Bristol Myers Squibb (BMS) has agreed to a research and licensing deal with Prime Medicine to develop ex vivo T cell therapies.

Under the terms of the deal announced yesterday (30 September), Massachusetts-based Prime Medicine will design gene editing reagents based on its proprietary PASSIGE technology with BMS taking these to develop ex vivo T cell therapies. Prime Medicine will receive a $55m upfront payment as well as $55m as an equity investment from BMS.

In addition, Prime could be eligible for over $3.5bn in milestone payments. These include up to $1.4bn from developmental milestones and over $2.1bn based on commercialisation. Prime will also be entitled to royalties on future sales.

The PASSIGE platform (Prime Assisted Site-Specific Integrase Gene Editing) combines prime editing with an integrase or other site-specific recombinase to stably insert and express genetic cargo in the genome of extracted cells. The technology does not utilise viral components or double-strand DNA breaks, intended to allow for precise genetic modification without off-target edits.

Prime’s lead candidate, PM-359, is currently in an open-label, single-arm Phase I/II clinical trial (NCT06559176) to treat chronic granulomatous disease (CGD). The cell therapy was granted orphan drug designation in January 2024 and an Investigational New Drug (IND) in April by the US Food and Drug Administration (FDA).

In May 2024, Prime released preclinical data demonstrating that PM-359 precisely corrected CGD-causative mutations in more than 75% of patients’ CD34-positive cells. Furthermore, no off-target edits were detected in these cells post-engraftment.

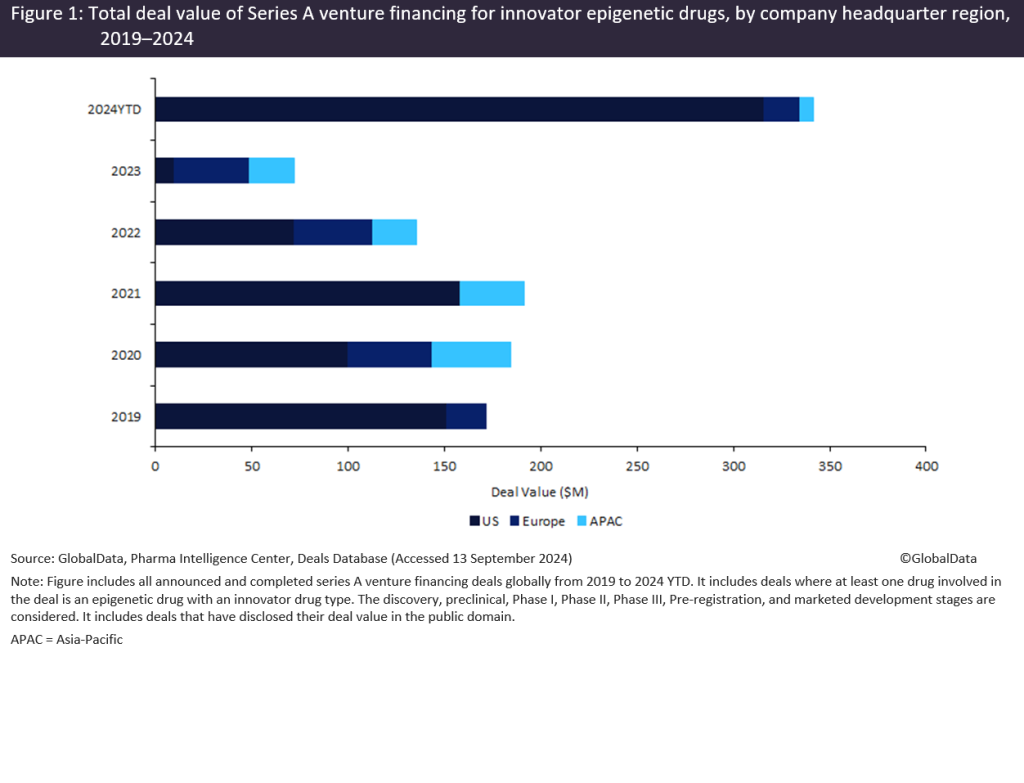

Prime Medicine launched in 2021 with $315m in Series A and B financing. Since the company’s initial public offering in October 2022, its stock has steadily declined. Following the announcement of this deal, Prime’s share price opened at $4.23 on 30 September, 22% higher than at market close the previous Friday (27 September). The company’s market cap currently stands at $464.5m.

Also on 30 September, Prime unveiled a strategically focussed pipeline. This involved prioritising its candidate for Wilson’s disease, with an IND and potentially a clinical trial application (CTA) expected in 1H 2026. Additionally, the company said that data from the Phase I/II PM-359 trial could be released in 2025.