mRNA-based innovator pharmaceuticals have experienced a massive increase in licensing agreement deal values following success with the technology in Covid-19 vaccines, which helped to curtail the pandemic.

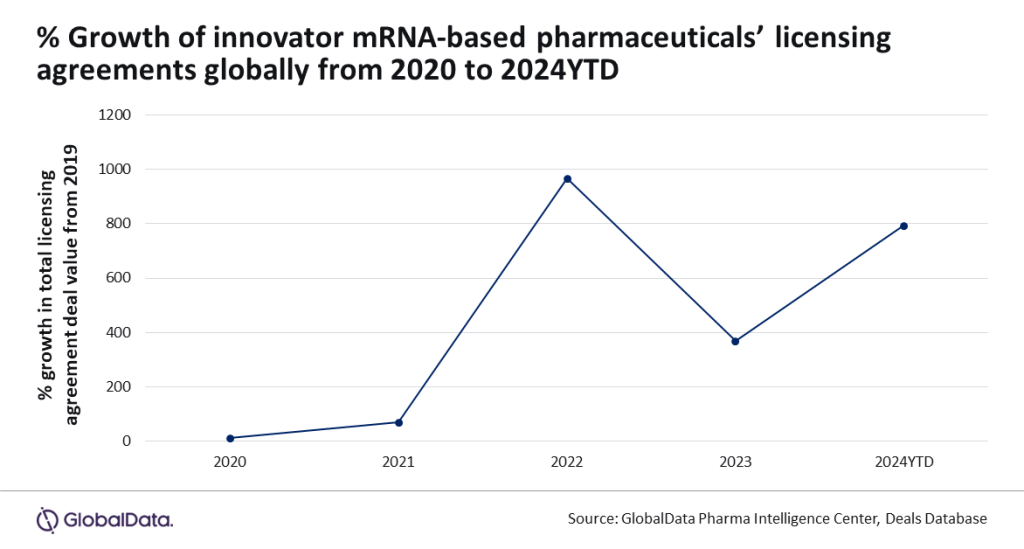

Data and analytics provider GlobalData identified an 800% increase in deal values between 2019 and 2024 so far and has noted that key companies are continuing to invest heavily in the development of mRNA-based pharmaceuticals.

GlobalData is Pharamceutical Technology's parent company.

However, recent lawsuits filed by GSK against mRNA vaccine producers Pfizer, BioNTech and most recently (15 October) Moderna, have put the licensing of mRNA-based pharmaceuticals in the spotlight.

In its lawsuit, GSK has alleged the use of its technology without proper licenses. GSK is suing Moderna in two lawsuits regarding its mRNA vaccines: Spikevax for Covid-19 and mResvia for RSV. The British pharma giant alleges that Moderna ignored patents relating to lipid nanoparticles used in mRNA vaccine formulation technology.

It follows a similar lawsuit against Pfizer and BioNTech filed in April in which GSK alleges the companies were in violation of five patents relating to mRNA vaccine technology.

Pfizer/BioNTech’s Covid-19 vaccine, known as Comirnaty, was approved by the FDA in August 2021 and was the first mRNA vaccine to enter the global market. It was followed by the approval of Moderna’s Spikevax in January 2022, although an emergency use authorization (EUA) had made Moderna’s vaccine available earlier.

Ophelia Chan, business fundamentals senior analyst at GlobalData, has pointed to Covid-19 vaccines as a turning point for the mRNA sector. “The Covid-19 pandemic highlighted the key advantages of mRNA technology in vaccine development, including rapid production, precise immune targeting and streamlined manufacturing factors that drove the success of mRNA-based Covid-19 vaccines,” she said.

mRNA Covid-19 vaccine sales declined significantly in 2023 compared to 2022. However, GlobalData reported that 2023 still saw Moderna’s Spikevax generate around $18.4bn in global revenue, while Pfizer and BioNTech’s Comirnaty generated around $42.4bn.

Considering the reasons behind the jump in licensing deal values, Chan added: “Licensing agreement deal values for mRNA-based pharmaceuticals have doubled since 2023, reaching $3.8bn as major players like GSK and Bristol Myers Squibb invest in mRNA therapeutics to address unmet medical needs.”

In April, Bristol Myers Squibb entered into a multi-year, $1.87bn strategic collaboration with Repertoire Immune Medicines looking to develop mRNA-based tolerising vaccines. Meanwhile, GSK and CureVac contributed to the jump in licensing value in July, with a new licensing agreement worth up to $1.57bn.

Beyond licensing, GlobalData also expects the sector to see growth across mRNA sales, predicting that the global sales of innovator mRNA-based drugs will rise from $22bn in 2023 to $26.2bn in 2030.