The US Food and Drug Administration (FDA) and European Medicines Agency (EMA) have accepted Biogen’s applications for a higher dose regimen of spinal muscular atrophy (SMA) treatment Spinraza (nusinersen).

The proposed higher dose regimen includes two 50mg doses administered 14 days apart, followed by a maintenance dose of 28mg every four months. This is fewer doses compared to the existing regimen, which involves four loading doses of 12mg over 60 days and a maintenance dose of 12mg every four months.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Biogen previously announced that it was planning regulatory approval for the investigational dose regimen in September 2024, alongside data from the Phase II/III DEVOTE study which has supported these regulatory filings.

The three-part study (NCT04089566) enrolled 145 patients of various ages across various SMA types. In a key cohort of 75 treatment-naïve children with infantile-onset SMA, the higher-dose regimen of Spinraza demonstrated statistically significant improvements in motor function at six months, as measured by the CHOP-INTEND scale. The results were compared to a prespecified untreated control group from the earlier ENDEAR trial, which supported Spinraza’s standard dose approval.

Secondary outcomes from the DEVOTE trial showed favourable trends for the higher-dose version in biomarker and efficacy measures compared to the 12mg dose. Safety data indicated that adverse events were consistent with SMA and Spinraza’s established profile. Notably, the incidence of serious adverse events was lower in the higher dose group at 60%, compared to the 72% incidence seen in the 12mg group.

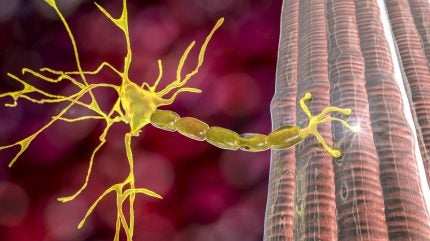

Spinraza – approved in the US in 2016 and Europe in 2017 – was the first disease-modifying therapy for SMA. It is an antisense oligonucleotide (ASO) designed to increase the production of survival motor neurone (SMN) protein, addressing the underlying cause of motor neuron loss. The treatment is administered directly into the central nervous system to target motor neurons.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDespite its early success, Spinraza faces increasing competition from newer SMA therapies. Roche’s Evrysdi (risdiplam), approved in the US in 2020 and the EU in 2021, is an oral treatment that may be a more convenient way of administration. Novartis’s Zolgensma (onasemnogene abeparvovec), approved in the US in 2019 and the EU in 2020, provides a one-time treatment option for SMA. These therapies have shifted market dynamics, impacting Spinraza’s sales.

Spinraza pulled in $1.74bn in sales for Biogen in 2023, as per the company’s financials. Sales of the drug are set to decrease steadily year-on-year, generating $1.15bn in 2030, according to GlobalData’s Pharma Intelligence Center. By contrast, Evrysdi and Zolgensma are expected to generate $2.78bn and $2.13bn in 2030, respectively.

The global SMA market, valued at $2.7bn in 2023, is projected to grow to $3bn by 2033 in the seven major markets (US, UK, France, Germany, Italy, Spain, and Japan).

GlobalData is the parent company of Pharmaceutical Technology.