On 1 February, Roche presented its full-year results for 2017. Overall, sales of the pharmaceutical division registered a 5% increase over 2016 sales and reached CHF41.2bn (approximately $45.1bn). This increase was mainly driven by fast uptake of the recently-launched Ocrevus (ocrelizumab), Tecentriq (atezolizumab), and Alecensa (alectinib), as well as by the increased sales of established brands, such as Herceptin (trastuzumab) and Perjeta (pertuzumab).

However, the decreased performance of one of the company’s key brands, Rituxan/MabThera (rituximab), an anti-CD20 monoclonal antibody approved for the treatment of non-Hodgkin’s lymphoma (NHL), chronic lymphocytic leukemia (CLL), rheumatoid arthritis (RA) and granulomatosis with polyangiitis (GPA), stood out.

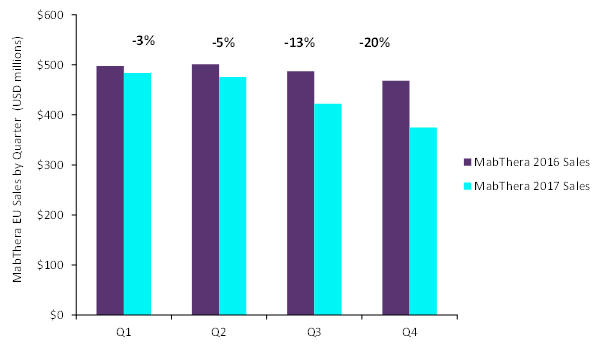

Sales of MabThera (as it is referred to in Europe) were down by approximately 10% in Europe in 2017. This negative performance was mainly due to the launch of two rituximab biosimilars, Sandoz’s Rixathon and Celltrion’s Truxima, in the second half of the year. Losses were registered mainly in Q4, during which MabThera sales fell by 20% compared with Q4 2016. GlobalData expects MabThera sales to decline further in 2018, as rituximab biosimilars will launch in additional European markets.

Comparison of MabThera sales in the EU between 2016 and 2017

Source: GlobalData, PharmaIC [accessed 5 February 2018]

The biosimilar threat

The fall in MabThera sales reported by Roche confirms that the biosimilar threat hangs over the company’s portfolio. Roche’s Q4 results suggest that barriers to biosimilar uptake may be overcome by the potential cost savings offered by these cheaper treatments, which offer the possibility to widen access to innovative biologic medicines.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData has found that, in Europe, rituximab biosimilars are priced at a 10–15% discount to the innovator biologic. This discount, despite being very far from generic discounts, has been enough to guarantee a substantial uptake of rituximab biosimilars in their first five months on the market. Further, the applied discounts might increase as more rituximab biosimilars are launched and the price competition increases.

Rituxan/MabThera is not the only product under pressure in Roche’s portfolio. Up to five copycat versions of another company blockbuster, Herceptin, whose patent expired in 2014 in Europe, are expected to launch in 2018. However, GlobalData expects a lower penetration for trastuzumab biosimilars compared with rituximab biosimilars. This is mainly due to a successful lifecycle management strategy implemented by Roche, which led to the launch of subcutaneous versions of Rituxan and Herceptin in 2014.

These subcutaneous reformulations allowed the company to extend the exclusivity window for the two assets. While the penetration of subcutaneous Rituxan is relatively low (approximately 30%) across all indications, key opinion leaders suggest that the majority (50–60%) of breast cancer patients currently receive Herceptin subcutaneously.

For this reason, trastuzumab biosimilars exploiting an intravenous route of administration might have a hard time competing against the more convenient and cost-effective route of administration guaranteed by subcutaneous Herceptin. The formulation patent protects subcutaneous Herceptin and Rituxan/MabThera beyond 2025 and will limit any biosimilar erosion experienced by the two agents.

However, as physicians become more accustomed to biosimilars and additional blockbusters go off-patent in Europe and the US, where Rituxan and Herceptin biosimilars are expected to launch in mid-2018 and mid-2019, respectively, GlobalData believes it will become harder for Roche to defend its leadership in the oncology arena.

Related Reports

GlobalData (2018). Biosimilars in Oncology, to be published

GlobalData (2017). PharmaPoint: HER2-Positive Breast Cancer – Global Drug Forecast and Market Analysis to 2025, June 2017, GDHC151PIDR

GlobalData (2016). OpportunityAnalyzer: B-Cell Non-Hodgkin’s Lymphoma (NHL) – Opportunity Analysis and Forecasts to 2024, January 2016, GDHC018POA