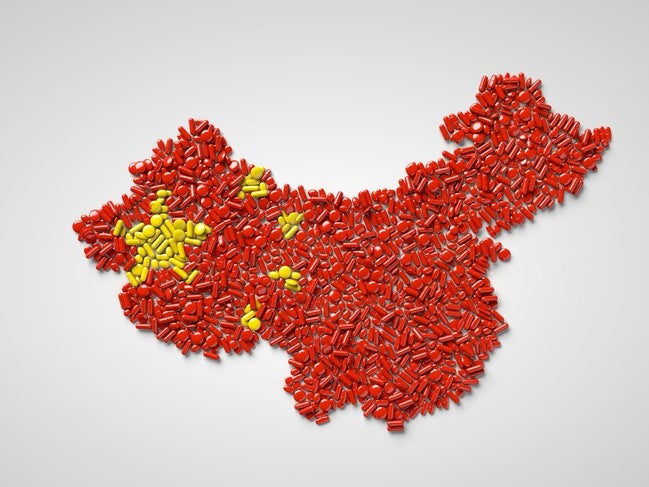

China’s National Healthcare Security Administration (NHSA) has announced it has agreed an average 61% cut in prices of 70 top-selling drugs with large pharma manufacturers in exchange for inclusion on a state-run insurance scheme list.

According to the South China Morning Post, the 70 drugs include Roche’s Perjeta, Novartis’ Xolair and the top selling drug in the world AbbVie’s Humira, as well as Eli Lilly and China-based Innovent Biologics’ Tyvyt.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

However, some top selling anti-programmed cell death-1 (PD-1) drugs were not included in this list – Bristol-Myers Squibb’s Opdivo and Merck’s Keytruda, which are both approved in China – an analyst explains to the Financial Times (FT) this is to allow domestic pharma companies to be able to compete in this lucrative area of the oncology market.

The FT also listed AstraZeneca, Gilead, Sanofi and Roche among big pharma who agreed to slash their drug prices.

State-owned news organisation Xinhua noted that 22 anti-cancer drugs, seven drugs for rare diseases, 14 for chronic diseases, four for paediatric indications and three for hepatitis were reduced in price by 87%.

In addition, the FT reported 27 drugs already reimbursed through the scheme have had their prices further reduced by an average 26%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe NHSA claims this makes the prices of these drugs the lowest in the world. Also, this agreements means big pharma and their drugs will have greater access to the world’s second largest pharma market because more Chinese citizens in smaller, more remote cities will be able to afford the drugs through their state medical insurance system.

Big pharma has been making overtures to China over the last few years since the Chinese Government began to open up the country’s healthcare system in 2015. Over the past year, companies have been expanding their R&D presence in China and signing various deals with domestic biotechs.