Everyone has a view on Brexit’s business impact these days, but the most valuable opinion belongs to insiders. For this reason, research company GlobalData polled 150 global health industry professionals in February and March 2021 to gauge the impact of Brexit on the healthcare sector.

In the survey, insiders were polled on business environment, opportunities and risks that the UK’s pharmaceutical industry is going to face post Brexit. Verdict looks at the key findings from a subsequent report based on the results alongside the latest post-Brexit developments within the healthcare space.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

What’s a bigger threat to healthcare: Brexit or Covid?

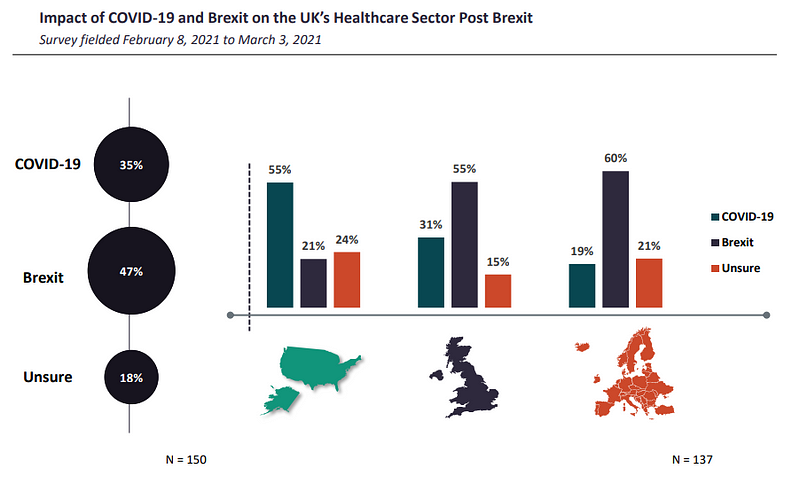

A total of 55% of respondents from the UK and 60% from the rest of Europe (ROE) believed that Brexit would have a more damaging effect on the UK’s healthcare sector than the Covid-19 pandemic.

Even though the pandemic severely disrupted supply chains when it began, the disruptions were short-lived. In contrast, as GlobalData notes, Brexit-imposed border restrictions may permanently alter the way businesses trade and operate. Consequently, Blighty’s divorce from the trading bloc exit is expected to bring a bigger burden on sectors that rely on trade with the EU.

“Brexit is a mess for R&D, distribution, and support of clinical trials and development” said one anonymous UK C-Level executive in the survey. “Covid-19 has created a false assumption that all medicine development will be fast and co-operative.”

Not everyone shared the sentiment. Contrary to British participants, US respondents told GlobalData that Covid will have a greater negative impact than the EU exit.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Impact of Covid[-19] is far more important and detrimental than Brexit given the significant economic impact [caused by] UK government lockdown, which was far more comprehensive and stricter than in other EU countries,” said one anonymous US director polled in the survey.

What are the biggest Brexit negatives for healthcare?

The healthcare industry has had reason to feel optimistic. This year saw the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) replace the European Medicines Agency (EMA), becoming the standalone medicines and medical devices regulator in the UK, which may present new avenues and independence for British healthcare.

Curb your enthusiasm though, urges Urte Jakimaviciute, senior director of research and analysis at GlobalData

“The UK has a significant dependence on exports to EU markets, hence full divergence from EU regulations may not be possible especially given how closely connected the UK and EU markets are,” she tells Verdict.

“Even though separation from the EU allows the UK to create a more efficient regulatory strategy, the UK will still need to find a sustainable balance if the country wants to keep close alignment with the EU while moving toward its own independent, commercially viable, and competitive regulatory regime.”

