Chinese pharmaceutical manufacturer Innovent Biologics has transferred the licence for Fucaso (equecabtagene autoleucel), a chimeric antigen receptor (CAR) T-cell therapy, to its development and commercialisation partner IASO Biotechnology (IASO Bio).

Although the companies did not disclose the sale price of the deal, Innovent stated that it would use the proceeds to acquire an 18% stake in IASO Bio. Following the agreement, IASO Bio holds global commercial rights to Fucaso.

Discover B2B Marketing That Performs

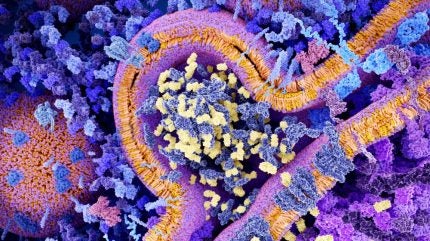

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Fucaso is a B cell maturation antigen (BCMA) targeting CAR T-cell therapy. It was approved by China’s National Medical Products Administration (NMPA) as a fourth-line therapy to treat relapsed and/or refractory multiple myeloma (r/r MM), last month. The companies have also received an investigational new drug (IND) application for Fucaso as a treatment for r/r MM patients who have undergone up to two lines of prior therapies and are refractory to Revlimid (lenalidomide).

Fucaso has also received orphan drug, medicine advanced therapy and fast track designations from the US Food and Drug Administration for treating r/r MM and obtained an IND approval. The companies are also looking to expand Fucaso’s label and trial the therapy for other indications including refractory generalized myasthenia gravis, for which it received an IND in both China and the US.

The cell and gene therapy market is forecasted to be worth over $81bn by 2029, as per GlobalData’s sales and forecast database. The sector has also seen increased scrutiny, after the FDA launched a safety probe into CAR-T cell therapies in November 2023. The US regulatory agency also sought to add boxed warnings for secondary T-cell malignancies to all approved CAR-T therapies.

GlobalData is the parent company of Pharmaceutical Technology.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDespite safety warnings, the CAR T-cell sector has seen several high-profile deals. In December 2023, AstraZeneca shelled out $1.2bn to acquire China-based Gracell Biotechnologies. Gracell’s lead asset was dual BCMA- and CD19- targeting CAR-T cell therapy, GC01F. The therapy is being investigated in multiple indications, including multiple myeloma and systemic lupus erythematosus (SLE).

In November 2023, Novartis signed a licensing agreement potentially worth over $1bn with Legend Biotech Ireland for its delta-like ligand protein 3 (DLL3)-targeting CAR-T cell therapies.

Cell & Gene Therapy coverage on Pharmaceutical Technology is supported by Cytiva.

Editorial content is independently produced and follows the highest standards of journalistic integrity. Topic sponsors are not involved in the creation of editorial content.