A day after announcing a $400m convertible bond offering, Telix Pharmaceuticals has had a new drug application (NDA) accepted by the US Food and Drug Administration (FDA) for prostate cancer imaging agent TLX007-CDx.

The agency has set a prescription drug user fee act (PDUFA) goal date of 24 March 2025, as per a 24 July press release.

Radiopharmaceutical specialist Telix said its objective is to further enhance patient access to prostate-specific membrane antigen (PSMA) PET imaging.

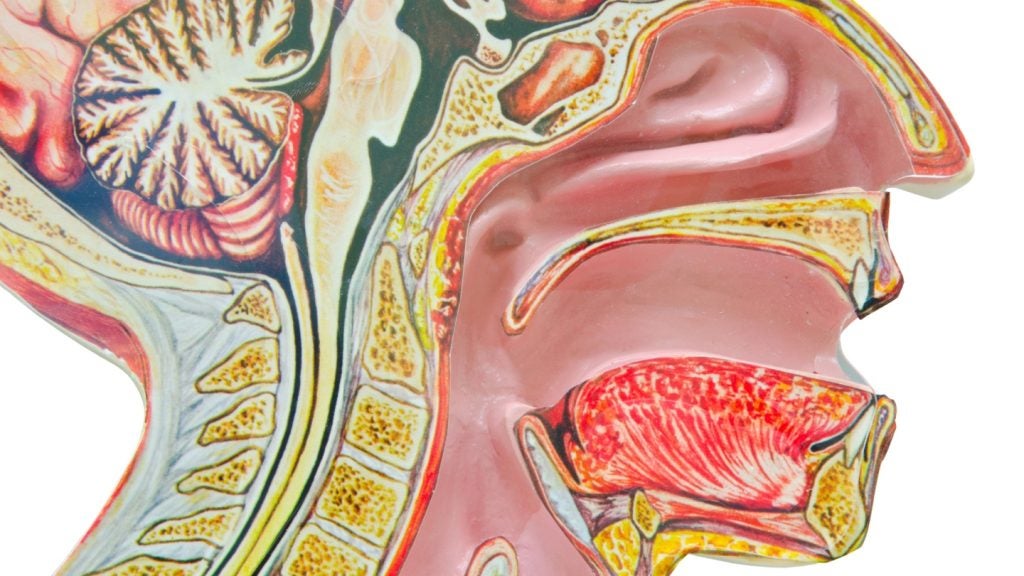

PSMA is a protein specific to prostate cancer cells, and the test can detect increased areas of its uptake in cells by linking it with a radioisotope. The technique is seen as superior to conventional imaging methods for prostate cancer tracking, but issues with accessibility and regulatory requirements mean many prostate cancer patients do not undergo the scan.

Telix’s TLX007-CDx is a so-called “cold kit” to prepare PSMA-PET imaging. The Australia-based company said the kit can help with PSMA imaging product utilisation at locations that are not close to a nuclear pharmacy, a requirement for many current gallium-68 agents.

There are currently around 350-450 certified nuclear pharmacists in the US. Cardinal Health operates the largest radiopharmaceutical network in the country.

The kit is designed to facilitate more flexible production and includes higher activity gallium-68.

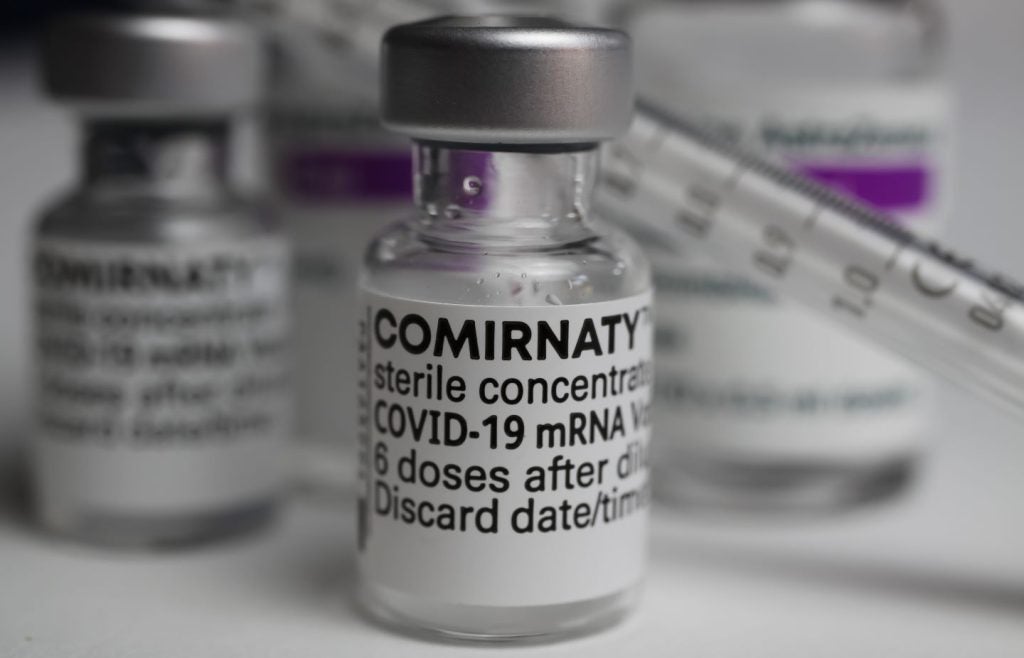

Telix already has an FDA-approved imaging agent, a gallium-68 gozetotide injection marketed under the brand name Illuccix. The company’s group CEO Dr Christian Behrenbruch said the filing acceptance for the cold kit is a step towards “improving equity of access”.

Behrenbruch added: “We now look forward to working with the FDA to bring TLX007-CDx to American men living with prostate cancer, including those residing in underserved communities and regions where access to state-of-the-art imaging remains limited.”

As Telix waits for the FDA review, it has set its sights on label expansions for its other diagnostic imaging agents. On 23 July, Telix offered $398m in convertible bonds, which will be used to fund the necessary studies and pivotal trials for kidney and brain cancer therapy programmes.

Currently listed on the Australian Securities Exchange, Telix had been planning on going public on Nasdaq earlier this year. The company U-turned on the IPO, however, citing market conditions at the time.

Eli Lilly has joined Telix in the growing radiopharmaceutical space, acquiring POINT Biopharma in a $1.4bn deal in October 2023. The drugmaker then partnered with Radionetics Oncology in a $140m deal earlier this month, which included an exclusive option to acquire the partner for $1bn.

Bristol Myers Squibb and Novartis have also conducted their own radiopharma acquisitions for $4.2bn and $1.75bn respectively in the past year.