It has been a long decade for the pharmaceutical industry. Some changes, like the pace of innovation and influx of venture capital, have had positive effects. Others, like supply chain shocks and pandemic-driven instability, have bred uncertainty. Many businesses are still adapting.

The result has been upheaval. Between 2012 and the beginning of 2023, GlobalData figures suggest that the number of clinical trials initiated remained largely stable across North America and Europe. But, in the same period, 1,200 more clinical trials took place each year across the Middle East and Africa region; in the Asia-Pacific region, this figure is 7,000. And while countries like Nigeria, Egypt, Pakistan and Iran might not have the same clout in the world of pharmaceuticals as traditional big hitters in North America and Western Europe, over this timespan they have led the world in clinical trial growth. The number of trials in each country has risen by 36%, 32%, 32% and 27% respectively.

Other factors driving trends in medical research have included technological shifts (like the rise of mRNA vaccines) and political necessity (like Covid-19 driving resources into combatting infectious diseases). Add to this wider industry developments – including the drive towards making processes both more efficient through digitalisation and more sustainable via decarbonisation – and it's a lot for decision makers to get to grips with.

The past decade has been transformative for the pharmaceutical industry. They key to mastering these shifts is what underpins them all: data.

The global picture

GlobalData analysis offers some valuable insights into key developments in the pharmaceutical industry. Two key trends stand out; delving into these in more detail offers valuable insights into their origins, their likely future trajectory, and how leveraging data can help make sense of an uncertain world.

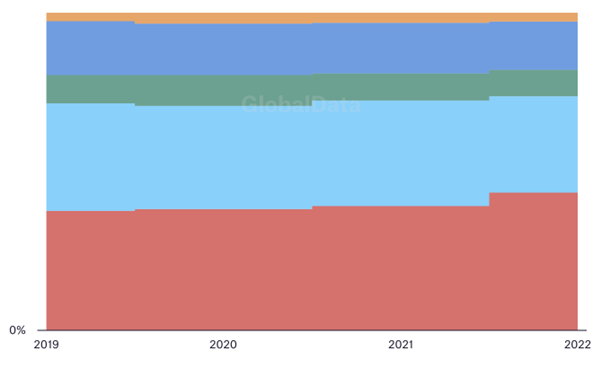

First, geographical trends. In just over a decade, the Asia-Pacific region has become a world leader in clinical trial starts. Driven by massive growth in China's pharmaceutical sector, it is eclipsing former big hitters like Europe and North America – and shows no signs of slowing down. Between 2019 and 2023, the number of Asia-Pacific clinical trials increased by 15%; nearly half of all clinical trials globally began in the region. Although individual countries in the Middle East and Africa have also exhibited strong growth, and European and American activity remains largely stable, the overarching story is clear: Asia has transformed into a pharmaceutical powerhouse.

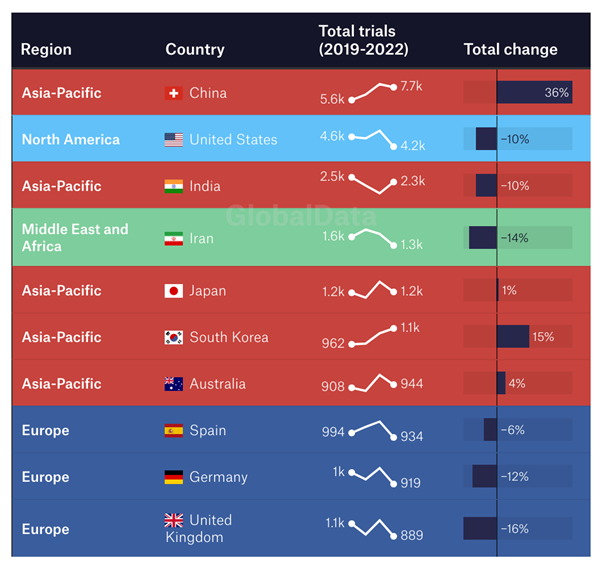

Breaking down the big players country-by-country enhances this picture. With 7,700 clinical trials in 2022, China's total was nearly higher than that of the next three most prolific countries – including the USA – combined. While nearly all other countries saw their total number of clinical trials decline over the period – notably in Europe, where no nation exceeded 1,000 clinical trials per year in 2022 – China's rose by over a third.