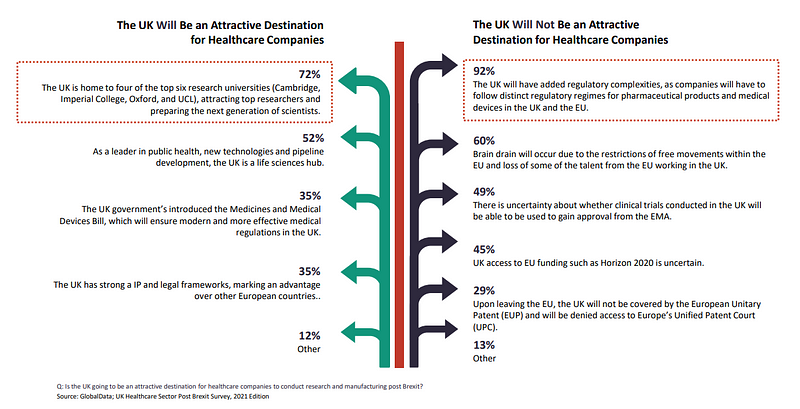

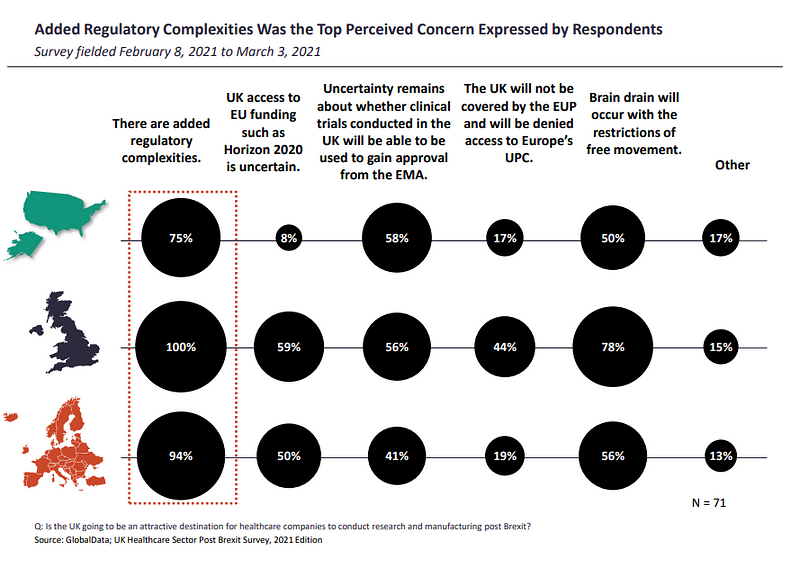

The adjustment shift in regulation for businesses may be why added regulatory complexities are perceived as the top concerns by insiders, with respondents from the UK (100%), ROE (94%) and US (75%) marking their concerns for a 92% share of responses.

When asked if the UK will be an attractive destination for healthcare companies to conduct research and manufacturing post Brexit, 60% of all respondents believed brain drain will occur due to the restrictions of free movements within the EU and loss of some of the talent from the EU working in the UK.

For 49%, there is uncertainty about whether clinical trials conducted in the UK will be able to be used to gain approval from the EMA.

45% were uncertain about UK access to EU funding such as the EU’s €95.5bn ($114.4bn) research and innovation programme Horizon 2020, although the Trade and Cooperation Agreement (TCA) does secures the UK access to it. It will be excluded though from the new European Innovation Council Accelerator fund, aimed at providing equity investments to smaller businesses.

For 29%, respondents feel the UK’s attractiveness is diminished by it not being covered by the European Unitary Patent (EUP) and denied access to Europe’s Unified Patent Court (UPC).

“Increase in paperwork, cost, and hassle makes the UK an unattractive location for clinical trials,” said one anonymous UK director in the survey. “[There will be] additional import licenses required for IP coming from UK to EU for clinical trials, and additional QP [qualified person] complexity. The trade deal has not looked after the interests of [the healthcare] industry.”

Brexit’s impact on corporate strategy was felt in European countries the most, including the UK as confirmed by 50% (UK) and 43% (ROE) of the polled healthcare industry professionals, with Brexit deterring companies from considering any long-term strategies or plans.

