Type 2 diabetes (T2D) is a crowded and competitive landscape with multiple “me-too,” generic and biosimilar drugs entering the market, with market growth primarily driven by an increasing prevalent population across nine major markets (9MM: US, France, Germany, Italy, Spain, UK, Japan, China, and India). The leading blockbuster franchises, from 2019, such as Victoza in the glucagon-like peptide-1 (GLP-1) space, Januvia for dipeptidyl peptidase-4 inhibitors (DPP-4Is), and Lantus in the insulin market, are undergoing an erosion of their market share due to a combination of novel therapies emerging from the pipeline, and generics and biosimilars rapidly entering the market. Specifically, there is the erosion of Victoza’s market share, from the continued growth of Lilly’s once-weekly GLP-1 Trulicity (dulaglutide) and the rapid growth of Novo Nordisk’s Ozempic (semaglutide) and Rybelsus (oral semaglutide). The erosion of Januvia is due to patent expiry in that had been expected in 2022 and physicians’ preference for sodium-glucose linked transporter-2 inhibitor (SGLT-2I) therapies such as Farxiga (dapagliflozin) and Jardiance (empagliflozin) due to their ability to improve glycemic control and address cardiorenal comorbidities.

Many of the current existing therapies are often viewed by physicians as not optimal to addressing the needs of patients, and challenges remain such as improving patient compliance, safety profile, and addressing comorbidities of T2D. The majority of therapies entering the market are either me-too therapies or generics, offering little or no difference to their originators, and therefore these unmet needs largely remain needing to be addressed. The development of drugs that address these unmet needs can be identified in the pipeline, with the most significant innovative therapy recently launching to market, Eli Lilly’s GLP-1 receptor agonist (GLP-1RA)/gastric inhibitory polypeptide (GIP) receptor agonist Mounjaro (tirzepatide), immediately obtaining a significant market share across the US, five European countries (5EU: France, Germany, Italy, Spain, UK), and Japan.

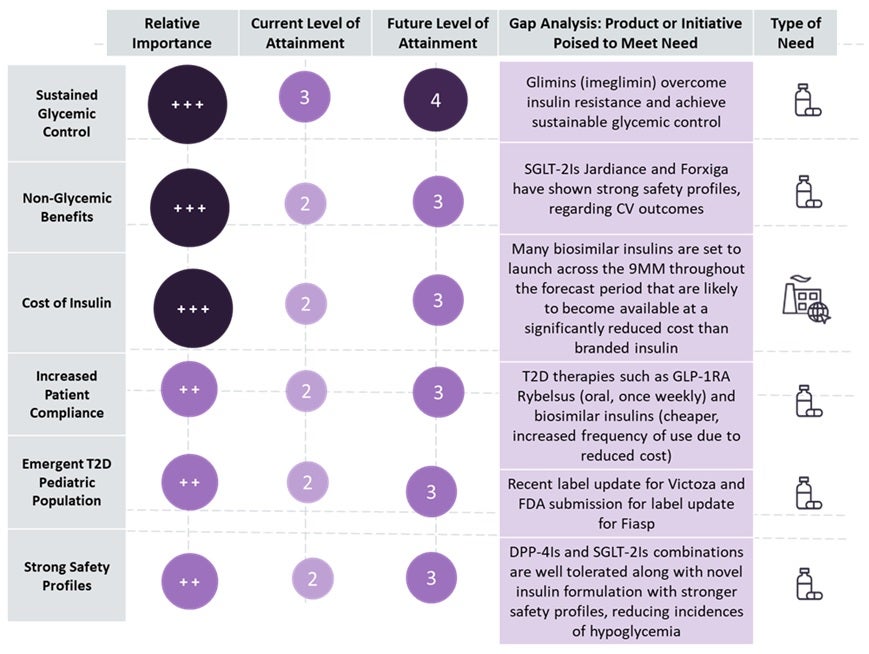

The figure below summarizes the unmet needs and opportunities in T2D.

