Takeda Pharmaceutical Company has exercised its option to acquire Maverick Therapeutics for a pre-negotiated upfront payment and potential development and regulatory milestones totalling up to $525m.

Through this acquisition, Takeda will be able to expand its novel immuno-oncology portfolio.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The latest development follows a multi-year collaboration signed by the companies in 2017 for developing conditionally active T-cell engager therapies, though which Takeda received an equity stake and an exclusive right to buy Maverick after five years.

Under the agreement, Takeda will gain access to Maverick’s T-cell engager COBRA platform and a wide development portfolio, including the latter’s lead development candidate, TAK-186 (MVC-101) and TAK-280 (MVC-280).

At present, TAK-186 is in a Phase I/II study for treating EGFR-expressing solid tumours while TAK-280 is set to enter the clinic for treating B7H3-expressing solid tumour patients.

On closing of the deal, employees of Maverick, including its scientists’ team will join Takeda’s Research & Development organisation.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTakeda oncology therapeutic area unit head Chris Arendt said: “Collaboration is paramount to our R&D strategy and our pursuit of novel approaches to treat cancer.

“Maverick’s cutting-edge COBRA platform is an exciting addition to our oncology portfolio that provides a novel conditional bioengineering approach to advance redirected immunotherapies against solid tumours.”

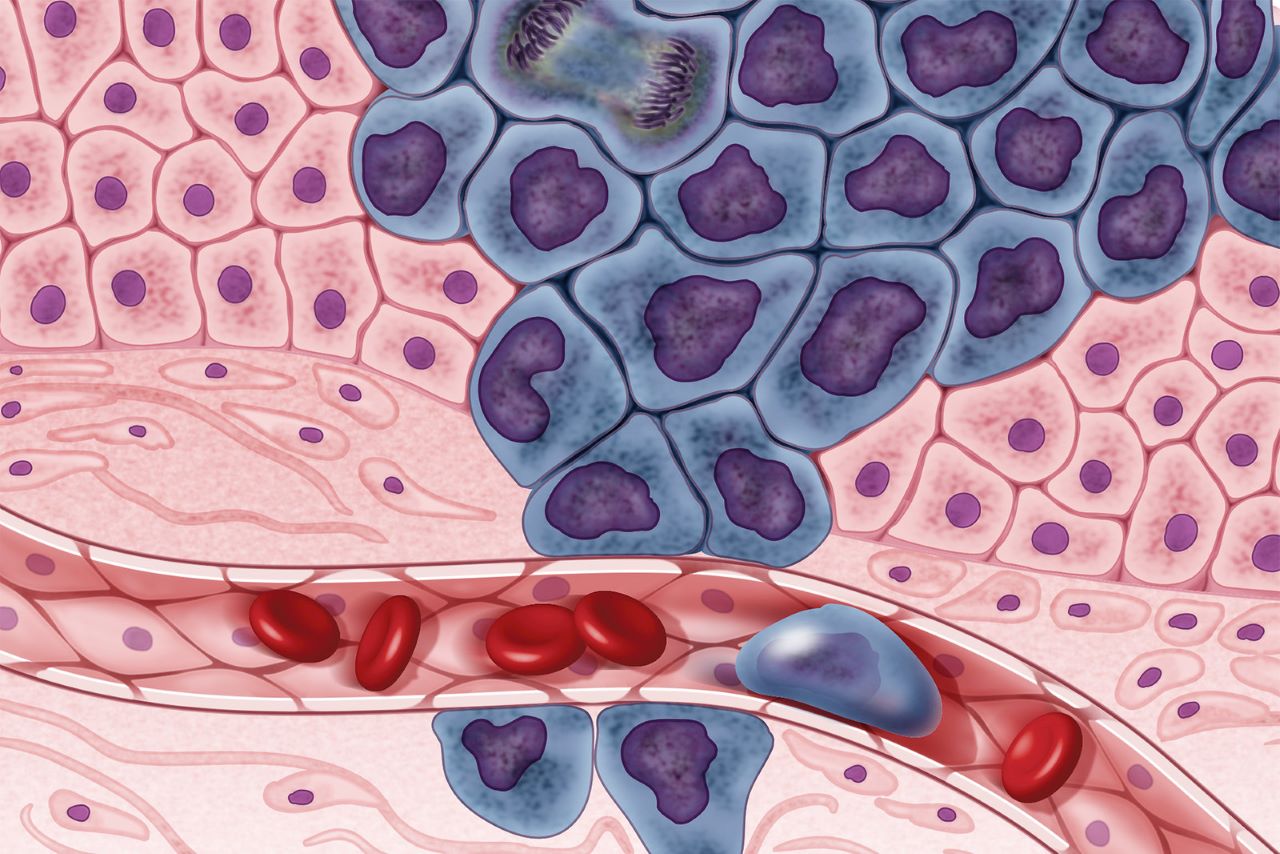

Designed to safely target a wide range of solid tumours with highly specific and potent activity, Maverick’s COBRA platform can limit toxicities in normal tissues.

As compared to standard T-cell engaging immunotherapies that are systemically active on administration, COBRA-engineered, protein-based therapies can potentially exploit the tumour microenvironment, prompting T-cell-mediated killing only at the tumour site without causing damage to healthy tissues.

Last week, Takeda signed an agreement to sell four non-core type 2 diabetes products in Japan to Teijin Pharma for JPY133bn ($1.25bn).