On August 28, the FDA approved the label expansion of Bristol Myers Squibb’s Reblozyl (luspatercept-aamt) as a first-line treatment of anaemia in adult patients with very low to intermediate-risk myelodysplastic syndromes (MDS) who require regular blood transfusions and had no prior erythropoiesis-stimulating agent (ESA) treatment. The approval was granted based on the promising interim results from the Phase III COMMAND trial (NCT03682536) where the molecule was placed in a head-to-head study with epoetin alfa, an ESA used as the standard of care. A total of 58.5% of patients who received Reblozyl versus 31.2% of patients who received the ESA achieved red blood cell transfusion independence (RBC-TI) that lasted at least 12 weeks, with a mean haemoglobin increase of at least 1.5g/dL, within the first 24 weeks of treatment. With the first-line approval, Reblozyl is set to improve MDS patients’ quality of life, as it results in fewer visits to hospitals and less exposure to risk associated with transfusion at an earlier stage of the patient journey.

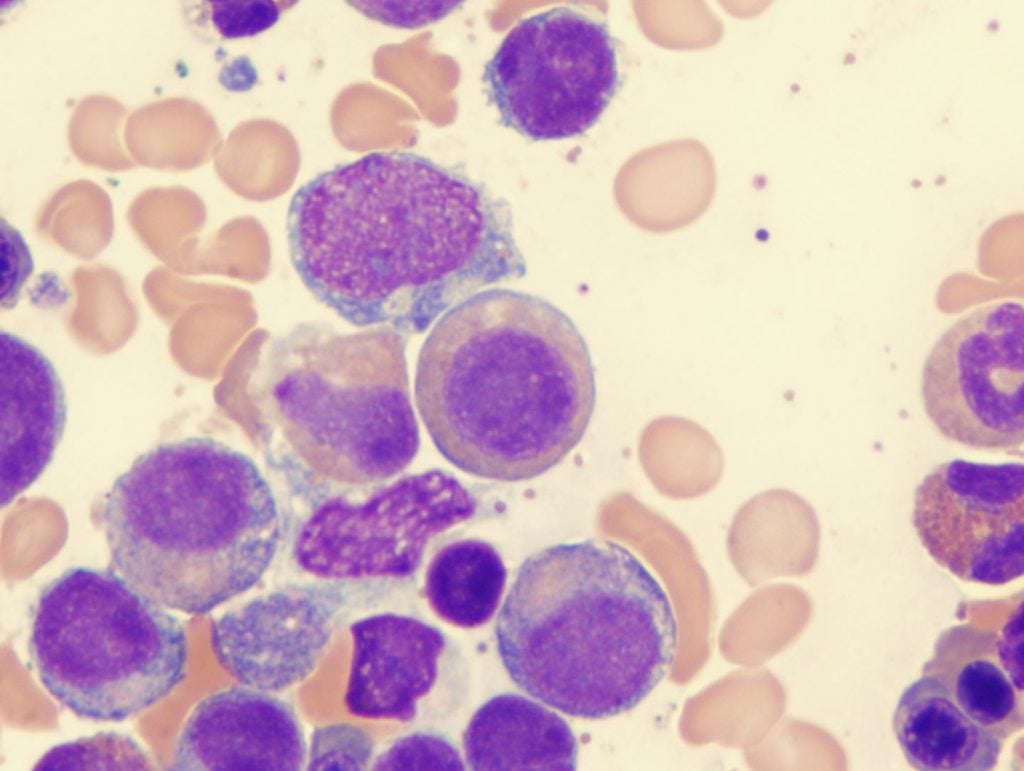

Reblozyl is an erythroid maturation agent that promotes the differentiation of erythropoietic stem cells and increases the proportion of late-stage erythroid precursors, thus driving the production of red blood cells and minimizing the need for transfusion. In the MDS space, Reblozyl was previously approved in 2020 as a treatment for very low to intermediate-risk MDS patients with ring sideroblasts or thrombocytosis who are poor responders to first-line ESA treatments. Reblozyl’s first approval was granted in 2019 as a treatment for beta-thalassemia patients who require regular transfusions.

According to GlobalData’s analyst consensus forecasts, GlobalData anticipates Reblozyl’s projected total annual sales to reach $3.2bn by 2029. The first-line approval expands Reblozyl’s total addressable market, aids Bristol Myers Squibb in recapturing the market share that it lost from Revlimid’s (lenalidomide) exclusivity loss, and erodes the foothold of ESAs in the anaemia space even further. The National Comprehensive Cancer Network (NCCN) MDS guideline states that the current first-line treatments for very low to intermediate-risk MDS patients include Bristol Myers Squibb’s Revlimid (lenalidomide), and ESAs, which are Amgen’s Epogen (epoetin alfa) and the off-label use of Amgen’s Aranesp (darbepoetin alfa).

Reblozyl demonstrated unrivalled RBC-TI benefit in the COMMAND trial, where 66.7% of patients receiving Reblozyl achieved RBC-TI for at least 12 weeks. Only 46.1% of patients receiving epoetin alfa achieved the same endpoint. In a separate trial (NCT00179621), 66.9% of patients receiving Revlimid achieved RBC-TI for at least eight weeks. A longer period of RBC-TI further eases the burden of anaemia patients by minimizing the need for commuting to medical centres, as well as the risks of iron overload, infections, and adverse reactions caused by transfusions.

Still, obstacles exist on Reblozyl’s path to total commercial victory. The agent is likely to face considerable downward pressure in pricing due to the influx of lenalidomide generics and ESA biosimilars, as well as drug reimbursement budget control in different markets. In terms of convenience for patients, Reblozyl’s dosing regimen of one subcutaneous injection every three weeks limits its threat to the once-daily oral agent lenalidomide, even though the molecule beats epoetin alfa’s weekly dosing schedule. Engagement with patient advocacy groups, reimbursement assistance programs, and adoption of the NCCN guidelines would be viable strategies for Bristol Myers Squibb to consider for emphasising Reblozyl’s competitive advantage and boosting its clinical uptake in the new space.