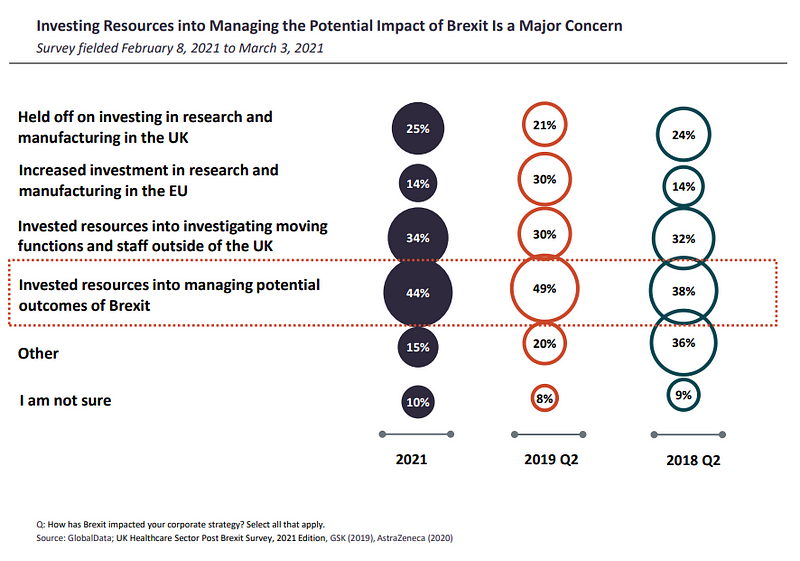

Investing resources into managing potential Brexit outcomes was one of the top concerns among respondents (44%). 10% less of global respondents were investing resources into investigating moving functions and staff outside of the UK, while one quarter said they had held off on investing in research and manufacturing in the UK.

Meanwhile, 14% had increased investment in research and manufacturing in the EU.

Costs bear out the sentiment: vaccine giant GSK for example has stated that its contingency plan-related costs could reach £70m ($85m) over the next two to three years, with ongoing additional costs of approximately £50m ($60.7m) per year. In its 2020 Annual Report, AstraZeneca meanwhile highlighted that costs incurred by the company since the referendum were approximately $47m, of which $7m was incurred in 2019.

Both companies have probably made back some of that loss off the back of Covid, though.

Is the UK still a healthcare leader?

72% of respondents found the UK to still be an attractive destination as it is home to four of the top six research universities in Cambridge, Imperial College, Oxford and UCL.

52% said the country is a leader in public health, new technologies and pipeline development, making the UK a life sciences hub.

Which outcomes does healthcare want after Brexit?

The TCA between the UK and the EU was finalised on December 24, 2020, and guarantees tariff-free trade between both parties. Industries though, as GlobalData notes, will face additional barriers as the sides will now function as separate legal and regulatory jurisdictions.

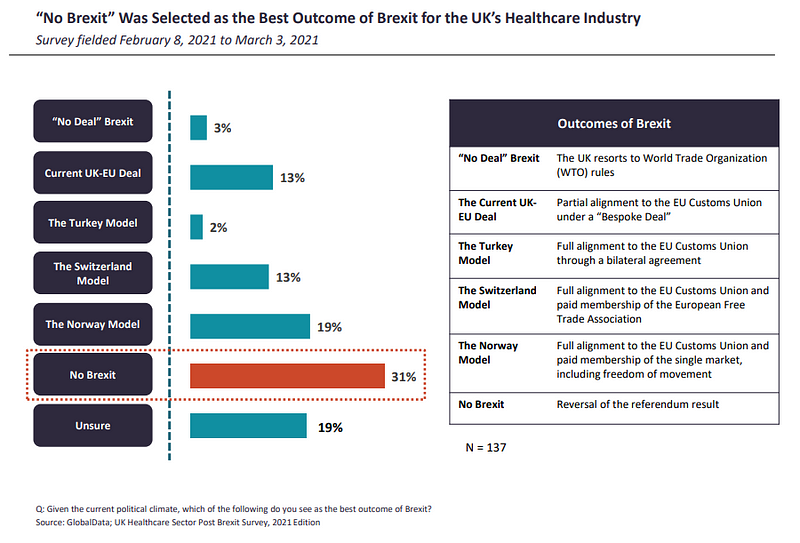

Respondents from the ROE were more pessimistic about the negotiated deal being the best outcome of Brexit, at 7%, compared to their UK counterparts (13%). In order to achieve the deal, both the EU and the UK had to make compromises. This may be why, as of at the start of the year, a significant proportion (31%) of respondents still believed that a reversal of the referendum result, or “No Brexit”, is the best outcome of the Brexit saga.