GlobalData expects that the T2D market will see significant growth from 2019–29, with the 9MM having a total of $45.9 billion in sales in 2019, increasing to $136.2 billion in 2029, with drug sales almost doubling at a compound annual growth rate (CAGR) of 11.5%. There are multiple drugs in the pipeline, predominantly me-too and biosimilar therapies, with a significant number developed in the emerging markets of India and China by domestic pharmaceutical companies for their own rapidly growing markets. The therapies likely to drive growth significantly across the market include GLP-1RAs semaglutide (Ozempic), at a CAGR of 29.3%, and oral semaglutide (Rybelsus) with a 112% CAGR, due to significant market growth as the therapy launches across the 9MM throughout the forecast period. In addition, market growth will be driven by dapagliflozin (Farxiga) in the SGLT-2I space, and novel GLP-1/GIP Mounjaro (tirzepatide), biosimilar/interchangeable insulins such as insulin lispro and insulin glargine (Basaglar), and the launch of once-weekly insulins icodec and Icosema, forecast for 2024 launch.

Specifically, across all the major classes there are significant developments, label updates, and biosimilar launches that are driving their growth. In the GLP-1RA space, the launch of once-weekly subcutaneously administered Ozempic and orally administered Rybelsus, in 2020, were particular game-changers and demonstrated cardiovascular benefits, reducing the risk of major adverse cardiovascular events (MACE), and demonstrating weight loss benefits for treating obesity. In the current GLP-1 market, there is a significant competition regarding clinical data for weight loss in patients with and without T2D, and semaglutide has demonstrated significance in this space. However, Eli Lilly’s recently launched GLP-1/GIP dual agonist therapy Mounjaro has demonstrated superior clinical data to semaglutide in weight loss, as well as improving glycemic control, potential cardiovascular benefits, and improving blood triglycerides. Mounjaro is forecast to compete for significant market share with semaglutide and also Lilly’s Trulicity (dulaglutide), reaching peak sales of $10.2 billion in 2029, although its sales growth is likely to continue beyond 2029.

There is a general decline in the major brands across the DPP-4I market, with sitagliptin (Januvia), the former market-leading T2D therapy, undergoing significant market decline with its impending patent expiry in 2027 and the development of sitagliptin generics in the Indian market. However, there are several me-too DPP-4I therapies launching in the Chinese market, which has led to a steady growth (9MM CAGR of 0.3%, China CAGR of 0.39%) for the DPP-4I market, but a likely continued erosion of the traditional branded therapies such as Januvia, Onglyza, and Tradjenta.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the SGLT-2I market, there is significant market activity with label updates for the main blockbuster therapies addressing T2D patients who suffer from heart failure (HF) and now chronic kidney disease (CKD). Farxiga has successfully won label updates for these two cardiorenal comorbidities of T2D due to the successful results from the Dapa-HF, Dapa-CKD, and DECLARE-TIMI 58 trials, and Invokana for T2D heart failure and diabetic kidney disease. Jardiance (empagliflozin) has achieved similar label updates for T2D with HF and CKD as a result of the EMPA-REG trials and is competing heavily with Farxiga for successful long-term market dominance in the SGLT-2I market. However, Invokana is likely to continue to lose market share (forecast 9MM CAGR decline of 14.6%), due to an FDA boxed warning regarding diabetic ketoacidosis and increased risk of lower limb amputations.

The SGLT-2I space is rapidly gaining market share from the DPP-4Is and other non-insulin anti-diabetic therapies as a barrage of clinical data in the last several years has demonstrated that they address the comorbidities of T2D. This addresses a key unmet need and is a revival for the class, as physicians had previously become weary of SGLT-2Is due to problems regarding their safety profile. There is increased competition in the SGLT-2I market in India and China also, with multiple generics in the Indian market and several me-too therapies in China, such as the recently launched Ruiqin (henagliflozin) and Phase III janagliflozin (XZP-5965) as well as SGLT-1/SGLT-2/DPP-4I triple combination oral therapy, THDBH-100.

