Telix Pharmaceuticals has signed a conditional non-binding term sheet to acquire QSAM Biosciences in a deal worth up to $125m.

The term sheet agreement also includes the acquisition of QSAM’s lead radiopharmaceutical therapeutic agent CycloSam (samarium-153-DOTMP).

Telix will pay $2m in pre-losing collaboration and option fees following signing the term sheet. For the acquisition, the Australian company will also pay $33.1m in equity as ordinary shares, as per a 13 November press release.

QSAM will also be entitled to receive $90m in clinical and commercial milestone-based payments following the closing of the acquisition. The deal is expected to close in Q1 2024, as per a 14 November press release.

If the QSAM acquisition is terminated, the option fee and upfront costs will be converted to QSAM common stock, priced at $6.70 per share.

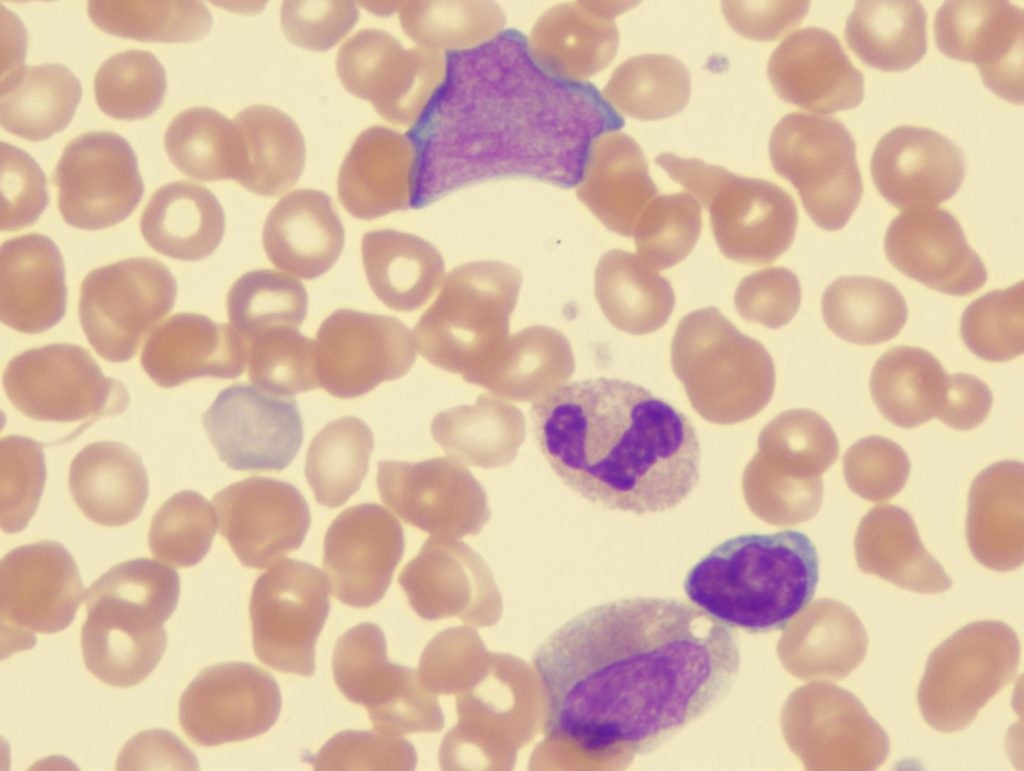

CycloSam has received an orphan drug designation and rare paediatric disease designation from the US Food and Drug Administration (FDA) for the treatment of paediatric osteosarcoma.

CycloSam is currently being investigated as a potential treatment for primary and metastatic bone cancer, including osteosarcoma. The open-label, unblinded, dose-finding Phase I trial (NCT06008483) for CycloSam is planned for completion in Q1 2024, as per a 16 August press release.

“With CycloSam we plan to leverage Telix's extensive experience and success in distributing short-life radiopharmaceuticals using a cold kit product from a nuclear pharmacy. Given these factors, we see a strong pathway to commercialisation," said Telix managing director and group CEO Dr Christian Behrenbruch in a 13 November press release.

Telix’s pipeline consists of therapeutic and diagnostic radiological agents, including targeted radiation therapy, TLX250 (¹⁷⁷Lu-DOTA-girentuximab). It is currently in Phase I clinical trial (NCT05868174) as a combination therapy with Merck (MSD)’s M3814 (peposertib) in patients with solid tumours that express carbonic anhydrase IX.