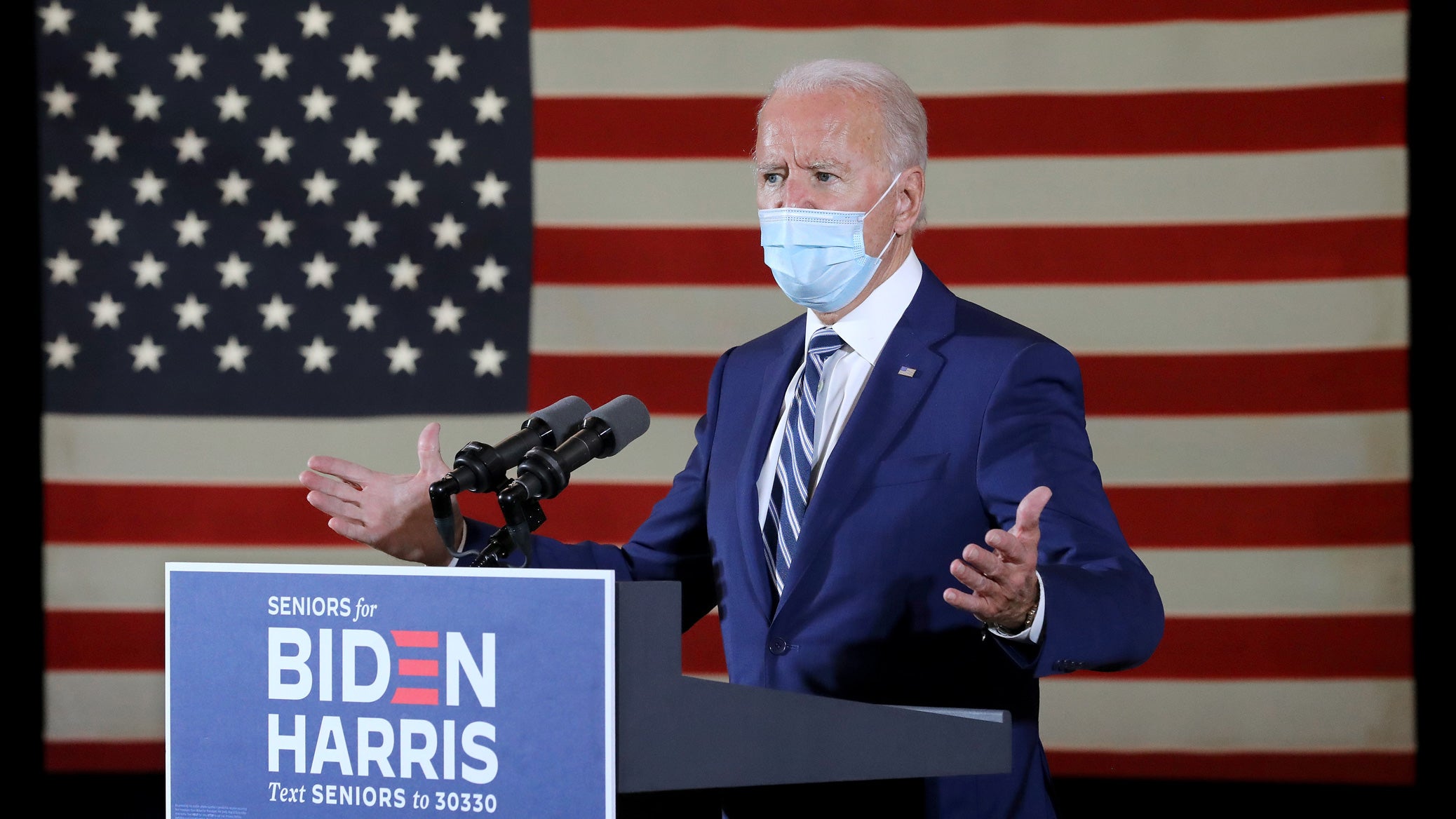

On Tuesday 3 November, the US population went to the polls to decide if they wanted to stick with incumbent Republican Donald Trump or twist and choose former vice-president and Democrat nominee Joe Biden as their next President.

After almost four days of counting, Biden passed the required 270 electoral college votes to win the US Presidential election; he will be sworn into office on 20 January.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

After almost a month of consistently declaring the electoral results to be fraudulent and calling for recounts in many states, on 23 November, Trump finally directed his team to initiate a transition of power. This came soon after the General Services Administration head Emily Murphy formally declared Biden to be the winner.

Unsurprisingly, given than the US is living through a severe public health crisis, healthcare has been a huge battleground issue in this election. According to polling by the Kaiser Family Foundation, Covid-19 was the second most important issue and healthcare in general was fourth; Biden led Trump in both areas throughout the campaign.

Since the 1990s, the pharma industry has largely ploughed most of its campaign fundraising into the Republican party. However, interestingly, in this year’s US election, they bucked the trend; according to the Centre for Responsive Politics’ Open Secrets, the industry gave significantly more to Biden and the Democrats. Biden received $6.3m from pharma, compared to $1.6m for Trump, while the Democrats in total received $32.6m, while Republicans received $19.8m.

This clear support from pharma of Biden and the Democrats over the incumbent Republican Trump administration begs the question, why is Biden’s electoral victory viewed as positive for the pharma industry?

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe significance of Biden’s previous record in office

Unlike President Trump, who brought uncertainty and inconsistency to policy making, Biden is a known quantity, argues industry association Biotechnology Innovation Organisation chair of the board Jeremy Levin.

This is because he has been in public office since 1973 first as a senator for Delaware and then as President Barack Obama’s vice-president between 2008 and 2016.

As a result of his record, the pharma industry can predict how President Biden and his administration may potentially operate, notes PricewaterhouseCoopers (PwC)’s Health Research Institute leader Ben Isgur.

