The top 20 biopharmaceutical companies demonstrated resilience during the second quarter (Q2) of 2024 as global markets and investor optimism improved with anticipation of a potential interest rate cut from the US Federal Reserve.

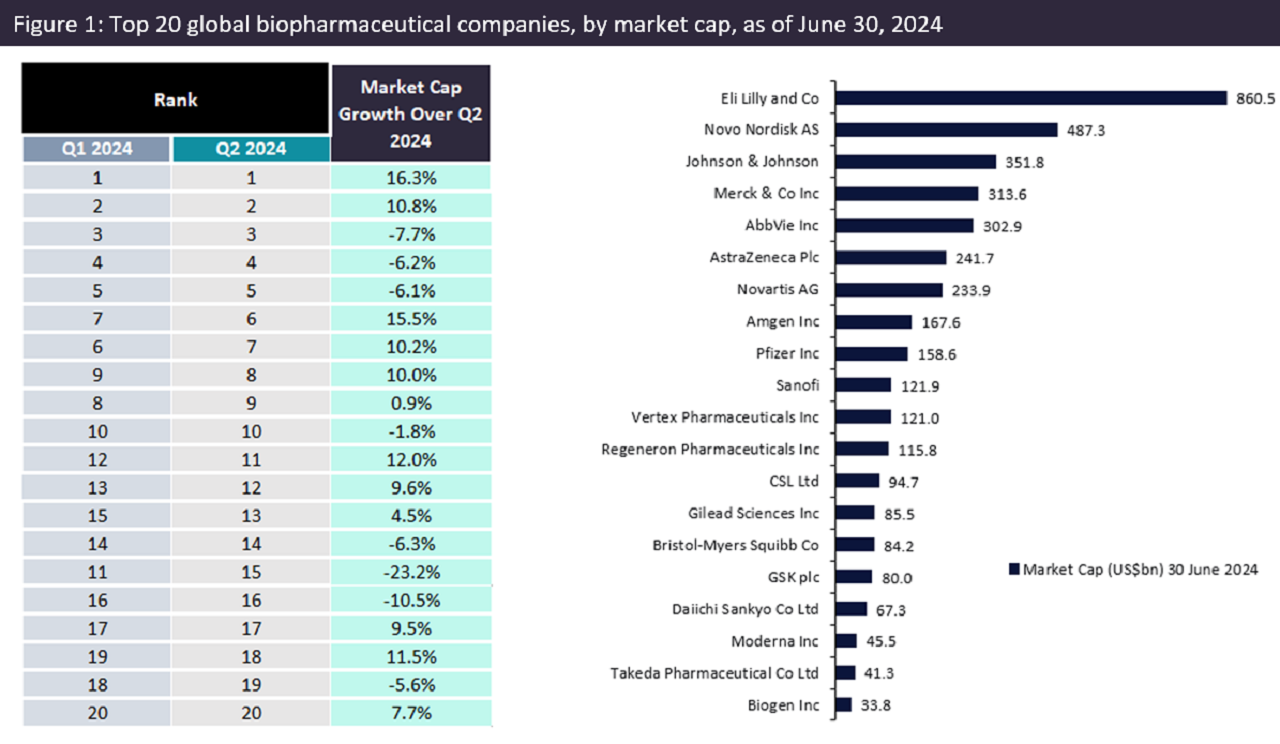

These companies reported a total increase of 4.3% in market capitalisation, from $3.8trn on 31 March 2024 to $4trn on 30 June 2024, as reported by GlobalData, a leading data analytics and research company.

Eli Lilly achieved the largest market capitalisation growth of 16.3% over Q2 2024, surpassing $800bn (Figure 1).

Lilly’s growth is attributed to the soaring demand for its glucagon-like peptide 1 (GLP-1) drugs – Mounjaro for Type 2 diabetes and Zepbound for obesity – along with strong sales of its breast cancer drug Verzenio.

