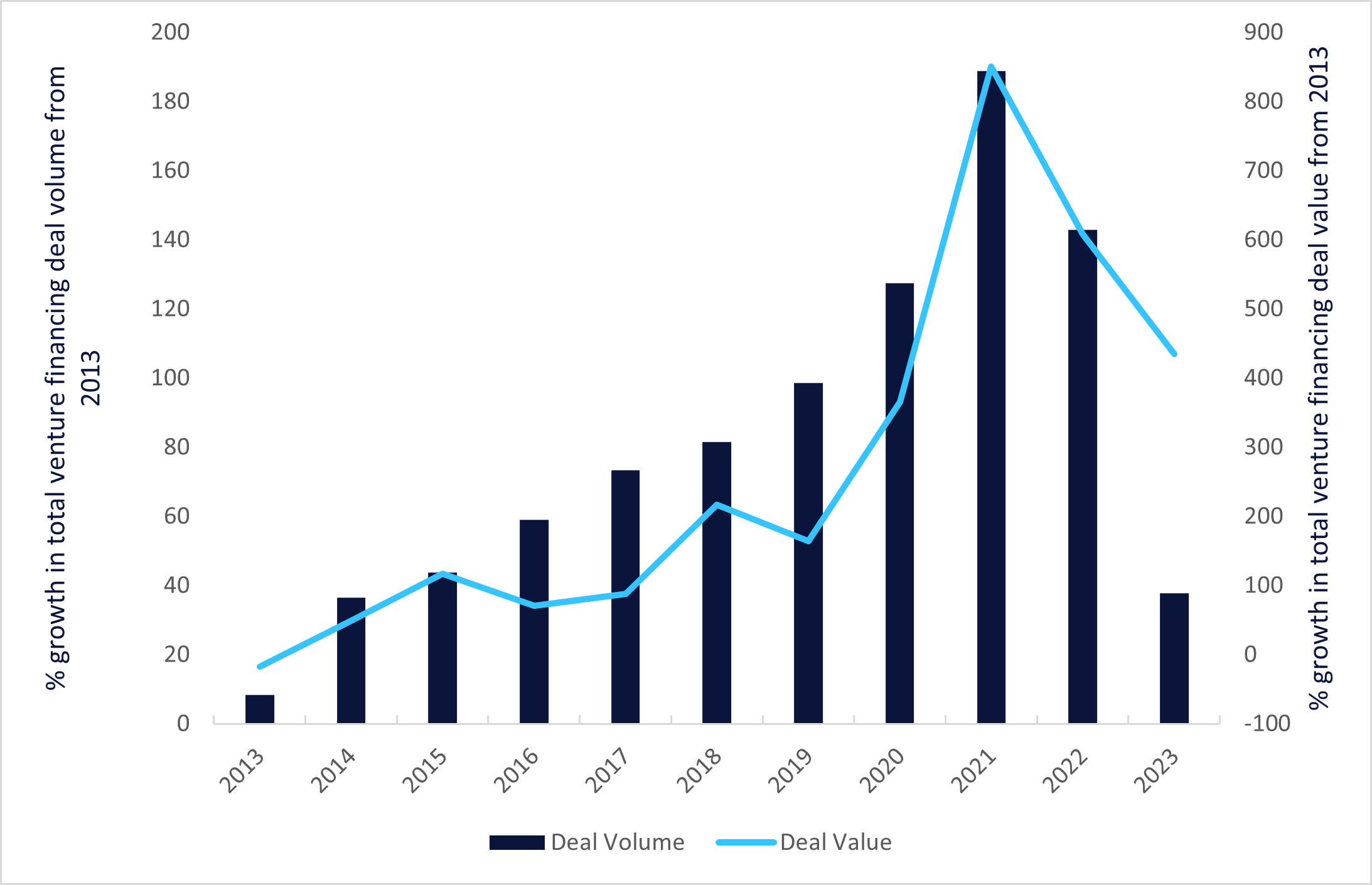

GlobalData’s recent survey The State of the Biopharmaceutical Industry 2024 revealed that 44% of healthcare industry professionals surveyed globally are optimistic or very optimistic on the recovery of biotech funding in the next 12 months. This optimism comes after the downturn in private biotech venture financing seen in 2022 and 2023. During 2023, funding decreased by 43.2% compared to 2022 and by 52.3% compared to 2021, attributed to macroeconomic pressures causing investors to be more cautious and prioritise existing portfolios.

Currently, 607 venture-backed companies headquartered in the US are affected by the downturn in biotech funding with over 1,500 drugs at stake (including pre-clinical). Of these 607 venture-backed companies, approximately a third have not raised any capital in the past three years.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to GlobalData’s Pharma Intelligence Center Deals Database, venture financing for US-headquartered companies with innovator drugs peaked in 2021, by 104% to $20.7bn, which in turn saw many early-stage biotechs going public that year with inflated valuations. However, this led to overvalued biotechs that were unable to deliver milestone outcomes, causing a decline in investor confidence and selectivity in new investments. Furthermore, recent challenges such as high inflation, high-interest rates, and geopolitical instability have also prompted investors to become more selective.

Biotechs are turning to alternative sources of funding; in the same survey, 39% of all respondents identified enhanced industry partnerships as the most effective measure to mitigate a downturn in biotech funding. Respondents in the APAC region favoured government incentives or grants over private VC investors to tackle the funding downturn compared to those in North America and Europe. In the US, NIH grant funding to private companies reported a total deal value increase of 16.1% to $1.86bn from 2021 to 2022, according to GlobalData’s Pharma Intelligence Center Grants Database, highlighting its importance in mitigating the gap in investments received from venture capitals.

Despite the challenges within the private biotech funding landscape, venture capital funding has been crucial to sustaining biotech innovation. Following a decline from record highs in 2021, venture capital funding has remained relatively resilient throughout 2022. However, signs now seem to point towards a potential return to pre-pandemic levels. With access to alternative sources to secure capital including enhanced industry partnerships and government grants, along with a stabilising market and easing inflationary pressures, the outlook for future biotech investment appears promising.