Merck has signed a definitive agreement to acquire biopharmaceutical company Peloton Therapeutics for an upfront payment of $1.05bn.

The deal includes an additional $1.15bn in potential future regulatory and sales milestones for select candidates.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

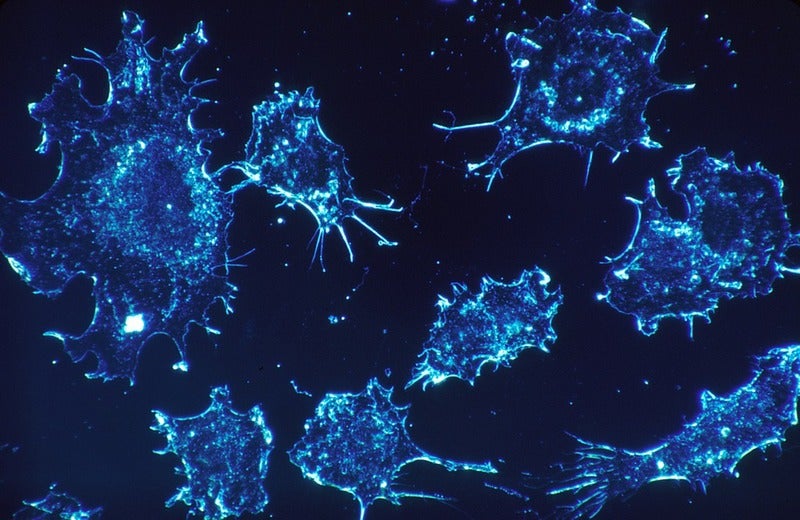

Peloton Therapeutics aims to create first-in-class drugs for the treatment of patients with cancer and other debilitating or life-threatening diseases.

The company is currently developing a small molecule to inhibit hypoxia-inducible factor-2α (HIF-2α), a transcription factor associated with clear cell renal cell carcinoma (RCC) and other diseases.

Named PT2977, the therapeutic is in late-stage development for RCC.

A Phase II clinical trial is evaluating the molecule in von Hippel-Lindau (VHL) disease-associated RCC, while another Phase II trial is assessing its combination with cabozantinib in metastatic RCC.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataA Phase I/II study is being conducted for metastatic RCC, along with an expansion arm of the Phase I/II trial in glioblastoma multiforme (GBM).

Merck said that the acquisition of Peloton Therapeutics will expand its oncology research and development (R&D) programme.

Merck Research Laboratories president Roger Perlmutter said: “Peloton scientists have applied their unique expertise in HIF-2α biology to develop PT2977, which has already shown intriguing activity in the treatment of renal cell carcinoma. We look forward to advancing this late-stage asset as part of our broad oncology R&D programme.”

Subject to customary closing conditions, the deal is expected to close in Q3 2019.

In January, Bristol-Myers Squibb (BMS) agreed to a $74bn deal to buy Celgene, which focuses on cancer, inflammation and immunologic diseases and cardiovascular diseases.

The transaction was followed by GlaxoSmithKline (GSK)’s acquisition of Tesaro for $5.1bn and Eli Lilly’s acquisition of Loxo Oncology for $8bn.