Sanofi has bought back a €3bn ($3.1bn) stake held by cosmetics giant L'Oréal, the first of multiple share buybacks the French drugmaker has planned for 2025.

L'Oréal was selling 29,556,650 shares at €101.50 each, meaning its stake in Sanofi will decrease from 9.4% to 7.2%. Both listed in Paris, L'Oréal opened 2.5% lower on 3 February following the announcement whilst Sanofi opened 0.4% down.

The cosmetics company has held shares in Sanofi since 1999 and received $431m in dividends from the drugmaker in 2022 alone.

The transaction of shares represents a 2.8% discount on where Sanofi’s shares closed on 31 January. The pharma company’s shares have been flying high after raising its full-year profit outlook propelled by blockbuster asthma drug Dupixent (dupilumab) and new launches such as respiratory syncytial virus (RSV) vaccine Beyfortus (nirsevimab), developed as part of a partnership with AstraZeneca.

Whilst revealing its Q4 2024 results, Sanofi said it is planning to execute a $5.12bn share buyback programme in 2025. As of June 2024, Sanofi’s stakeholder structure comprised 67% owned by non-French institutional investors and 10.8% owned by French institutions. Individual shareholders and employees amounted to 5.3% and 2.6% of the drugmaker respectively. At the time, L'Oréal held 9.4%, with the remaining shares either unassigned or held via ‘miscellaneous’ buyers.

Sanofi’s chief financial officer François Roger said: “This transaction highlights Sanofi's dedication to sustainable value creation while upholding our strategic priorities and preserving the strength of our key partnerships.”

Sanofi is in the process of transitioning into a pure vaccine and drug manufacturer as the company edges closer to closing a deal that would see it sell a controlling stake in its consumer health company Opella. In October 2024, Sanofi entered talks with US private equity company Clayton Dubilier & Rice (CD&R) over the sale of Opella, valued at around $17bn. A deal is slated to be completed by Q2 this year.

The share buyback comes nearly a week after Robert F Kennedy Jr was questioned on his anti-vaccine stance by senators ahead of potentially heading up the US Health and Human Services (HHS). Sanofi was one of many vaccine manufacturers whose shares took a temporary hit when he was announced as the nominee for the position by President Donald Trump late last year.

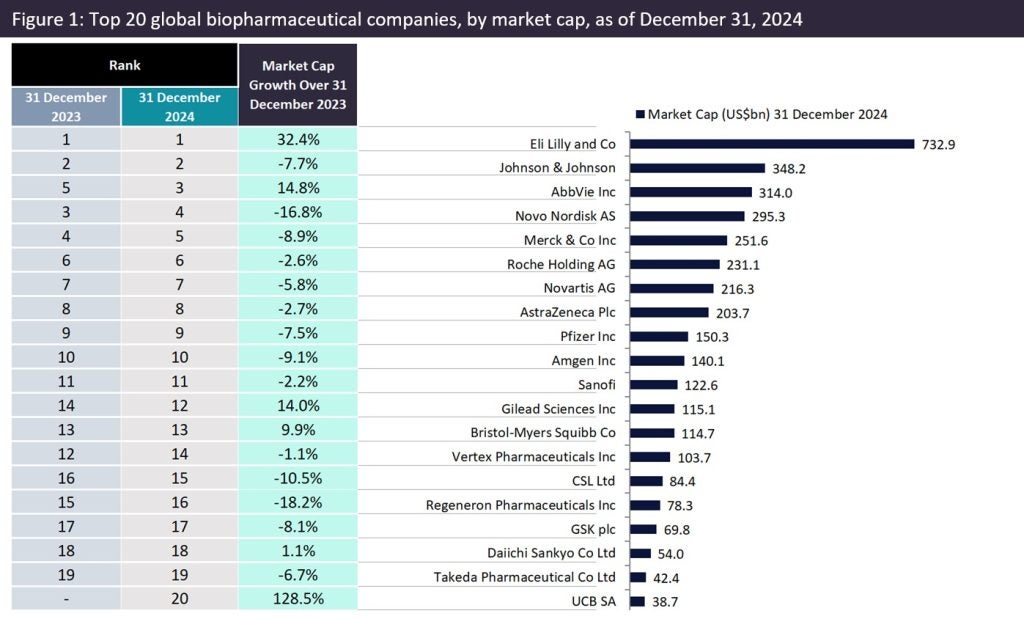

Sanofi is not the only big pharma company targeting a share buyback campaign. On the back of booming popularity for diabetes and weight loss treatments, Eli Lilly plans to buy back around $15bn in shares, as announced in December 2024. Buying back stock is a way for companies with auxiliary cash to boost earnings per share. It also increases the value of remaining shares and adjusts voting rights.