It isn't just the geography of clinical trials that has shifted. The types of therapies subject to trial are ebbing and flowing too.

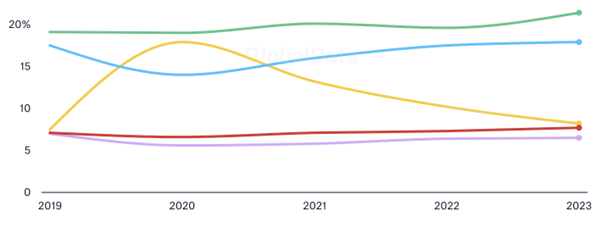

Rising interest in infectious disease therapies spiked with the coronavirus pandemic, tapering off afterwards. Other therapies experienced more stable fortunes, with oncology continuing to dominate treatments by percentage of total trials.

This stability contrasts with the volatility in trial starts for individual countries. The fact that China is experiencing such prolific growth amid relative European and American decline - all while the overall proportion of treatments subject to trial remains relatively constant - suggests that rising nations are muscling in on established markets' territories. Many pharmaceutical outfits will have relocated, but many more have sprung up over the past decade to help insurgents dominate.

At the beginning of the twenty-first century, it would have seemed inconceivable that the Asian pharmaceutical world would be on course to outperform European and American giants. The fact this came to pass – and so rapidly – is a cautionary lesson for pharmaceutical decision makers. Productivity-boosting changes like supply chain digitisation, sustainability drives and process automation cannot afford to wait.

How to stay on top

In the ever-evolving world of pharmaceuticals, businesses face a stark choice: adapt or fade away. In a globalising and diversifying industry, data is the key to unlocking success amid industry transformation.

Whatever therapies a firm specialises in, wherever they are based, they face some common hurdles. One is real-time visibility, the absence of which can lead to frustrating delays in product releases. Distributed, overlapping systems for creating, tracking and releasing shipments adds layers of complication to the process. Manual procedures remain dominant in many areas, resulting in inefficiencies and potential errors. Maintaining high-cost safety stock levels to protect against product damage or spoilage during transit places a significant burden on resources. And overarching all of this is the industry imperative to crack down on product waste and address pressing concerns around carbon emissions.

Trailblazers are tackling these concerns via a data-driven approach to supply chains. Consider Controlant's innovative Product Release Process. Automatically triggered upon shipment delivery, the process expedites release decisions, seamlessly incorporating inspections when necessary. It ensures precision and efficiency by generating comprehensive shipment reports, meaning operators can examine package data to ensure timely arrivals wherever they are in the world.

Controlant's Product Information Module goes further, enabling product-specific releases and thereby drastically reducing the need for manual interventions. Traditionally, temperature excursion boundaries are handled on a shipment-by-shipment basis. This can be costly if certain products fare better than others over the course of a shipment. Controlant's Product Information Module introduces a new approach, digitizing and maintaining a stability profile for each product in a shipment. This means that if a shipment temperature excursion breaches the stability information for only one of the products in the shipment, only that product faces rejection, while the rest can be automatically released upon arrival.

There are further advantages to incorporating an all-in-one supply chain solution of this kind. For example, Controlant’s Single Purpose View offers comprehensive data accessibility, so that non-users can view preconfigured supply chain data in real time without needing log-in access – cracking down on labour intensive manual data sharing. This is supported by automation on the company’s cloud platform, meaning shipment information and reports can be shared seamlessly with no need for human intervention. All stakeholders enjoy instant access to shipment information and reports at the click of a button thanks to real-time access, allowing decisions about supply chain strategies to be made quickly and transparently. And, although cross-platform compatibility can be a concern in an increasingly diversified world, Controlant's platform integrates effortlessly with their customers' – including the customer’s branding – to provide a cohesive and streamlined user experience.

Supply chain chiefs across the world are coming to terms with the need to develop new approaches that make the most of the power of data. They can do so by using data to make sense of the complex, diverse world of pharmaceuticals – whatever changes are coming down the track. Real-time visibility and decision making alongside revolutionary transparency are all within reach for firms that enjoy mastery over their data – and a platform like Controlant's can give them that mastery. Download the whitepaper on this page to find out more.