French biotech company Mablink has entered an agreement to be acquired by Eli Lilly. The deal is subject to approval from the French Ministry of the Economy.

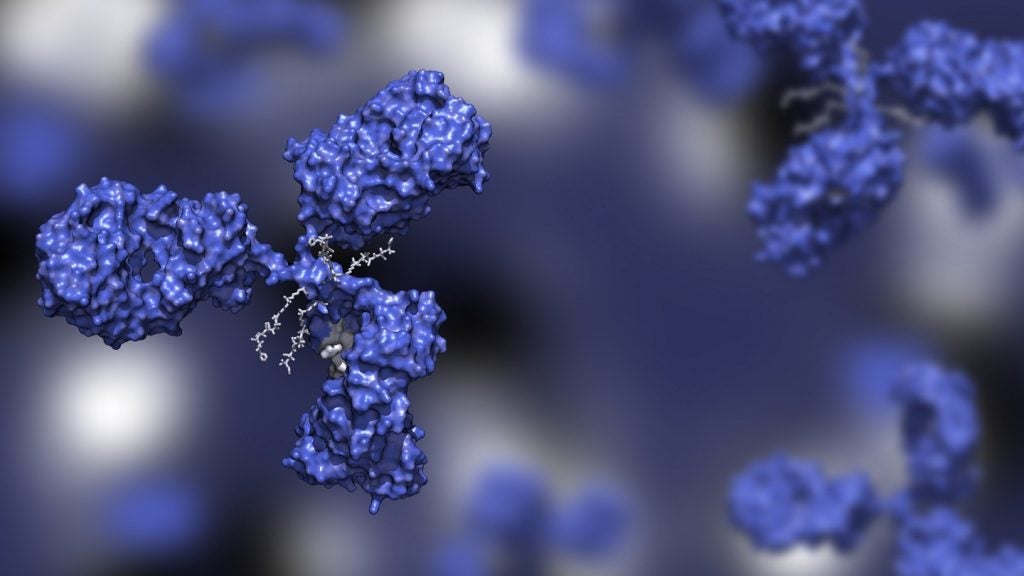

Lilly plans to utilise Mablink’s PSARLink technology, which disguises cancer-killing molecules, allowing them to be delivered precisely to cancer cells while sparing healthy cells. The technology will broaden the use of antibody-drug conjugates (ADCs).

In March 2023, Mablink revealed preclinical data for its lead ADC candidate MBK-103 at the American Association for Cancer Research (AACR) meeting, announcing plans to submit a clinical trial application (CTA) in Q4 2023.

Mablink CEO Jean-Guillaume Lafay said: “The values we share with Lilly, and our combined expertise are also a unique opportunity to leverage Mablink’s capabilities and endeavours to potentially bring transformative therapies to cancer patients with high unmet medical needs.”

This deal comes after a series of acquisitions made by Lilly in the past year. In early October, the company signed a definitive agreement for the acquisition of all outstanding shares of radiopharmaceutical company POINT Biopharma for an all-in cash price of $1.4bn. Two lead programmes, PNT2002 and PNT2003, are currently at the late development stage for the treatment of metastatic castration-resistant prostate cancer and gastroenteropancreatic neuroendocrine tumours.

In July, Lilly acquired clinical-stage biopharmaceutical firm Versanis Bio in a $1.92bn deal. Versanis Bio’s monoclonal antibody bimagrumab, is currently being evaluated in the Phase IIb BELIEVE clinical trial both as a monotherapy and with semaglutide in adults who are obese or overweight.

Lilly signed a definitive agreement for the acquisition of all outstanding shares of the biopharmaceutical firm Sigilon Therapeutics in a deal totalling $309.6m in June, in a collaboration to develop islet cell therapy solutions for type 1 diabetes.

Lilly made $28.54bn in revenues in 2022, which was up by 0.78% from $28.31bn in 2021, according to the company’s annual 2022 report.