Not does pharma understand Biden, but, Levin argues, Biden respects and understands the pharma industry and how it operates. In particular, Levin believes that Biden better understands how important innovation is to driving advancements and that the industry is a strategic asset in the US than Trump.

Duane Morris partner and team lead for the life sciences and medical technologies industry group Patrick Gallagher agrees. He adds that Biden knows “how the processes works, which should give pharma some confidence he is going to re-establish some norms, while at the same time identifying policies to move things forward”.

In his manifesto, Biden has committed himself to significant reform to the Affordable Care Act (ACA), which he was closely involved in the development and implementation while vice-president, and to control the high prices of drugs in the US. He also laid out an overview of his Covid-19 response.

Biden’s Covid-19 strategy

It is impossible to talk about the US election without looking at it in the context of the Covid-19 pandemic where the US has both more cases and deaths than any other country in the world.

Biden has been very vocal in his criticism of Trump’s handling of the pandemic. He specifically criticised Trump’s anti-expert approach and accused him of applying political pressure and cronyism in his handling of the pandemic. In contrast, Biden’s commitment to work closely with scientific experts was made evident when within days of winning the election he announced the personnel in his Covid-19 taskforce.

Beyond this, Biden has committed himself in his manifesto to ramp up large-scale manufacturing of as many vaccines candidates as necessary, build a nationwide vaccination campaign and ensure that everyone who wants a vaccine gets one.

Pharma’s perspective on Biden’s pandemic plans

According to PwC research, Trump’s pandemic response plans were viewed as negative for the pharma industry, while Biden’s were seen as positive.

Healthcare consultancy Avalere’s market access practice director Lance Grady thinks Biden has been saying the right things around listening to the science and handing the microphone over to experts. Levin agrees that Biden’s “steps to assemble experts are very well though through”; “the industry at large is highly supportive of an administration that lets medicine and science prevail, not politics”.

Beyond Biden’s commitments to listen to the science, Grady says it is too soon to “put anything in print about what his policy is until we see daily briefings and the fruit of his planning”. Gallagher agrees and states the impact of Biden’s approach on pharma remains to be seen, especially given the virus is a moving target.

Expanding coverage benefits the industry

Given Biden was vice-president when the ACA was implemented, it is not surprising large swathes of his manifesto focus on undoing Trump’s attempts to sabotage the Act. His plan centres on “giving Americans more choice, reducing healthcare costs and making our health care system less complex to navigate.”

The crux of Biden’s plan is to increase coverage – for instance, he wants to lower the age of Medicare eligibility from 65 to 60 and creating a new national public option for those not already enrolled in Medicare or Medicaid.

PwC’s research suggests that Biden’s plans related to increasing coverage and creating richer benefit plans are positive for pharma. Simply put, “pharmaceutical leaders care about insurance and coverage because they need paying customers with health insurance” to fund their drugs, states Isgur. Grady agrees that the pharma industry likes coverage and sees the Biden administration’s positive view of the ACA and insurance as good for the industry.

Gallagher adds that the positives for pharma around Biden’s approach to the ACA link to him generally bringing certainty and stability; “in large part, the industry wants to know what the regulatory framework is going to be so they can operate under that”.

Levin notes that the pharma industry was concerned by Trump’s attempts to undermine the ACA, including by supporting ongoing Supreme Court action. “Trump trying to disassemble and remove insurance without replacing it was very worrisome because you cannot operate a coherent pharmaceutical industry without a coherent insurance programme.”

Hot topic: reducing drug pricing

Over the past four years, President Trump has zeroed in on tackling drug pricing in the US. He has published multiple executive orders laying out a most favoured nation pricing model. The most recent was published in mid-September and called for the Medicare Part B and D to pay the lowest price, “after adjusting for volume and differences in national gross domestic product” (GDP), that the product is sold for in any Organisation for Economic Co-operation and Development with a similar per-capita GDP.

Pharma reacted angrily to this announcement. Levin calls the most favoured nation proposal “destructive”, “unworkable” and would destroy necessary innovation in the industry.

Although it is clear that reducing drug prices in the US, which is unsurprisingly not popular with the pharma industry as a whole, is also a priority of Biden, Levin says this is “a small price to pay for general consistency and commitment to innovation” which the President-elect offers compared to his predecessor.

Instead of a most favoured nation approach, Biden has suggested a few options for reducing drug prices in the US. These include establishing a review board to assess and recommend a reasonable price based on the average price elsewhere – this is terms external reference pricing – allowing the import of prescription drugs from abroad so long as the FDA has certified them as safe and linking generic prices to inflation.

Ultimately, because Biden is a known quantity and they have worked with him before, the pharma will have the opportunity to sit down and hold productive discussions with the Biden about drug pricing, notes Gallagher. This contrasts sharply to “Trump [who] was elected to shake things up and take a different approach”, he adds.

Constraints on Biden’s legislative success

Unfortunately for Biden, although he may have ambitious plans for reforming the ACA, expanding Medicare eligibility, and lowering drug prices, these may be difficult to achieve given the Democrats do not control the Senate, the upper legislative chamber in the US.

As it stands, the Republicans have 50 seats in the Senate to 48 for the Democrats with two seats in Georgia undergoing a by election in January. Therefore, Grady concludes that it is unlikely Biden will be able to “aggressively advance major legislative reform”. Isgur agrees that it becomes harder for Biden to manage drug prices in a divided congressional situation; although most legislators agree that the prices of drugs need to be controlled, “the devil is in the details”.

As has been established, the pharma industry likes certainty and consistency in legislation and regulation, therefore, Grady concludes, “it is probably the best case for pharma that we have a bicameral split” in the Senate.