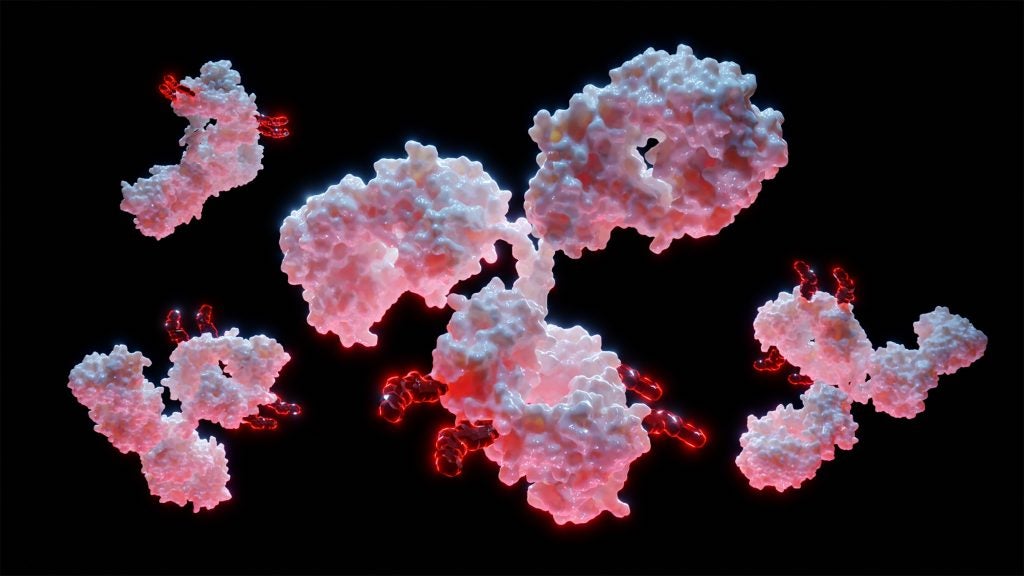

Prelude Therapeutics and AbCellera have partnered to jointly discover, develop, and commercialise antibody-drug conjugate candidates (ADCs) for cancer treatment.

The collaboration leverages Prelude’s expertise in targeted protein degradation, medicinal chemistry, and clinical development and AbCellera’s antibody discovery and development engine to generate novel precision ADCs.

ADCs have been identified as a key innovation area by GlobalData, with multiple companies investing in these therapies. The most recent company to join this trend was MSD (Merck & Co), which signed a collaboration agreement with Daiichi Sankyo to develop and market three ADCs last month.

GlobalData is the parent company of Pharmaceutical Technology.

Prelude will be responsible for the clinical development and global commercialisation, whilst AbCellera will lead the manufacturing activities for the ADCs. AbCellera will also have the option to co-promote the ADCs in the US, as per the 1 November press release.

AbCellera generated $10.1m in revenue from discovery activity in Q2 2023, as per the company’s financials. AbCellera has a market cap of $1.19bn.

In September, AbCellera expanded its partnership with Regeneron to discover up to eight therapeutic antibodies against the targets selected by the latter. The same month, the Canadian company also partnered with Incyte BioTherapeutics to develop and commercialise therapeutic cancer antibodies.

In June, AbCellera partnered with Confo Therapeutics to discover specific G protein-coupled receptor (GCPR) ligand-targeting antibody candidates.

Early R&D project coverage on Pharmaceutical Technology is supported by Mimotopes. Editorial content is independently produced and follows highest standards of journalistic integrity. Topic sponsors are not involved in the creation of editorial content.