Swedish biopharmaceutical firm Swedish Orphan Biovitrum (Sobi) has signed agreements to acquire the rights to AstraZeneca’s Synagis (palivizumab) medicine in the US for an upfront payment of $1.5bn.

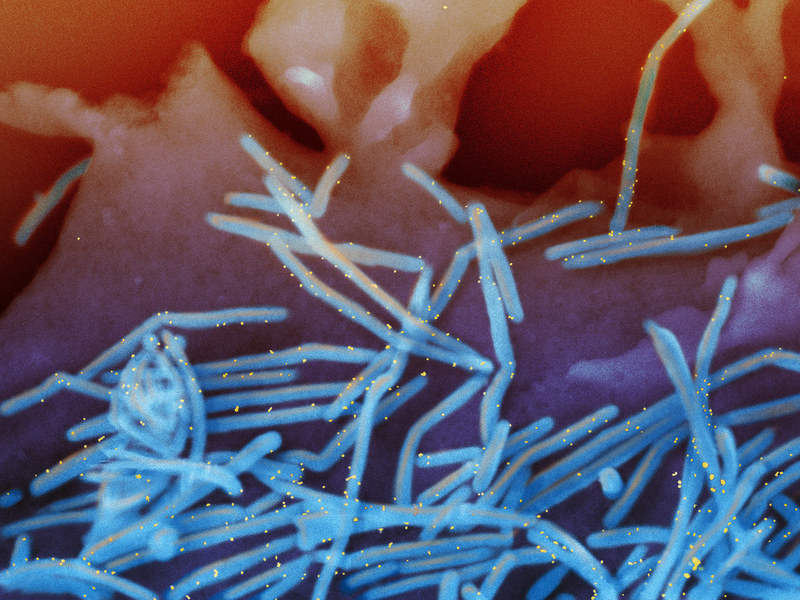

Synagis is a RSV F protein inhibitor monoclonal antibody (mAb) indicated to prevent serious lower respiratory tract infection (LRTI) caused due to respiratory syncytial virus (RSV) in infants and young children who are at high risk of the disease.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

As part of the deal, Sobi will commercialise the drug in the US and gain approximately 130 AstraZeneca employees.

The acquisition is expected to more than double the Swedish company’s footprint and revenue in the US.

Furthermore, Sobi will hold the right to participate in AstraZeneca’s share of future profits and losses associated with potential new medicine MEDI8897 in the US. AstraZeneca will develop MEDI8897 in alliance with Sanofi Pasteur.

Sobi president and CEO Guido Oelkers said: “We see the acquisition as a stepping stone to drive sustainable growth in the US and make Sobi more attractive for partnering. It also increases the overall Specialty Care franchise and diversifies our portfolio in Immunology.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to the terms of the agreement, the upfront payment will comprise $1bn cash and $500m worth of Sobi ordinary shares. The deal gives AstraZeneca an 8% stake in Sobi.

Additionally, AstraZeneca will obtain up to $470m in sales-related payments for Synagis from 2026.

Sobi will also pay $175m after submission of the biologics license application (BLA) for MEDI8897 to the US Food and Drug Administration (FDA), along with potential net payments of around $110m on reaching other MEDI8897 profit and development milestones.

The deal further involves up to $60m in non-contingent payments for MEDI8897 during 2019-2021.

AstraZeneca CEO Pascal Soriot said: “We continue to streamline our portfolio, allowing AstraZeneca to allocate resources more effectively, while Sobi’s focus on Synagis will enable infants in the US to continue benefiting from this important treatment.”

The transaction, which is subject to customary closing conditions, is expected to close early next year.