Chinese biopharmaceutical firm BeiGene has agreed to exclusive rights to develop and commercialise Leap Therapeutics’ cancer drug DKN-01 in the Asia Pacific region, excluding Japan.

Under the agreement, Leap will continue to have sole rights to develop, manufacture and commercialise the drug in the remaining global markets.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

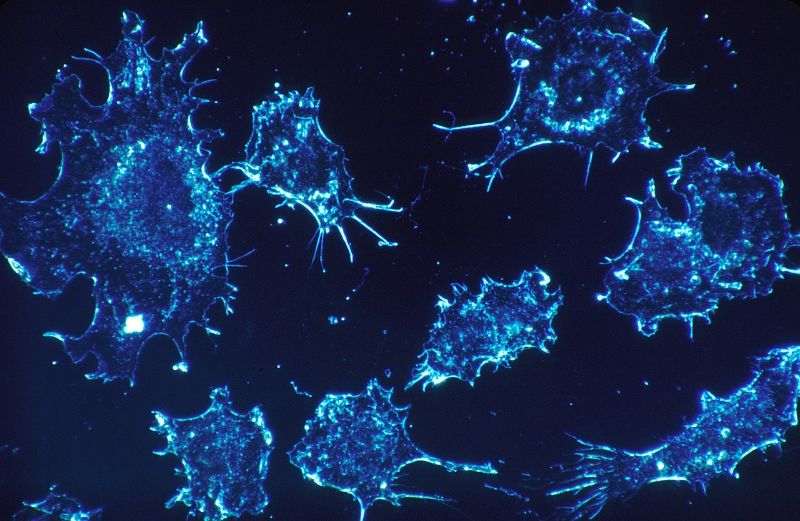

DKN-01 is a humanised monoclonal antibody designed to inhibit the activity of the Dickkopf-1 (DKK1) protein, which modulates the Wnt / Beta-catenin signalling pathway linked to tumorigenesis and immune suppression.

During the option period of the deal, Leap will assess DKN-01 in combination with tislelizumab, a PD-1 inhibitor, in around 40 second-line gastric cancer (GC) or gastroesophageal junction cancer (GEJ) patients.

The trial will enrol patients with tumours expressing high DKK1 levels.

Leap also intends to investigate DKN-01 plus tislelizumab and chemotherapy in almost 20 first-line GC / GEJ patients, set to be launched in the first half of this year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBeiGene Immuno-Oncology chief medical officer Yong Ben said: “We are excited about the potential to combine our anti-PD-1 inhibitor tislelizumab with DKN-01 as there have been promising signals in a biomarker-defined population of gastric cancer patients in combination with checkpoint blockade.”

In return for DKN-01 licence in Asia, excluding Japan, Australia and New Zealand, BeiGene will pay $3m in an upfront cash payment to Leap, along with up to $132m in development, regulatory and sales milestones, as well as royalties on sales in the territory covered under the agreement.

Furthermore, Leap signed an agreement for a $27m equity financing from BeiGene and two institutional investors. BeiGene will pay $5m as part of this equity financing.

Leap and BeiGene also forged a securities purchase agreement. Equity financing is subject to customary closing conditions.