In October last year, the National Institute for Health Research (NIHR) made a welcome announcement – for the first time, all NHS Trusts in England are engaged in clinical research. At such a testing time for the NHS, this is good news, standing not just to improve patient care, but also to add to the pool of private funding.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

As Matt Cooper, NIHR business development and marketing director, explains, the number of clinical studies sponsored by life sciences companies is increasing year on year.

“That’s important in part because they bring new innovations into the NHS for our patients to experience and our clinicians to use,” he says. “But it also brings in a level of income at a time when the NHS is quite sensitive to finances, and provides a cost saving to the NHS’ drugs budget.”

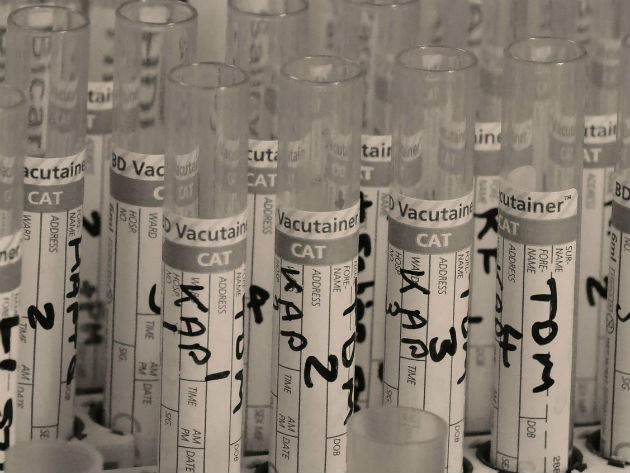

As the UK’s largest health research funder, the NIHR provides a research infrastructure across NHS England, and works to bring clinical studies of all varieties into the NHS. Over the course of 2015/16, it brought in over 1,200 new academically sponsored trials along with 650 funded by the private sector. This was on top of the many others still ongoing.

A strong research focus

The NIHR’s 2015/16 Research Activity League Table, published in October, provides a snapshot of clinical research across the country. Not unexpectedly, the big secondary care hospitals saw the most activity, with the highest performer – Newcastle Upon Tyne Hospitals NHS Foundation Trust – having conducted 514 research studies that year. Some of the research, however, came from more surprising places. The South Western Ambulance Service NHS Foundation Trust, for instance, supported eight studies throughout the period.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“The NIHR tries to encourage the greater spread and uptake of research across the country, and the league tables enable us to demonstrate that,” says Cooper. “It’s a great thing for us to say – that everywhere is now participating in research in some form or another and that we are as an infrastructure helping to facilitate that. The league table also inspires a level of healthy competition among organisations.”

For the NIHR, the objective is clear – to ensure that as many patients as possible have the opportunity to participate in clinical trials. Naturally, certain research portfolios are larger than others, with oncology, cardiovascular, musculoskeletal and respiratory featuring particularly highly. However, a growing number of studies are being conducted in rare diseases, and, as the shift towards personalised medicine gathers steam, many are becoming more specific to particular patient populations.

These trials are also structured in many different ways. While some are purely ‘academic’ and others are purely ‘commercial’, many are strictly speaking collaborations. For instance, an academic institute might set up a trial after receiving a grant from a life sciences company. It might also work with the UK research charity sector, typically producing data that’s highly relevant to the UK population.

“We have a role to ensure there’s a portfolio there for all types of patient to access,” says Cooper. “I think that’s what makes the UK an attractive place to come to for companies carrying out research – we have that breadth of experience across all parts of medicine and our portfolio is pretty enormous.”

Obvious advantages

The benefits to the patients themselves go without saying. Through participating in clinical trials – especially those funded by pharmaceutical or medical device companies – patients can access the newest and most innovative medicines at an early stage, long before these treatments have the chance to become available on the NHS.

There are also advantages to hospitals more generally. In October, an NIHR-supported study found that bowel cancer patients showed better outcomes in research-active hospitals, whether or not those particular patients had been involved in trials. For those treated in the most research-active institutions, there was nearly a 4% spike in five-year survival rates.

“There’s something about being research-active that raises the game for everybody in that organisation,” Cooper explains. “Your clinical teams and nurses get additional experience in using novel drugs and extra information about that type of treatment, and that diffusion of knowledge is then spread to all members of the trust. So at a time when hospitals might just be focusing on the normal service to patients, there’s a real benefit to participating in clinical research.”

The clincher, perhaps, is the impact on the UK economy. According to a recent KPMG report, the research conducted within the NIHR Clinical Research Network infrastructure in 2014/15 generated £2.4bn of gross value added (GVA) , as well as 39,500 jobs. For each patient recruited into commercial clinical research studies, NHS Trusts in England received an average of £6,658 in revenue.

Extolling the virtues

It stands to reason, then, that the NIHR should wish to promote the UK as a good place for pharma companies to conduct studies.

“We have some good links with all the major global pharmaceutical companies,” says Cooper. “Part of the role of my business development team is to be very externally focused and talk to these companies about the UK’s achievements. We’re a reliable place to come and do good quality clinical trials that will recruit to the agreed targets and produce good quality data.”

He contends that, even a decade ago, this wasn’t quite the case, and that there is still a perception in certain quarters that conducting trials in the UK is arduous and slow. However, the NIHR is working hard to convey how things have changed.

“It’s a message that they’ve been receiving more and more, and they’re coming back to the UK more regularly,” says Cooper.

As well as speaking to life sciences companies, the NIHR is also looking to spread awareness among patients themselves, pointing them towards the breadth of clinical trial opportunities on offer.

“We work with the general population to say that, when you as a patient go to your clinician, whether it be a GP or a consultant in a secondary care hospital, it’s part of your right to ask whether there are clinical trials you can take part in,” says Cooper. “It’s really important that it’s not just clinician-led, but that the patients themselves are aware of the benefits of being involved in a research-active NHS.”

Overall, the NIHR aims to continue as it is currently, by providing a diverse portfolio that will span all areas of medicine. As the NHS continues to grapple with financial pressures, the need to incorporate clinical research is likely to remain as salient as ever.