The number of Covid-19 cases continues to increase across the world particularly in developing and emerging nations and fresh outbreak being reported in China. Some countries, however, have started reopening their economies and easing lockdown restrictions increasing the possibility of a V-shaped recovery.

John Ashcroft

John Ashcroft, an economist, shared an article on Morgan Stanley’s projections that the global economy is headed for a V-shaped recovery. The article notes that the global economy will return to pre-crisis levels by the fourth quarter of 2020.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The predictions are based on the latest economic data in addition to policy actions taken by various governments. Morgan Stanley predicts that the recession will be sharp but short although uncertainty still remains around this outlook.

Morgan Stanley Economists Double Down on V-Shape Global Recovery @business https://t.co/sLX0N418ff

— John Ashcroft (@jkaonline) June 15, 2020

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMohamed A. El-Erian

Mohamed A. El-Erian, chief economic adviser at Allianz, shared a chart on how the majority of recent job losses in the US are due to reallocation shock. The situation occurs when companies and sectors suffer lasting damage due to the Covid-19 pandemic.

Hospitality and retail sectors are some of the biggest sectors hit by the pandemic, followed by education and health, and manufacturing. El-Erian noted that the economic shock caused by the pandemic may not be temporary or reversible, which is cause for worry.

A major worry for me is how much of the #COVID economic shock is not temporary/reversible

As an illustration, @economics estimates that 30% of recent US job losses are due to a reallocation shock–where "firms and even entire sectors suffer lasting damage"https://t.co/AOVYknkAWB pic.twitter.com/q0TarSBPXy— Mohamed A. El-Erian (@elerianm) June 14, 2020

Linda Yueh

Linda Yueh, economist at the University of Oxford, shared an article on how the Covid-19 pandemic is impacting Latin America. The region is home to only 8% of the world’s population but has reported more than of the deaths resulting from Covid-19.

The number of infections continues to rise despite the implementation of lockdowns. The damage caused by the pandemic is leading experts to fear that the region may lose another decade of growth and fall into a new debt crisis.

Latin America, home to just 8 per cent of the global population, is suffering half of coronavirus deaths, stoking fears of another lost decade and a new debt crisis. https://t.co/ShLTsoRdnU

— Linda Yueh (@lindayueh) June 15, 2020

Holger Zschaepitz

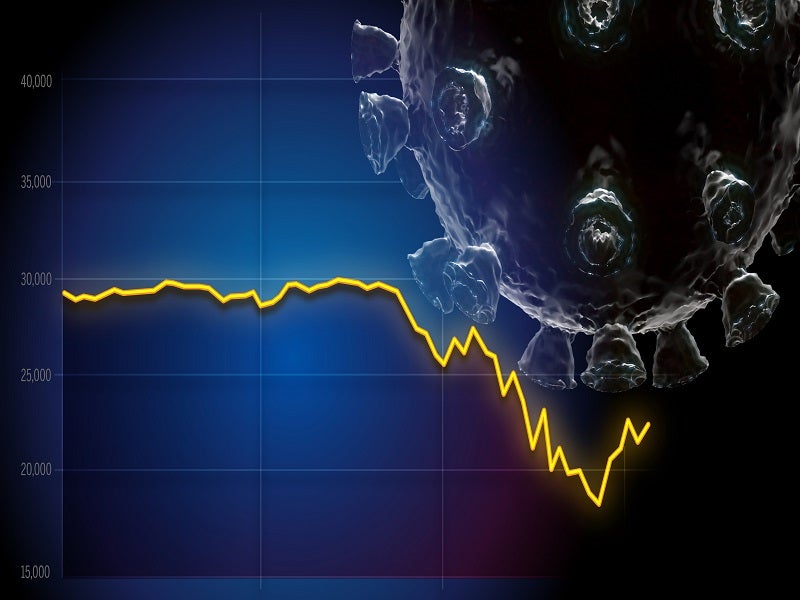

Holger Zschaepitz, an author, shared a chart on how the global markets started with a risk-off mode after fears of a second wave emerged. More than 20 states in the US reported an increase in cases, while Tokyo reported a jump in cases apart from a new outbreak in Beijing.

The situation caused US, European and Asian futures to retreat, while Brent oil dropped to 37.58.

https://twitter.com/Schuldensuehner/status/1272399483888959489