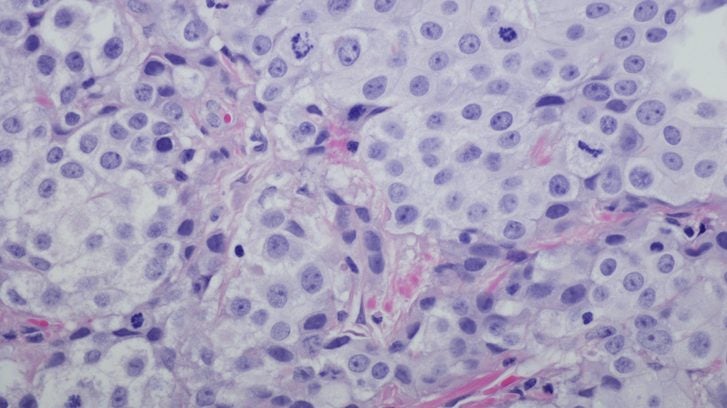

Bristol Myers Squibb’s (BMS) Opdivo (nivolumab) got one step closer to getting another labeled indication under its belt as the European Medicines Agency (EMA) validated the application for its first-line use in combination with chemotherapy for unresectable or metastatic urothelial carcinoma.

The application is based on results from the Phase III CheckMate-901 trial (NCT03036098), which were presented at the European Society for Medical Oncology (ESMO) Congress 2023 that took place from 20-24 October in Madrid. The trial tested Opdivo in combination with cisplatin-based chemotherapy followed by Opdivo as a standalone treatment. The treatment regimen showed statistically significant and clinically meaningful improvements in both overall survival (OS) and progression-free survival (PFS) when compared to standard-of-care cisplatin-based chemotherapy. The study is the first Phase III trial to show such improvements with an immunotherapy-based combination for this patient population, as per BMS.

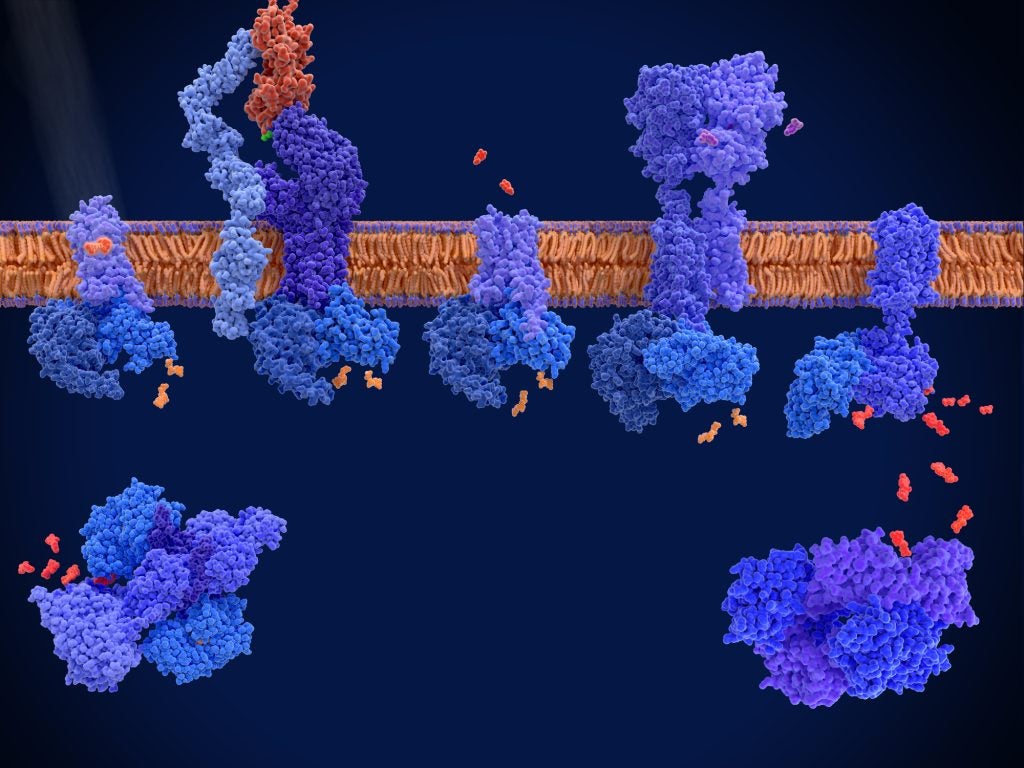

Opdivo, a PD-1 inhibitor, was first approved by the US Food and Drug Administration (FDA) in 2014 for the treatment of metastatic melanoma. It has since been approved to treat various different types of cancer, including non-small cell lung cancer, esophageal squamous cell carcinoma (ESCC), kidney cancer and liver cancer. More recently, in October the FDA granted approval for Opdivo to treat stage IIB or IIC melanoma patients who have undergone complete resection.

Opdivo generated $8.2bn in sales last year, as per BMS’ Annual 2022 report. According to GlobalData, Opdivo is forecast to make $12.2bn in sales in 2029.

GlobalData is the parent company of Pharmaceutical Technology.