Sanofi has entered exclusive talks with US private equity company Clayton Dubilier & Rice (CD&R) over the sale of the former’s consumer health business Opella, with a deal also reached with the French Government to quell political fears over loss of regional jobs and production.

The exclusive negotiations are for the potential sale of a controlling 50% stake in Opella, which is the third-largest business in the world in the over-the-counter and vitamins, minerals & supplements market, according to Sanofi. The French pharma company said the deal, which saw CD&R prevail over rival France-based bidder PAI Partners, would close no earlier than Q2 2025.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Sanofi has placed an enterprise value of €16bn ($17bn) on Opella, around 14 times the estimated core earnings (EBITDA) for 2024, as per a 21 October press release.

Shares in the French pharma opened 0.69% down at market open on 21 October compared to the previous day’s market close. The company has a market cap of $136.3bn.

French public investment bank Bpifrance is expected to participate as a minority shareholder, taking a stake of around 2%. The state-owned company will spend between €108m and €163m in the deal, Bpifrance CEO Nicolas Dufourcq said at a press conference on 21 October, as per Bloomberg.

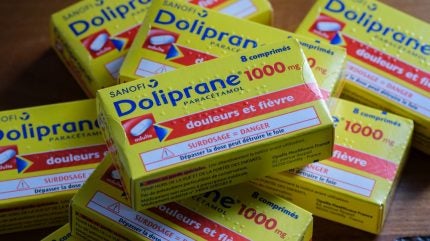

Early reports of the deal prompted backlash from government parties across France’s political spectrum over the past few weeks, who were worried about the potential loss of a strategic asset to a US company. Doliprane, one of France’s most sold painkillers, was at the centre of the storm. The medicine is so popular that most paracetamol products are referred to as Doliprane, regardless of the manufacturer. A breakthrough in Opella negotiations came after the French Government secured guarantees on keeping jobs in the country along with maintaining regional production, with the Bpifrance stake as part of the tangible result.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOpella employs over 11,000 people globally and, along with Doliprane, is known for making allergy treatment Allegra (fexofenadine) and irritable bowel syndrome (IBS) relief medicine Buscopan (hyoscine butylbromide), amongst others. Sales in the business totalled €5.6bn in 2023, accounting for 11% of Sanofi’s total business.

Sanofi also upgraded its earnings per share (EPS) guidance, saying it expects its 2024 EPS excluding Opella to increase by at least a “low-single-digit percentage” at constant exchange rates (CER). Shedding Opella as a standalone business allows increased focus on innovative medicines and vaccines, Sanofi stated. This is part of a wider trend across the pharmaceutical industry, with Johnson & Johnson and GSK both making the same play in 2022.

Sanofi’s CEO Paul Hudson said: “We will support Opella on its path to become an independent company, grounded in talented people, a deep consumer expertise and a truly global presence with deep roots in France.

“Our chosen partner CD&R has demonstrated unique capabilities in the consumer space, with deep values of respect for employees, customers, communities in which they operate, and the environment.”