As cell and gene therapy developers struggle against an investment slump and competition from established autologous treatments, allogeneic cell therapies may still find a niche.

Though still nascent, allogeneic options are “poised for prime time,” said Stefanos Theoharis, CEO of the Barcelona, Spain-based Onechain Immunotherapeutics, at the Advanced Therapies 2025 conference, in London on 18 March.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

One of the primary attractions of allogeneic options is that they have relatively fewer operational challenges than autologous treatments. Theoharis noted that concerns around the limited scalability and lengthy quality controls for autologous manufacture is spurring the sector’s desire for allogeneic alternatives.

But allogeneic therapies have their own challenges; namely a lack of demonstrated efficacy, and the difficulty in finding donors.

Conversely, despite logistical difficulties, autologous treatments maintain future viability thanks to their demonstrable efficacy and lack of immunogenicity, said Johannes De Munter, PhD, CEO of the Dutch biotech Neuroplast BV. De Munter also suggested the decentralisation of manufacturing and affiliations between CDMOs and hospitals could shorten logistic chains and improve manufacturing and distribution efficacy.

Technological innovation was also noted as a potential route to upscale autologous therapy production. Pharmaceutical Technology spoke with Jason Jones, business development lead at the British cell therapy manufacturing company Cellular Origins. The company’s modular robotics system could support small scale, regional manufacturing facilities for cell therapy biotechs to greatly reduce material transport times, said Jones.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGiven heterogenous needs for patients, both cell therapy approaches can co-exist. There is potential for competition between the two approaches with chimeric antigen receptor (CAR)-T therapeutics in particular.

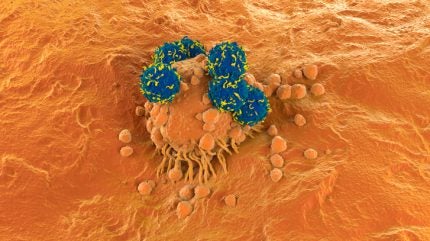

Another topic that was widely discussed at the meeting was in vivo cell therapies. Approved ex-vivo CAR-T therapies like Gilead Sciences’ Yescarta (axicabtagene ciloleucel) or Novartis’s Kymriah (tisagenlecleucel) involve modifying the T cells extracted from a patient outside their body and then re-administering them. In vivo cel therapies are based on emerging science where T cells are engineered into CAR-Ts inside a patient’s body.

On 17 March, AstraZeneca announced its planned acquisition of EsoBiotec in a deal worth up to $1bn. The biotech currently has one in vivo cell therapy in clinical development, ESO-T01, which is being developed for multiple myeloma. EsoBiotec is not the only cell therapy developer with research in this space. In January, another biotech, Umoja Biopharma raised $100m to advance its own in vivo CAR-T therapy in the clinic, while Capstan Therapeutics received $175m in funds to develop its in vivo CAR-T therapy CPTX2309 for treating autoimmune disorders.