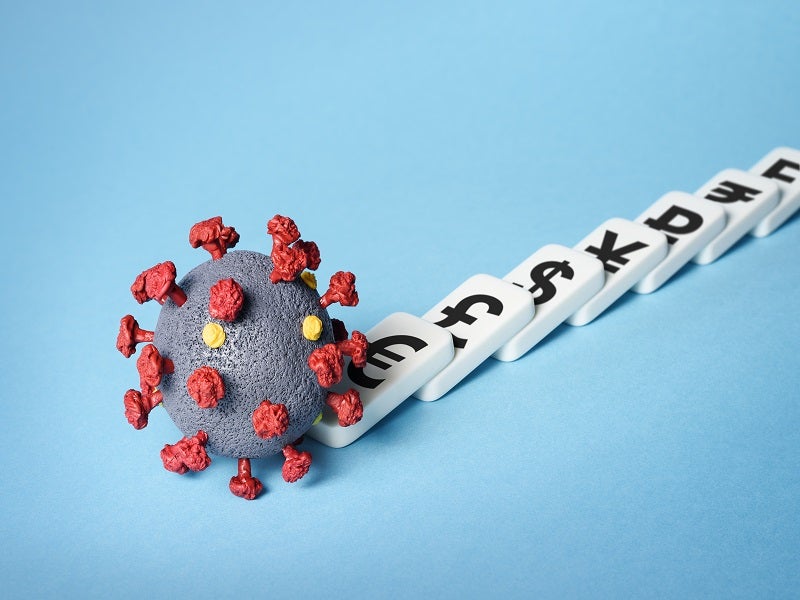

The Covid-19 pandemic has led to unprecedented levels of unemployment, huge levels of debt and an imminent threat of inflation or even deflation. Economists believe that moderate levels of inflation can help economies around the world to deal with the debt and recover from the crisis.

Atif Mian

Atif Mian, an economist, tweeted that the world is witnessing the highest levels of debt for the first time in many years. He added that the best way to reduce this debt will be moderate inflation particularly in advanced economies.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Mian noted that implementing moderate targeted-inflation may be a challenge in the near term.

The level of debt has never been higher in the world – and that is a major issue.

One way to reduce the real burden of debt gradually over time is moderate inflation.

We need moderate targeted-inflation in advanced economies. And that might be a challenge in the near term.

/end GlobalData Strategic Intelligence

GlobalData Strategic IntelligenceUS Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData— Atif Mian (@AtifRMian) May 6, 2020

Adrian Saville

Adrian Saville, founder and Chief Executive at Cannon Asset Managers, shared an article on how inflation has declined to the lowest levels in advanced economies plunging the world into recession. The article added the prolonged recession may lead to lower levels of inflation.

Failure to stimulate demand and too much support from central banks can lead to below-target inflation or deflation, which can be more damaging, the article added.

"Inflation across the OECD area dropped to 1.7% in March from 2.3% in February, the largest deceleration since the 2008 financial crisis".@TlotlisoPhakisi@AdrianSavillehttps://t.co/P8lObB3NkJ

— Wynand Steyn (@Wynand_Steyn) May 6, 2020

Miles Kimball

Miles Kimball, professor of economics at the University of Colorado, tweeted about the impact of the Covid-19 pandemic on the manufacturing sector. He shared an article that noted that the manufacturing index fell by 41.5 in April from 49.1 in March, according to the Institute of Supply Management. The article added that any number below 50 indicates a contraction in the manufacturing sector.

Kimball added that interest rates will need to be reduced for investment and for durables purchases.

If nondurable and services consumption is stunted by unemployment, interest rates need to be cut far enough for investment and durables purchases to make up the difference. Fortunately, there is no limit to how much rates can be cut. https://t.co/Xra4bL4zGD

— Miles Kimball (@mileskimball) May 6, 2020

Steve Hanke

Steve Hanke, applied economist at the Johns Hopkins University, shared an article on the bankruptcies filed by Hertz, Gold’s Gym, and J. Crew. Lenders provided some reprieve to Hertz from a potential bankruptcy and the company has until 22 May to develop a financing strategy.

Hanke noted that together the three companies employed more than 50,000 people. He added that the impact of unemployment will be more that of the coronavirus outbreak and will continue until the lockdown restrictions are lifted.

Hertz, Gold's Gym, and J. Crew are the newest companies to file for bankruptcy amidst the lockdown. Together, these companies employ 50k people.

The impacts of #Unemployment will soon rival the impact of the #Coronavirus if the #Sledgehammer isn't lifted.https://t.co/RG6yMYGaA6

— Prof. Steve Hanke (@steve_hanke) May 6, 2020