Bristol Myers Squibb (BMS) has signed another development deal focused on cancer therapeutics after acquiring the ORM-6151 programme from South Korean biotech Orum Therapeutics.

The agreement takes place less than a month after BMS' high-profile acquisition of Mirati.

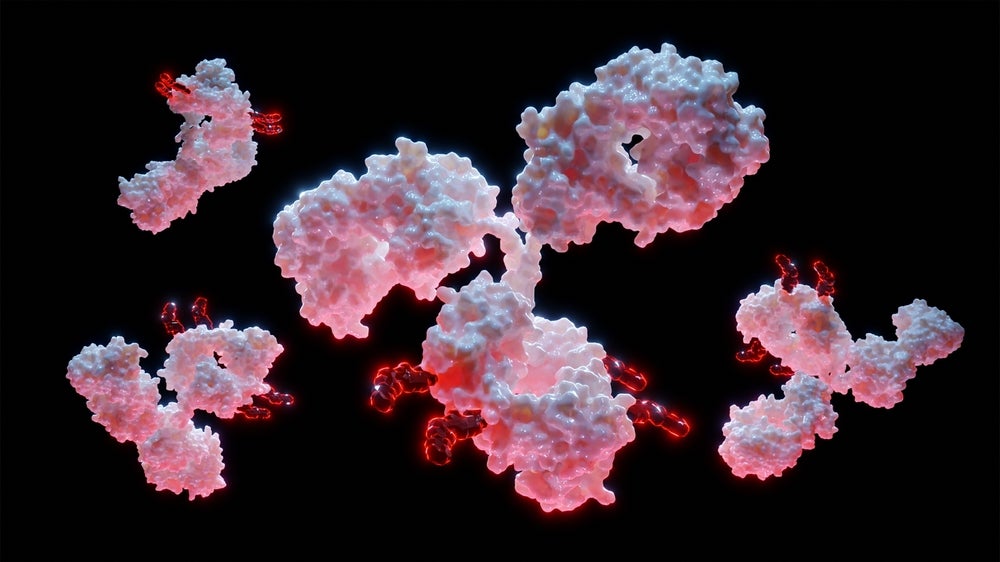

ORM-6151 is an anti-CD33 antibody-enabled GSPT1 degrader to treat acute myeloid leukaemia (AML) and myelodysplastic syndromes.

This acquisition validates Orum’s dual-precision targeted protein degradation approach, which involves the precision delivery of targeted protein degraders to cancer cells using antibody-drug conjugates (ADCs). The ORM-6151 programme is designed to target and degrade CD33, a protein found on the surface of certain cancer cells.

BMS will pay an upfront amount of $100m, with the potential for milestone payments, taking the total deal value to $180m.

Orum’s lead drug, called ORM-5029, is in Phase I clinical trials and targets HER2-expressing solid tumours in breast cancer patients. The company expects to complete the study in 2025. ADCs are targeted medicines that deliver chemotherapy agents to cancer cells. Rather than a toxin being used to target the cancer cells, Orum is using a small molecule designed to degrade target proteins.

This is not the first ADC-related acquisition for BMS this year. In April, BMS gained exclusive rights to access the P5 conjugation platform from the Planegg, Germany-based Tubulis for the development of differentiated ADCs to treat cancer patients. The deal, which involved a $22.75m upfront payment, gave BMS sole responsibility for the development, production, and commercialisation of the resulting ADCs.

According to GlobalData, the biopharmaceutical industry witnessed a 400% growth in total deal value of ADC-focused licensing agreements from 2017 to 2022 and reached a peak of $16.6bn in 2022.

GlobalData is the parent company of Pharmaceutical Technology.