TORL BioTherapeutics has raised $158m in Series B-2 financing to advance the clinical development of its lead antibody-drug conjugate (ADC), TORL-1-23, for the treatment of solid tumours.

The financiers included multiple venture capital firms Deep Track Capital, Goldman Sachs Alternatives, UC Investments, and Vertex Ventures HC, among others. Bristol Myers Squibb was also one of the investors. The current funding round, in addition to previous Series B funding, brings to total funds raised so far to exceed $350m.

The Series B-2 funds are planned to finance the ongoing Phase I (NCT05103683) and a pivotal Phase II trial of TORL-1-23. The Phase II study is expected to aid in regulatory review and potential approval for TORL-1-23 as a treatment of claudin (CLDN) 6-positive, platinum-resistant ovarian cancer. The trial is slated to start in H2 this year.

The US-based company also plans to use the proceeds to fund the ongoing Phase I trials for multiple ADC therapies in the company’s pipeline. TORL-2-307 is an ADC composed of an unnamed tumour-associated antigen (TAA) linked to an as-of-yet undisclosed cytotoxic agent. It is being evaluated in a Phase I trial (NCT05159440) in patients with CLDN 18.2 positive advanced solid tumours with adequate organ function.

TORL-3-600 is an ADC that targets the cadherin 17 (CDH17) protein, which plays a role in cell-to-cell adhesion. It is currently in Phase I trial (NCT05948826) as a treatment for CDH17-positive advanced colorectal cancer. TORL-4-500 is another ACD in TORL’s pipeline. It is being evaluated in a Phase I trial (NCT06005740) as a treatment for Delta-like non-canonical Notch Ligand 1 (DLK1) positive solid tumours.

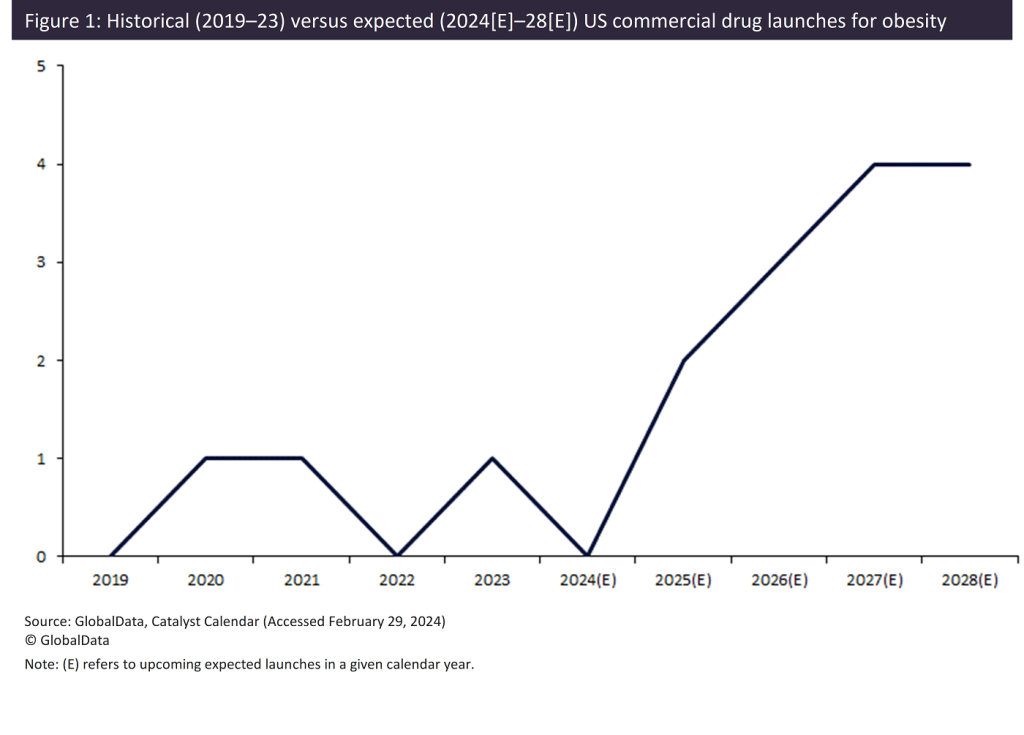

ADCs have been identified as a key innovation area by GlobalData, with multiple companies investing in these therapies. In December 2023, Johnson & Johnson (J&J) signed a licensing agreement potentially worth $1.7bn with South Korean LegoChem Biosciences to develop and commercialise LCB84.

In November, Prelude Therapeutics and AbCellera partnered to jointly discover, develop, and commercialise ADCs for cancer treatment. In October, Merck & Co (MSD) partnered with Daiichi Sankyo to develop and commercialise three of the latter’s DXd ADC candidates, potentially spending up to $22bn on the partnership. In March, Pfizer paid approximately $43bn to acquire Seagen, which specialised in ADCs.

GlobalData is the parent company of Pharmaceutical Technology.