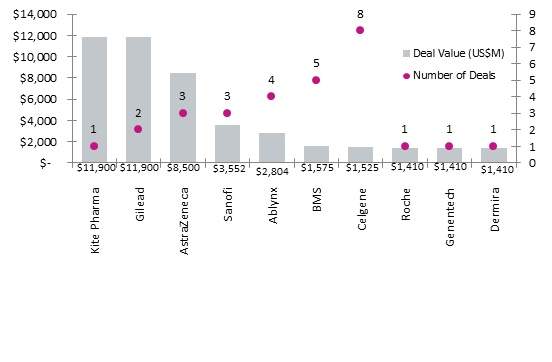

Figure 1 shows the top 10 pharma companies by deal value for 2017 quarter 3. The number of deals for each company is also shown. The acquisition of Kite Pharma by Gilead Sciences for $11.9 billion was the biggest deal for this quarter.

Gilead Science also entered into partnership with Spring Bank Pharma for an unspecified deal value. This activity from Gilead Science shows it is advancing its research and development and is a one-to-watch for future drug developments. AstraZeneca also had a busy quarter by securing three partnerships; the most prominent of which was with Merck worth $8.5 billion.

The number and value of deals by country is shown in figure 2. US had more deals and a higher deal value than the other top 10 countries combined. This shows that US companies had the biggest foot-hold in pharma deals for quarter 3. Outside of US and Europe, China had the next biggest impact in the pharma market, followed by Japan and Israel. The success of Japan and Israel was largely due to Mitsubishi Tanabe Pharma Corp’s acquisition of NeuroDerm Ltd for $1.1.