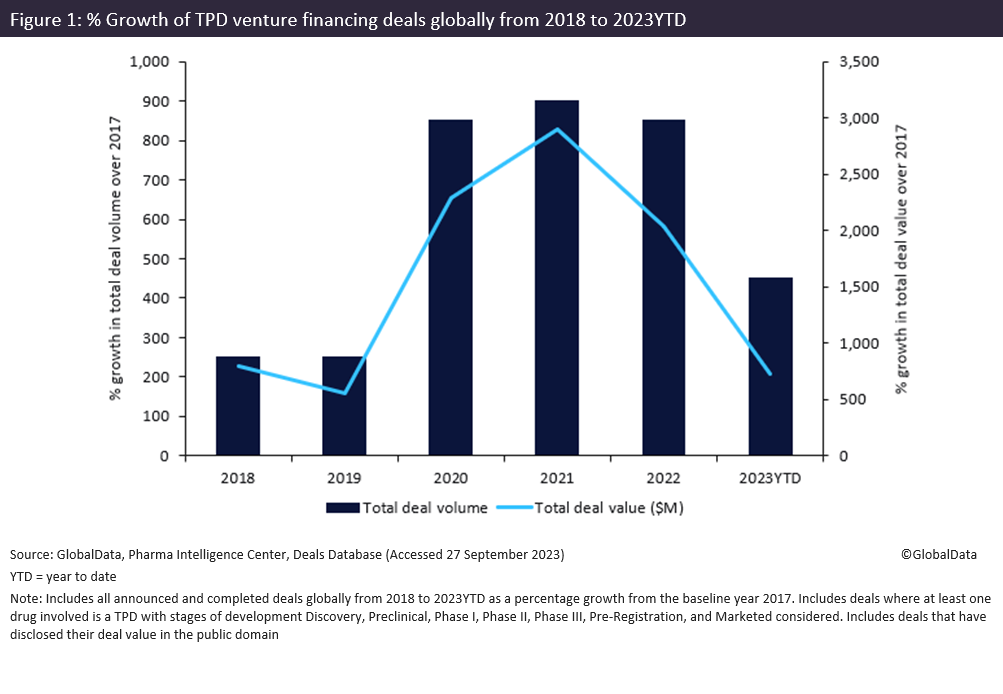

Targeted protein degrader (TPD) drugs have seen a greater than 2,000% increase in the total value of venture financing deals, rising from $33 million in 2017 to $707 million in 2022, according to GlobalData’s Pharma Intelligence Center Deals Database. This growth in venture financing was driven by the increase in the number of TPD drugs advancing into clinical development, and by preclinical data demonstrating improved selectivity and potency compared to traditional small molecule inhibitors.

TPD drugs are an emerging modality that selectively targets disease-causing proteins by leveraging intracellular protein degradation mechanisms, such as the ubiquitin-proteasome system and autophagy. The ability of TPDs to target disease-causing proteins, especially those previously found to be difficult to treat with conventional small molecules, has spurred considerable interest among investors and biopharmaceutical companies. In May 2023, US-based biotech Cullgen secured an additional $35 million in venture financing towards the development of its pipeline of PROTAC TPD drugs for the treatment of oncology diseases, contributing to a total of $166 million of venture capital across four deals from 2018 to 2023.

According to GlobalData’s Pharma Intelligence Center Deals Database, venture financing for TPD drugs reported an increase in activity with a total deal value of $3.3 billion from 2018 to 2023 year-to-date (YTD) (shown in Figure 1 above). Furthermore, TPD observed a marked increase in venture financing deal volume and value from 2020 onwards, with a peak of $1 billion across 20 deals in 2021.

Oncology was the top therapy area for venture financing deals involving TPD drugs, with a total deal value of $3 billion from 2018 to 2023 YTD. Central nervous system and immunology came second and third for venture financing, securing total deal values of $764 million and $893 million respectively from 2018 to 2023 YTD.

TPD drugs in preclinical and discovery stages received the largest total venture funding, with $1.6 billion and $800 million respectively. This demonstrates investor confidence in the TPD proof of mechanism to further move into clinical trial development and then potential therapies.

US-based biopharmaceutical company, Olema Pharmaceuticals, received the largest total venture financing of $187 million across four deals in 2020 towards the development of its pure antagonist selective oestrogen receptor degrader, palazestrant. It is currently being investigated in a Phase II trial for ER+/HER2- metastatic breast cancer. In June 2020, US-based pharma company C4 Therapeutics secured $170 million of venture financing towards the development of its portfolio of targeted therapies, including its Phase II oral TPD drugs CFT-7455 and CFT-8634 for multiple oncology indications, representing the largest round of venture financing for TPD drugs. CFT-7455 is an IKZF1/IKZF3-targeting molecular glue currently in Phase II for multiple myeloma and non-Hodgkin lymphoma. CFT-8634 is a BRD9/CRBN-targeting PROTAC currently in Phase II for the treatment of solid tumors.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWith multiple TPD drugs entering clinical trial development, the therapeutic potential of TPDs has been recognised by investors in the biopharmaceutical industry. However, the long-term safety and efficacy of TPD drugs over conventional therapeutics will remain a top priority, to enable the success of this drug class in clinical stage trials and when it is brought to market.