The European Commission (EC) has granted unconditional approval to Pfizer for its prospective takeover of Seagen for $43bn in cash.

The EC noted that the acquisition would not cause any competition issues for cancer treatments in the European Economic Area (EEA) under EU merger regulations.

In March 2023, the companies signed a definitive merger agreement.

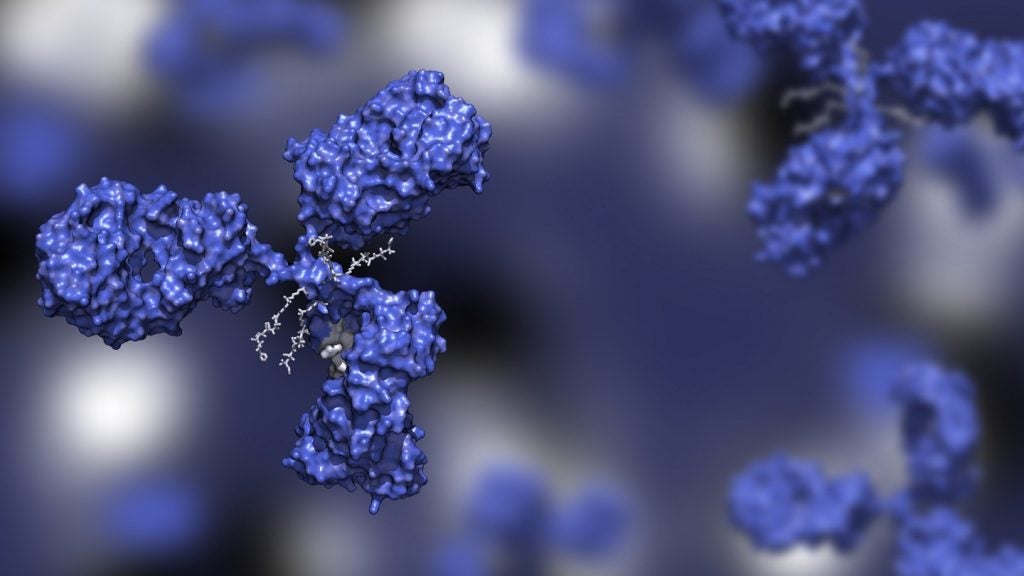

Seagen develops cancer therapies with a key focus on antibody-drug conjugates (ADCs).

Pfizer's oncology portfolio chiefly includes hormone therapies, immunotherapies and targeted therapies.

The marketed and pipeline products of the companies in the region overlap in the treatment of several cancer types including lymphoma and leukaemia.

Pfizer plans to bolster its portfolio with the acquisition of Seagen, including its ADCs technology. The takeover will also expedite the development and marketing of Seagen's ADC drugs.

In a press statement, the commission said: “Based on its market investigation, the commission found that the merger would not significantly reduce competition in the markets where their activities overlap within the EEA.

“Moreover, the commission found that the transaction was unlikely to have a negative impact on prices, given that the parties/offerings are differentiated and complementary and that the markets for the treatment of the various cancer types examined are sufficiently competitive.”

The EC also found that the merger will have no impact on existing and converging lines of research or pipeline developments since the companies target varying patient populations with different therapeutic modalities.