Kronos Bio has discontinued the development of its last remaining clinical asset, istisociclib (KB-0742), after a review of the safety data from a Phase I/II trial in patients with platinum-resistant high-grade serous ovarian cancer.

Out of the seven patients enrolled in the Phase I/II trial (NCT04718675) of the cyclin-dependent kinase 9 (CDK9) inhibitor, five reported neurological adverse events ranging from Grade 1 to Grade 3 with three patients discontinuing treatment whilst two reduced the drug dosage.

Kronos stated that “after an overall review of its business and given the clinical development timelines of its additional pipeline candidates, the company will explore strategic alternatives with the goal of maximising stockholder value”. The company also plans to institute cash-saving initiatives and explore strategic options including acquisition, reverse merger, and merger. Kronos reported $124.9m in cash reserves as of 30 September 2024.

The US-based company has had a hard year. In November 2023, the company fired 19% of its employees to preserve cash and allocate more resources to its cancer therapies, istisociclib and lanraplenib.

A month after that, Kronos discontinued the development of lanraplenib, citing patient discontinuation in a Phase Ib/II trial (NCT05028751) and difficulty in proving the clinical benefit of lanraplenib in combination with Astellas Pharma’s Xospata (gilteritinib) in patients with relapsed/refractory FLT3-mutated acute myeloid leukaemia (AML). In March, the company had another round of layoffs, dismissing 21% of its staff, to allow it to “maximise the potential” of istisociclib.

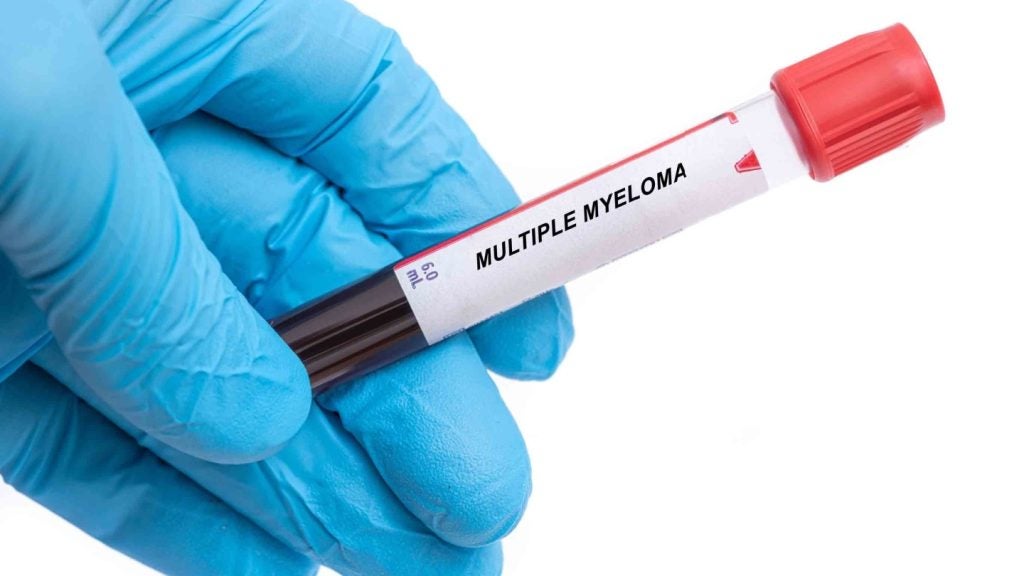

Kronos noted that it is also exploring partnership options for two of its preclinical assets - KB-9558 and KB-7898. Both of these are p300 lysine acetyltransferase (KAT) inhibitors.

KB-9558 is being developed as a treatment for multiple myeloma and human papillomavirus (HPV)-driven cancers. Kronos expects to be ready to submit an investigational new drug (IND) application to the US Food and Drug Administration (FDA) by the end of the year. KB-7898 is being evaluated for treating autoimmune disorders, with Kronos starting IND-enabling studies for the therapy in Sjögren’s disease.

Kronos is not the only company that had to institute cash-saving measures in the past 12 months. In April, Portage Biotech reported that it was exploring strategic alternatives including a wind-down of the company, citing the current funding climate and its future funding needs.

Tracon Pharmaceuticals also started cash-conserving measures after an efficacy analysis of a Phase II trial of its lead cancer therapy, envafolimab. The blinded independent central review analysis found that the therapy was unlikely to show the level of efficacy required to support a biologics licence application (BLA).