At the 76th annual meeting of the American Academy of Dermatology, Johnson & Johnson (J&J) released a cost per responder analysis of their interleukin 23 subunit alpha (IL-23A) inhibitor Tremfya (guselkumab) compared with Novartis’ IL-17 inhibitor Cosentyx (secukinumab) and Eli Lilly’s IL-17A inhibitor Taltz (ixekizumab) for the treatment of moderate to severe plaque psoriasis (PsO).

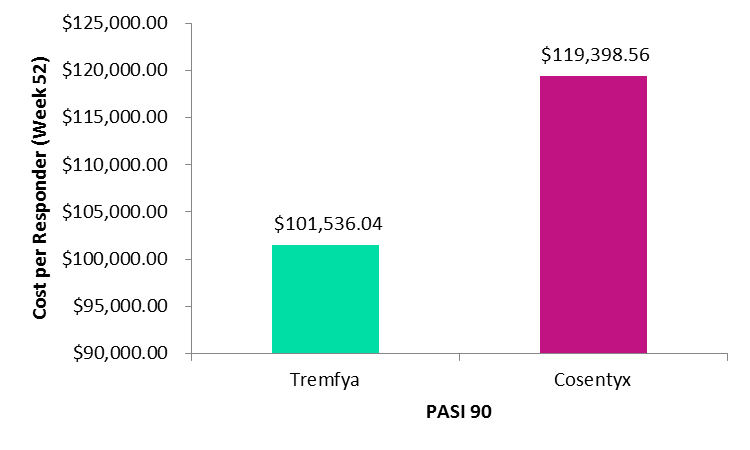

The objective of the study was to estimate the cost per responder in the US for the first year of treatment of Tremfya in comparison with Cosentyx and Taltz. Although Tremfya boosts a lower cost per responder at Week 52 than both IL-17 inhibitors, Tremfya entered the PsO market more than two years after Cosentyx and more than a year after Taltz. Is Tremfya’s strategy to be a more cost-effective option enough to overcome Cosentyx and Taltz’s market entry advantage?

In both the cost per responder analysis of Tremfya compared with Cosentyx and Taltz, the response rate was defined as the percentage of patients who reached at least a 90% improvement in the Psoriasis Area and Severity Index (PASI90). When comparing Tremfya to Cosentyx, response rates were estimated using Week 48 data from the pivotal VOTAGE1 clinical trial for Tremfya and the pivotal ERASURE clinical trial for Cosentyx.

When comparing Tremfya to Taltz, response rates were estimated using Week 60 data from the pivotal VOYAGE 1 long-term clinical trial for Tremfya and the pivotal UNCOVER 3 trial for Taltz. Cost per responder was calculated as the cost of the biologic, based on the wholesale acquisition price as of August 2017, divided by the PASI 90 response at Week 60 and Week 48, respectively.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIL-17 inhibitors have become a first-line biologic for the treatment of PsO, given the improved efficacy over other approved biologics. Cosentyx and Taltz have already started making a big impact on the market, despite high induction year costs of $75,211 and $85,992, respectively.

Despite Tremfya’s lower cost per responder results, J&J’s strategic analysis of Tremfya may not be enough to offset a later entrance in the PsO market. GlobalData anticipates J&J faces an uphill battle to Tremfya reaching blockbuster status given the overcrowded market space. That being said, Tremfya marks the first monoclonal antibody to block IL-23A to launch in the PsO market, providing a welcome addition to the PsO treatment landscape.

Images: Tremfya versus Cosentyx – Cost per Responder PASI 90. Credit: GlobalData, adapted from Teeple and Muser, 2018.