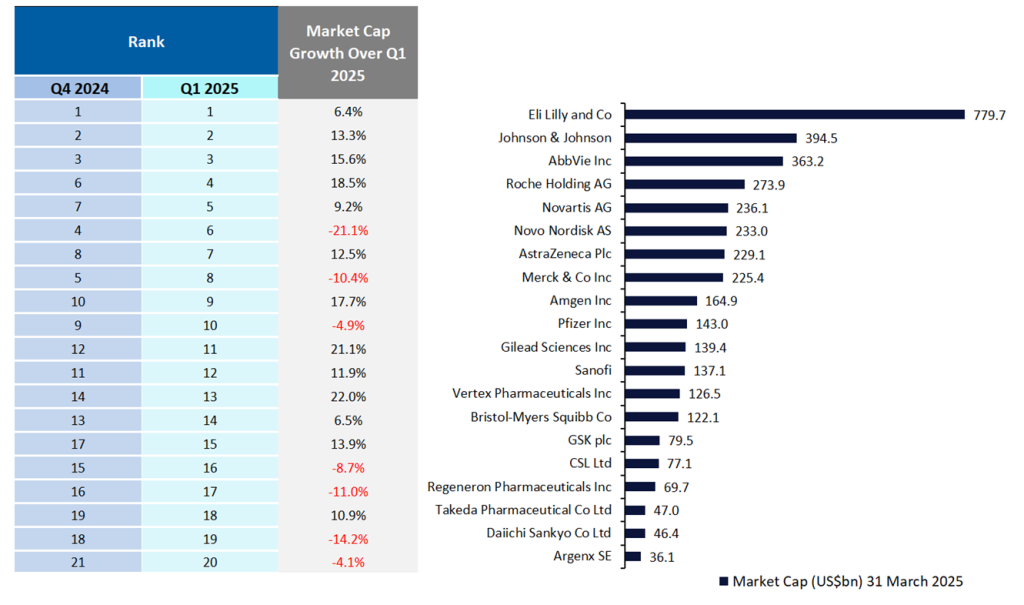

The top 20 biopharmaceutical companies demonstrated a strong start to 2025, despite ongoing uncertainty surrounding the potential impact of President Trump’s proposed pharmaceutical tariffs on global supply chains. Nevertheless, these companies reported an upturn of 6% in aggregate market capitalisation from $3.7tn on 31 December 2024 to $3.9tn on 31 March 2025, reveals GlobalData, a leading data and analytics company.

Figure 1: Top 20 global biopharmaceutical companies, by market cap, as of 31 March 2025

Vertex Pharmaceuticals recorded the highest market capitalisation growth in Q1 2025, rising 22% to $127bn, driven by strong demand and continued expansion of its cystic fibrosis portfolio. Vertex recently received FDA approval for Alyftrek (deutivacaftor + tezacaftor + vanzacaftor calcium) in December 2024, followed by UK MHRA approval in March 2025. Alyftrek adds a next-in-class, once-daily triple combination therapy to Vertex’s existing cystic fibrosis offerings. In addition to strengthening its cystic fibrosis portfolio, Vertex is also diversifying its pipeline. The FDA’s January 2025 approval of Journavx (suzetrigine), a non-opioid oral pain treatment, further contributed to the company’s market capitalisation growth.

Gilead Sciences witnessed a market capitalisation growth of 21.1%, fueled by promising developments in its HIV portfolio. This includes successful Phase I data for a once-yearly formulation of Sunlenca (lenacapavir) for HIV prevention, building on the successful Phase III PURPOSE 1 and 2 trials of its twice-yearly formulation. The candidate is under FDA priority review, with approval anticipated by mid-2025. Further strengthening its HIV pipeline, Gilead also reported positive Phase III results from the ALLIANCE trial, which evaluated Biktarvy (bictegravir sodium + emtricitabine + tenofovir alafenamide) for patients with both HIV and hepatitis B co-infection.

Roche reported an 18.5% increase in market capitalisation due to its $5.3bn licensing agreement with Zealand Pharma (in March 2025) to co-develop and co-commercialise petrelintide and a fixed-dose combination with Roche’s asset, CT-388, marking its expansion into the cardiovascular, renal, and metabolic space.

Amgen saw a 17.7% market capitalisation growth, attributed to robust product sales, with double-digit growth across ten key products. Notable contributors included Repatha (evolocumab) for hypercholesterolemia and hyperlipidemia, Blincyto (blinatumomab) for B-cell acute lymphocytic leukaemia, recently approved in June 2024, and Tezspire (tezepelumab-ekko) for severe asthma. Amgen’s market capitalisation growth was further fueled by recent positive Phase III data for Tezspire in the WAYPOINT trial in March 2025 for chronic rhinosinusitis with nasal polyps, and Uplizna (inebilizumab), which is now the first and only FDA-approved treatment for immunoglobulin G4-related disease.

Novo Nordisk experienced a 21.1% decline in market capitalisation, despite its weight loss drug Wegovy (semaglutide) generating $2.8bn in Q4 2024—more than double the sales from the same period in 2023, according to GlobalData’s Drugs Database Pharma Intelligence Center. However, sluggish sales momentum for both Wegovy and Ozempic, combined with investor concerns over growing competition from Lilly’s Zepbound, which showed superior weight loss results in head-to-head trials (20.2% versus Wegovy’s 13.7%), has raised doubts about Novo Nordisk’s market leadership in the weight loss market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDaiichi Sankyo’s market capitalisation fell 14.1% over Q1 2025, following disappointing late-stage results from the Phase III TROPION-Lung01 trial. The company’s investigational antibody-drug conjugate, datopotamab deruxtecan (Dato-DXd), failed to show an overall survival benefit in second-line non-small cell lung cancer, leading to the withdrawal of its regulatory application. However, Dato-DXd has since secured its first approval for the treatment of unresectable or metastatic HR-positive, HER2-negative breast cancer.

Regeneron Pharmaceuticals registered an 11% market capitalisation decline due to involvement in a lawsuit that alleges misleading pricing practices for its highly successful drug, Eylea (aflibercept), for eye diseases.

Meanwhile, the 10.4% market capitalisation fall of Merck & Co (MSD) was largely due to ongoing investigations and allegations of misleading safety claims related to its HPV vaccine, Gardasil (human papillomavirus [serotypes 6, 11, 16, 18] [virus-like particle, quadrivalent] vaccine). Nonetheless, Merck successfully dismissed the plaintiffs’ claims, and Gardasil remains its second-best-selling drug, with $8.58bn in sales in 2024, according to GlobalData’s Drugs Database Pharma Intelligence Center.

The biopharmaceutical industry is positioned for continued recovery, driven by recent FDA approvals and billion-dollar strategic collaborations. However, uncertainty remains as the implications of Trump’s proposed pharmaceutical tariffs unfold, raising concerns over the likelihood of additional interest rate cuts as the possibility of higher tariffs is on the horizon. As a result, industry leaders will continue to remain cautious during these shifting economic conditions.

For further insights into the latest Deal Trends in the Pharma Sector, please see our Venture Capital Investment Trends in Pharma – Q1 2025 and M&A Trends in Pharma – Q1 2025 reports.

Navigate the shifting tariff landscape with real-time data and market-leading analysis.

Request a free demo for GlobalData’s Strategic Intelligence here.