Over the last decade or so, immuno-oncology has gained a reputation as one of the most exciting areas in medicine. Referring to treatments that harness the immune system in the fight against cancer, it has grown from a niche and somewhat speculative field into a vibrant area of drug discovery. Aside from the drugs already approved, there are several others in the pipeline.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

To a large extent, the buzz is justified. In 2013, the journal Science named cancer immunotherapy the ‘Breakthrough of the Year’, stating: “clinical trials have cemented its potential in patients and swayed even the skeptics.” It explained that, even though today’s immunotherapies don’t benefit everyone, the data gives strong grounds for optimism.

In a 2012 study into anti-PD-1 therapy, tumours shrunk significantly in 31% of patients with melanoma, 29% of those with kidney cancer, and 17% of those with lung cancer. Another study found that, of 1,800 melanoma patients treated with Ipilimumab (an anti-CTLA4 therapy), 22% were alive three years later – an unprecedented survival rate for metastatic melanoma.

It is no surprise, then, that a large number of biotech companies have jumped into this area, intent on finding the next magic bullet for cancer. As Dr Christophe Quéva, chief scientific officer at iTeos explains, the field has become progressively more crowded.

“Until around 2010, immune cell therapy for cancer was viewed quite negatively, and if people were persistent enough to work on it, it was difficult for them to get a grant,” he says. “But the field really changed following the approval of Ipilimumab and Pembrolizumab. These antibodies have shown a significant response rate in a variety of diseases, which has been a game-changer.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataJumping on the bandwagon

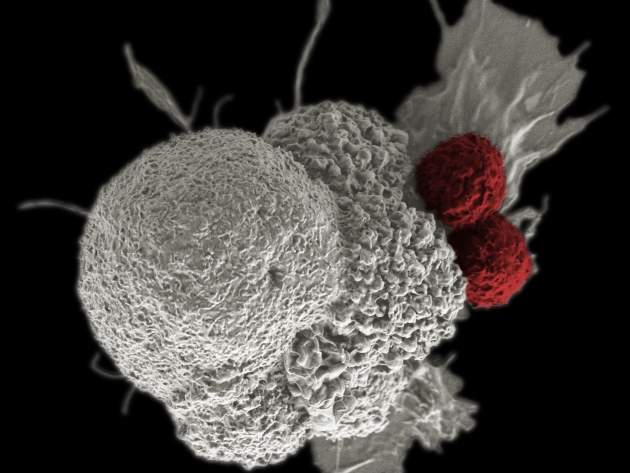

The antibodies in question are known as ‘immune checkpoint inhibitors’. Immune checkpoints, in essence, are proteins on the T-cells that need to be activated (or inactivated) to start an immune response. Drugs that target these checkpoints can boost the immune response against cancer cells, ensuring they don’t evade detection.

“There are a number of proteins on the surface of T-cells, especially in tumour cells, that could fit the profile for immunotherapy, so that created a lot of excitement for targeting these molecules and a point of entry for a lot of companies in the early days,” explains Quéva.

Aside from exploring immune checkpoint inhibitors, a number of biotechs have been attempting to revive an approach that worked poorly in the past – namely cancer vaccines. Others are trying combination approaches, testing out several immunotherapies in tandem.

“Then there are a number of companies that have unique platforms for generating biospecific antibodies, or even just regular antibodies that have nice platforms but a deficiency of exciting targets,” adds Quéva. “Once immuno-oncology came along, those companies quickly jumped on the bandwagon and looked at how they could apply their platform to look at novel targets.”

This has served to create the boom in clinical research, which has in turn made it difficult for biotechs to set themselves apart from the pack. With so many avenues being explored, where might an immuno-oncology startup actually find its niche?

Opportunities remaining

Quéva believes that one approach might be to target small molecules, which is a more challenging – and less popular – strategy than targeting the proteins on T-cells.

“Pharma companies have focused more on biologics recently, and have put to rest a number of their chemists doing small molecule work,” he says. “That has left a lot of opportunity for biotechs to conduct innovative small molecule research that’s applicable to immuno-oncology.”

He also suggests exploring the types of tumours that have not responded to immune treatment. Broadly speaking, tumours can be divided into two classes – ‘hot’, or inflamed, tumours that are full of immune cells, and ‘cold’, or non-inflamed tumours that are not. As clinical trials have demonstrated, only the former category is responsive to current therapies.

“Cold tumours have developed mechanisms that keep the T-cells away, and in these tumours it is challenging to see any efficacy of immuno-oncology, so I think this is still a niche that remains to be exploited,” explains Quéva. “If we could make those cold tumours hot, and responsive to immune checkpoints, I think that would be a way to broaden the scope of application of immuno-oncology drugs.”

He adds that there is still work to be done when it comes to safety, as while therapeutics are becoming more effective, this is often accompanied by an increase in adverse effects. A biotech startup might work on reducing toxicity, most likely by finding models that allow for safety testing early on.

At present, companies tend to avoid safety testing at the early stages, as what holds true in animal models will not necessarily apply to human patients, and it may flag up unnecessary concerns. Clearly, this is not an ideal state of affairs. It also points to a wider issue – specifically the poor predictive powers of animal models.

“Animal models in oncology are always flawed because there’s an expectation that what we see will be translated in patients, but this is not the case for oncology models in general and particularly for immuno-oncology targets,” says Quéva. “You have to use them in a way that’s very reductionist in my view – you can use them to help increase your confidence in your molecules and mode of action, but that’s pretty much all you can expect.”

At present, the rate of successful translation from animals to humans in oncology trials stands at just 8%. It’s a disconnect that a biotech company could try to bridge.

Game-changing drugs

Looking to the next few years, Quéva believes that most of the treatments in clinical development are likely to prove a dead end. The ones that remain, however, could prove very promising.

“I think there is a decent hope that they will further increase the benefits of immuno-oncology in combination with the current immune checkpoint inhibitors,” he says. “Potentially they could increase therapeutic index – increasing efficacy without increasing safety issues. I think the benefit will be mostly observable in the next two to three years with hot tumours, and in the next four to five years with cold tumours.”

Further out, he believes we are likely to see a new wave of game-changing drugs, which have a far higher response rate than those currently available.

“I think we will achieve that with more and more targeting of these drugs towards the tumour microenvironment,” he says. “This will use a range of different technologies, such as very specific antibody nanoparticles, and different ways of repotentiating stronger immune response but targeting it to the tumour.”

At iTeos itself, Quéva and his colleagues are working on a range of approaches. These include an IDO1 inhibitor in preclinical development (licensed to Pfizer), a range of drug discovery programmes geared towards hot tumours, and a nanoparticle-based programme geared towards cold tumours.

“If you want to be successful, your offering has got to be differentiated, and this is what we try to do every day at iTeos,” he says. “I think there is a very large remaining area to be investigated.”