Drug manufacturers faced a variety of hurdles in 2024. Healthcare system reforms, preparation for the EU joint clinical assessments (JCAs) that went live at the end of January 2025, and drug shortages, alongside governments’ focus on cost containment, are only a few of these challenges. In this review, GlobalData considers the products that were both approved and priced in 2024 and the factors that influenced their launch strategy. Key trends that are considered include market prioritisation, HTA evaluation outcomes, distribution of indications that entered the market in 2024, and orphan drug designation.

To understand the key launch trends in 2024, GlobalData reviewed a sample of innovative drugs that were both approved and priced in 2024. Of the 33 drugs that entered various markets in 2024, their launch sequence was reviewed to gain an understanding of market prioritisation.

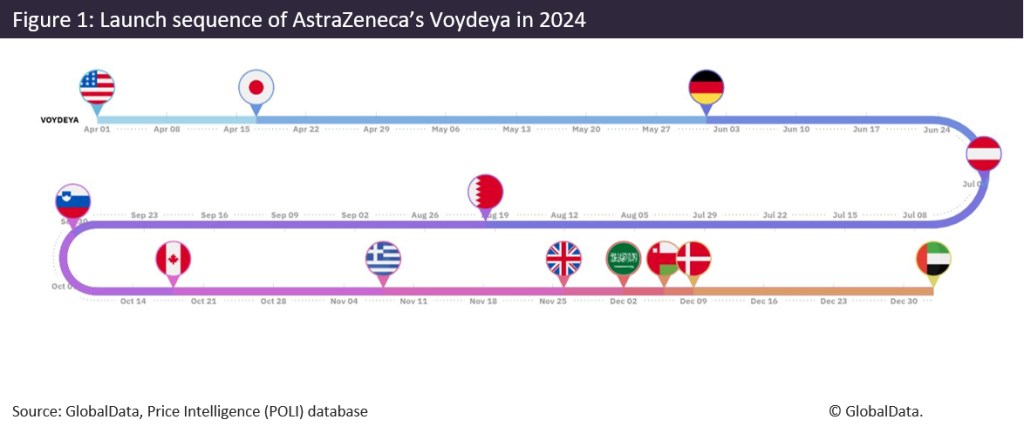

While the US remains a critical first-launch market, APAC markets such as South Korea and Japan did achieve early market launch status for certain products. For example, Onconic Therapeutics’s (SK) Jaqbo, On Cab, Q Zetas (zastaprazan), an anti-ulcer agent for the treatment of erosive gastroesophageal reflux disease (GERD), launched first in South Korea in 2024. Onconic Therapeutics is headquartered in South Korea, which may have influenced this launch strategy. The drug has yet to be launched in any other market. Similarly, AstraZeneca (UK) targeted an APAC market early on as part of its launch strategy for Voydeya (danicopan) in 2024. While the brand launched in the US first, its second market was Japan, followed by Germany. The full launch sequence for danicopan is shown below.

The US is traditionally an early launch market due to its free pricing policies and few price controls. However, last year, South Korea reformed its reimbursement system to help develop a more supportive drug innovation environment. These policy amendments have likely impacted South Korea’s position in the launch sequence. These changes included higher initial prices for innovative medicines, expansion of risk-sharing agreements, and improved drug reimbursement process transparency. Similarly, pharma welcomed several positive reforms in Japan in 2024 potentially influencing its position in the launch sequence as well. Several of these positive changes for branded medicines included: expanded eligibility criteria for a price maintenance premium (PMP), price increases for unprofitable drugs, easing of essential medicines requirements, and crucially the introduction of the “pioneer premium” which is rewarded to treatments launched in Japan at an earlier stage of their global rollout.

Voydeya’s average price per strength unit at launch was evaluated across all available markets to compare prices and better understand Japan and US prices for the product. These were the first two markets where the product launched, and despite its later launch in Japan, Voydeya’s price per strength at launch was slightly higher in Japan ($0.25/unit/mg) than in the US ($0.23/unit/mg). The average price per strength unit at launch was also the lowest in the US of all the markets.

In GlobalData’s analysis of 2024 launch trends for selected drugs, each market’s health technology assessments (HTAs) were also considered. For drugs that were both approved and priced in 2024, there were a total 16 decisions across seven markets. The figure below shows the distribution of these outcomes by market. Both positive and neutral decisions represent medicines that are eligible for reimbursement. A neutral outcome notes decisions where products or indications are reimbursed for a restricted part of the population, or where the pricing procedure is not as favorable as a fully positive assessment. In Japan, the UK, Canada, France, and Germany, those drugs that were evaluated all received positive outcomes leading either to inclusion onto respective reimbursement lists or more favourable pricing procedures. Most decisions delivered were in Japan. In Finland, one negative outcome was provided for Vyloy (zolbetuximab) after it was not recommended for reimbursement.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataA review of these drugs by indication shows a continued trend and significant investment into the oncology space, with most of the products (47%) approved and priced last year falling within this therapy area. This is followed by treatments for neurological disorders. Of those selected drugs that were launched and priced in 2024, 53% of brands had an orphan drug designation. While this ratio of orphan drugs reflects a continuing market trend of investment towards high-cost speciality drugs for rare diseases, it may also signal that orphan medicines may have reached their peak. For example, price controls and cost-containment policies such as US Medicare price negotiations and the recent growth in diabetes treatments such Rybelsus, Wegovy, and Ozempic (semaglutide) and Mounjaro (tirzepatide) are potential threats to the rare disease space.

While markets such as the US and Germany still maintain early launch market positions, last year’s drive from markets such as South Korea and Japan to become more innovation-friendly for developers through specific pricing and reimbursement amendments could have triggered a new paradigm in market prioritisation. While unlikely to challenge the US and Germany’s positions globally, these markets have become more attractive to developers. Furthermore, as the rare disease space continues to grow, it must be wary of the risks these drugs face, including the current investment in diabetes treatments and the tightening of government spending on high-cost treatments in certain critical markets. As the landscape evolves and more products launch into these markets, GlobalData will continue to follow these trends and whether they deviate from the sample that has been assessed in this review.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitor P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.