Collectively, these drugs boosted the company’s revenue by 36%, reaching $11.3bn compared to Q2 2023.

Last month, Lilly further strengthened its portfolio with US Food and Drug Administration (FDA) approval for Kisunla, its amyloid plaque-targeting drug for Alzheimer’s disease, positioning the company to compete with Biogen and Eisai’s Leqembi.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataLilly’s strong presence now spans metabolic disorders, oncology, and neurological disorders.

Novo Nordisk has also solidified its dominance in the GLP-1 market with its Type 2 diabetes and weight-loss drugs, Ozempic (semaglutide) and Wegovy (also semaglutide), resulting in a 10.8% increase in market capitalisation.

However, Novo and Lilly are now facing increasing competition from major pharmaceutical companies such as Roche and Pfizer, which are advancing their own oral GLP-1 drugs for Type 2 diabetes and obesity.

Specifically, Roche’s CT-996 is in Phase I and Pfizer’s danuglipron is in Phase II.

In Q2 2024, Wegovy received approval in China, the world’s second-largest economy, positioning Novo Nordisk to potentially dominate the Chinese weight-loss market.

However, the company faces a tight window to capitalise on this opportunity, as the patent for semaglutide is set to expire in China in 2026.

AstraZeneca’s market capitalisation growth of 15.5% was fuelled by the demand for its blockbuster oncology drugs, including Tagrisso for non-small cell lung cancer (NSCLC) and Imfinzi for multiple cancers, including NSCLC.

In June 2024, AstraZeneca took a significant step in advancing cancer therapies by completing its acquisition of Fusion Pharmaceuticals, a strategic move aimed at developing next-generation radioconjugates.

Both Vertex and Moderna demonstrated strong performance in Q2 2024, with Vertex achieving a 12% increase and Moderna reporting 11.5% growth in market capitalisation.

Vertex’s growth is driven by sustained demand for its cystic fibrosis therapies, several new approvals, and the completion of a $4.9bn acquisition of Alpine Immune Sciences, which includes Alpine’s lead asset, povetacicept, indicated for multiple autoimmune and inflammatory diseases.

Meanwhile, Moderna’s growth was fuelled by the FDA approval of its messenger ribonucleic acid (mRNA) respiratory syncytial virus vaccine, mRESVIA, in May 2024, marking the company’s second approved mRNA product.

Despite strong sales of its blood thinner Eliquis and oncology drug Opdivo, Bristol Myers Squibb‘s market capitalisation fell by 23.2% in Q2 2024.

In response to upcoming patent expirations and new pricing structures under the US’ Inflation Reduction Act, the company plans to cut costs by $1.5bn by the end of 2025.

These savings will be redirected to key drug brands, research and development, and launching new drugs to offset revenue losses as Eliquis and Opdivo near loss of exclusivity.

Eliquis sales may also face additional pressure from the new pricing structure.

GSK‘s market capitalisation declined by 10.5% following a ruling by the US Delaware State Court, which permitted jury trials for cancer claims associated with the heartburn drug Zantac.

Earlier this month, GSK settled another Zantac-related case, where the jury found the company not liable for the plaintiff’s colorectal cancer.

Despite these legal challenges, GSK’s Q2 2024 performance remained strong, with sales of human immunodeficiency virus and oncology speciality medicines more than doubling to $400m.

This growth underscores the resilience of GSK’s core therapeutic areas amid the ongoing litigation risks.

The top biopharmaceutical companies continue to demonstrate resilience amid ongoing macroeconomic pressures, drug price restructuring, and impending patent expirations.

The anticipated interest rate cuts by the US Federal Reserve could provide additional momentum, easing financing conditions and encouraging further investment in innovation and expansion.

As patent expirations loom, these industry leaders are intensifying their focus on launching new drugs and pursuing mergers and acquisitions to offset potential revenue losses.

Additionally, many are strategically entering the rapidly expanding GLP-1 market, positioning themselves for significant growth in this high-demand therapeutic area.