By 2025, 60% of the US’s pharmaceutical industry jobs could be vacant, the result of a lack of effective education policies coupled with growing competition from other countries, according to a series of reports released in June by industry trade group Pharmaceutical Research and Manufacturers of America (PhRMA).

Although the science, technology, engineering and maths (STEM) workforce is absolutely crucial to the future of the biopharmaceutical sector, the US Government has been neglecting education in these areas, just as competitors including Australia and China have been ramping up their efforts. In 2016, China had 4.7 million recent STEM graduates, compared to just 568,000 in the US.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

According to Anne Pritchett, vice president of policy and research at PhRMA, there is a real danger the country’s pharmaceutical industry could fall behind its competitors if nothing changes.

“R&D intensive industries like ours could be located in any country. If we get to a point where the policies and the STEM workforce in another country outweigh what we have in the US, there’s a real fear that we will lose our competitive edge,” she says.

Elly Earls sat down with Pritchett to find out how the US has got to this worrying point and what can be done to turn things around.

Elly Earls: Just how important is a strong STEM education system to the future of the US’s pharmaceutical industry?

Anne Pritchett: Just to give you a sense, we employ more than four times the share of STEM workers relative to the overall economy in jobs that span the drug development process. That’s about 27% compared to 6%. Our industry is incredibly research intensive and, as a result, all aspects of the process from R&D to manufacturing to delivery require highly skilled workers. This is only going to get more important.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWe are at the cusp of some amazing scientific discoveries and being able to harness those scientific discoveries is reliant on being able to have the skills to build advanced manufacturing facilities. We also need to be able to analyse the increasing amount of Big Data so we can assess real work evidence in developing new medicines. Plus, we need to have the regulatory expertise to be able to keep up with the emerging scientific advances. It’s really in all aspects of the R&D manufacturing process that there are growing needs for STEM workers.

EE: Despite this, one of PhRMA’s recent reports found that 60% of the US’s pharmaceutical industry jobs could be vacant by 2025. How has the US reached this point?

AP: We didn’t get here overnight; there’s not any one factor and this isn’t going to be resolved overnight. I think what’s important to recognise is that we’ve been falling behind on key indicators for a number of years. What’s different now is that we have other countries that have developed policies that have specifically focused on improving their global competitiveness when it comes to medical innovation and that are making sustained investments. They are looking at what we have done well in the US and seeking to replicate that and surpass us.

EE: What are other countries doing to bolster their STEM workforces?

AP: We recently supported a report by TEConomy on 18 different countries as well as the EU. And nearly all of them were active in developing, attracting and retaining talent through a range of sustained initiatives. We had done a similar analysis back in 2012 and one of the things that has changed since that time is that three countries – Australia, the UK and Canada – have implemented new initiatives.

In Australia, they’re establishing policies to help them recruit STEM graduate degree holders and provide incentives for STEM postgraduate career development. The United Kingdom is significantly ramping up its STEM education efforts with a focus on the economically disadvantaged. And Canada, similar to Australia, is looking at focusing on industrial internships and providing funding to attract and retain talent through the various nations’ research councils.

China is also impressive in terms of the commitment and investment it’s made. They have a very multi-faceted approach and are really focused on incentivising those that have gone overseas to come back to China. They say about 4,200 recruitments have been accomplished as of 2014.

EE: What does the US need to do to keep up with this growing competition?

AP: In terms of our overall policy approach, one of the things these countries have that we don’t have when you look at our STEM education is that we need a more integrated approach to STEM at the federal level. It’s funded across federal agencies but we need a more comprehensive approach for coordinating, evaluating and reviewing those STEM programmes.

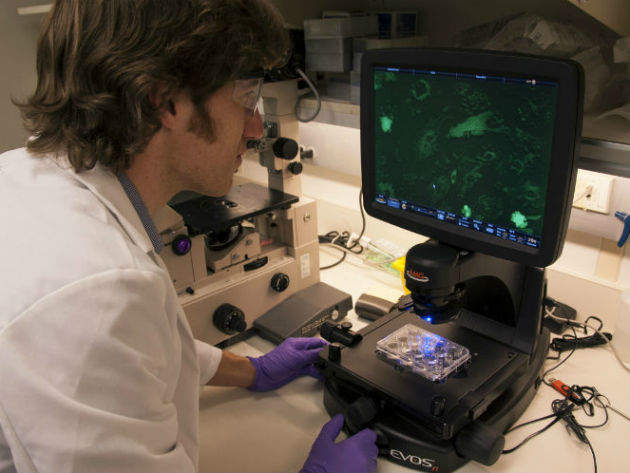

A number of our member companies are engaged in very innovative approaches to improving the quality of K–12 education in STEM areas by providing hands-on science experience in labs, engaging in science fairs and making STEM real and fun for students.

We need to be looking at those innovative approaches that seem to be working and replicating those. We also need to be looking at further fostering public-private collaboration. We need policies that are supportive of that approach and that are really identifying best practices and disseminating those.

EE: What is standing in the way of this happening?

AP: I think that there are a lot of other issues on the policy agenda and that STEM isn’t necessarily the highest on the list and I think that people don’t appreciate the long-term impact of investment in STEM education at early ages.

It’s something that there needs to be increased awareness of among policymakers – not just about what’s working in the US but also about what isn’t working. They also need to look more at what can be learned from what other countries are doing.

One of the interesting findings from our series of reports was that states aren’t just competing with one another to attract and grow their pharmaceutical presence, but they are competing with these other countries, such as China, where 40% of graduates finished a degree in STEM in 2013 – over twice the share in American third-level institutions.

We are close to being at a tipping point compared to other countries in terms of our competitiveness in STEM, and those numbers are a stark reminder of the need to redouble our efforts and really have a national dialogue about how to ensure that we maintain a competitive edge.

This should include identifying where we’re falling behind but also focusing on strengthening and promoting where we’ve been successful. Public-private partnerships between US biopharmaceutical companies and academic institutions have been a really bright spot. We need to learn from that and expand these.