Following behind in second place, 19% of respondents were either unsure of the best Brexit outcome, and the same amount believed the Norway trading model to be the next best thing.

“Even though Norway adheres to a substantial number of the EU regulations, the country has retained some autonomy over its pharmaceutical sector, including the control over pricing and reimbursement issues,” write GlobalData analysts. “Nevertheless, despite some level of sovereignty and unrestricted access to the EU single market, Norway makes significant contributions to the EU budget, must adhere to the free movement policies, and has no say in how the EU rules and regulations are formed.”

The new EU Clinical Trials Regulation is also expected to be fully implemented into Norwegian laws. With it will come the EU Portal and Database, a key component of the Clinical Trial Information System (CTIS). The regulation will streamline the registration, assessment and supervision processes for clinical trials throughout the European Union via the CTIS.

This is mainly down to how it allows a single, one-and-done application for trial sponsors to apply for a clinical trial in all countries of the European Economic Area (EEA), as opposed to applying for every one separately.

The UK, of course, won’t be included in its implementation.

What does the future hold?

According to 74% of the respondents, reducing barriers to the UK-EU collaboration on clinical research would be an important step to secure the UK healthcare industry’s success following Brexit.

A total of 64% of US and 57% of UK respondents remained positive that the UK would remain an attractive destination for healthcare research and manufacturing post Brexit. In contrast, the respondents from Europe were more negative, with only 25% of the respondents believing that the UK could be an attractive market.

“The US’ positive outlook can be associated with the UK’s Medicines and Healthcare Products Regulatory Agency (MHRA) joining the US FDA Oncology Center of Excellence (OCE)-initiated Project Orbis and UK’s ongoing attempts at a free trade deal with the US,” report GlobalData analysts.

UK government initiatives meanwhile such as the Medicines and Medical Devices Act, also provide hope for innovative healthcare in Brexit Britain. The act, aimed at boosting the country’s healthcare industry through supporting the availability and facilitating the access to medicines, was seen by 35% of respondents as something which will ensure modern and more effective medical regulations in the UK.

The Act also supports new regulation for novel therapies, clinical trials and makes provisions for the use of innovations in healthcare, such as artificial intelligence (AI). The AI solution of computer vision (CV), for one, can give surgical robots the power of visual recognition in a way that emulates human sight.

The Medicines and Medical Devices Act could even see more surgical robots in the NHS, along with augmented reality use, virtual therapies and smarter hospitals, as recently explored by Verdict.

According to Jakimaviciute, one of the biggest developments since the act became law has been the publication of the Medicines and Healthcare products Regulatory Agency Delivery Plan 2021–2023 in July.

“Aside from the strategies related to delivering scientific innovation, enhancing patients’ safety and revamping the clinical trials system, the plan also aims to establish a new medical devices legislative framework to support safe innovation and ongoing access to products,” Jakimaviciute says.

“In another policy paper, Life Sciences Vision, the UK also aims to sustain its position in novel vaccine discovery, development and manufacturing; and to create a globally competitive environment for Life Science manufacturing investments.”

“By strengthening the local supply chains and domestic manufacturing capabilities the UK, naturally, seeks to achieve a better risk management, autonomy and improved control.”

By Verdict’s Giacomo Lee. A total of 150 GlobalData Pharma clients and prospects participated in the 10-minute survey, which was fielded from February 8, 2021 to March 3, 2021. Find out more in the GlobalData Brexit and the Healthcare Industry — 2021 report here.