British biopharmaceuticals company Autolus Therapeutics has submitted a Biologics License Application (BLA) to the Food and Drug Administration (FDA) for its chimeric antigen receptor T cell therapy (CAR-T therapy), which treats a persistent form of leukaemia.

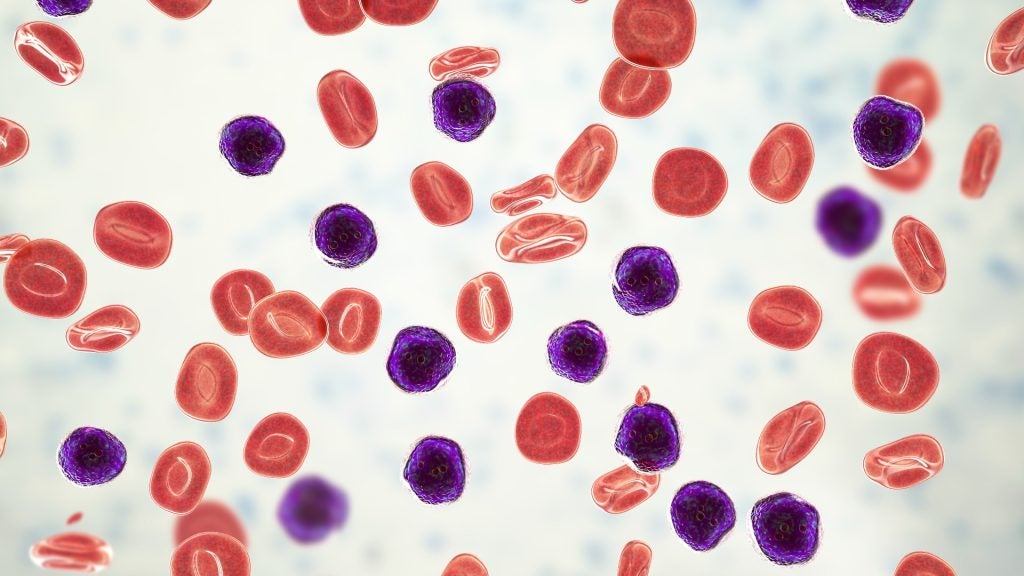

The therapy, obe-cel, targets relapsed/refractory adult B-cell acute lymphoblastic leukaemia (ALL), a blood cancer that currently has survival rates ranging from <10% to around 25% across all age groups. These rates are even lower for adults in older life. According to Phase II trial data, Autolus’ treatment had an overall response rate of 76%, with 97% of responders becoming minimal residual disease (MRD)-negative, meaning they entered a complete remission.

After a median follow-up of nine and a half months, 61% of responders remained in remission without subsequent anti-cancer therapies. These results have allowed the drug to obtain Orphan Drug Designation from the FDA and Orphan Medical Product Designation from the European Medicines Agency (EMA).

These designations are given to drugs or treatments for rare diseases that would otherwise be unlikely to offer enough of a financial incentive to bring to market. They come with a range of benefits, including market exclusivity, fee reductions and specialised advice, but are also subject to checks by the medical bodies to ensure that the medicine in the words of the EMA has “no satisfactory method of diagnosis, prevention or treatment […], or, if such a method exists, the medicine must be of significant benefit [bolding theirs] to those affected by the condition.”

These results and designations both bode well for the treatment’s likelihood of approval by the FDA, which would be a boon for the thousands affected by the condition. The comparative rarity of the condition even within the already very rare family of leukaemia, means that funding for the disease is low.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.