In the insulin market, there are several shifts in the therapies that are dominating the market share, with blockbuster franchises such as Eli Lilly’s Humalog (insulin lispro) and Sanofi’s Lantus (insulin glargine) significantly decreasing in sales during the 2019–29 period. This is being directly driven by the emergence of biosimilars/interchangeable insulins, such as Sanofi’s Admelog (insulin lispro), Lilly’s Basaglar (insulin glargine), and Mylan’s Semglee (long-acting insulin glargine). Furthermore, there is significant market uptake for Novo Nordisk’s insulin portfolio, including Fiasp (ultra-rapid insulin aspart), Tresiba (insulin degludec), and combinations Xultophy (insulin degludec + GLP-1RA) and Ryzodeg (insulin degludec + aspart). For combination therapies, market uptake remains strong, and this can be seen with the performance of Xultophy (CAGR of 9.1%) and Ryzodeg (CAGR of 16.9%), and additionally Sanofi’s Soliqua (insulin glargine + lixisenatide, CAGR of 28.5%). This is due to the innovative mechanism and benefits of combination therapy in increased efficacy, improved patient compliance, and removal of the complication of multiple daily injections. In addition, further drivers for the insulin market will include the launch of once-weekly basal insulins, which include Novo Nordisk’s insulin icodec and combinatorial insulin Icosema (icodec + semaglutide), both forecast to launch in 2024, and Eli Lilly’s Basal Insulin-fc, forecast to launch in 2026. These once-weekly basal insulins are likely to gain significant market uptake due to efficacy that is comparable, or superior, to existing basal insulins such as glargine and lispro, and improved patient compliance from reduced frequency of administration.

Novel classes are also emerging in the T2D market, with a novel pipeline agent in Phase II for the GLP-1RA/GIP/glucagon receptor (GR) triple agonist class, Lilly’s first-in-class therapy retatrutide. The glimins, a novel class, have Poxel’s first-in-class oral therapy imeglimin, currently marketed in Japan, but in Phase II in the EU and US, and the novel glucokinase (GK) activator class has PF-04937319 in Phase II in China and is likely to be the second therapy launching in that class after dorzagliatin that launched in 2022. These novel therapies all address key unmet needs in the T2D therapy space, with retatrutide addressing additional comorbidities, particularly obesity, and imeglimin having an entirely novel mechanism, which is useful for patients who poorly respond to traditional oral antidiabetic therapies. PF-04937319 offers some improvement by way of safety and tolerability, which the traditional first-line therapies thiazolidinediones (TZDs) and sulphonylureas (SUs) are failing to provide. There are several other promising therapies such as oral insulin (insulin tregopil), which will likely dominate the Indian insulin market, and Oramed’s ORMD-0801, an oral insulin that is in Phase III in the US and will likely gain a large share of the US insulin market by 2029.

In addition to these late-stage pipeline agents that are close to launch, and multiple updates in the market activity of the major classes across the US and 5EU, including GLP-1s and basal insulins, there are numerous biosimilar/interchangeable insulins and me-too DPP-4I and SGLT-2I therapies likely to enter the market in India and China between 2019 and 2029. This will lead to the erosion of leading blockbuster insulins and likely the long-term decline of branded therapies produced by major players in the T2D space, especially in the emerging markets. The launch of Lilly’s dual agonist Mounjaro and the continued significant market uptake of its GLP-1 Trulicity (dulaglutide), Novo Nordisk’s semaglutide therapies (Ozempic and Rybelsus), the GLP-1 and GLP-1/GIP classes, and in future the GLP/GIP/GR class, will lead to significant market erosion of the established GLP-1 therapies.

Furthermore, there are therapies with patent expiries during the 2019–29 period that will lead to the development of generics and biosimilars and pave the way for novel classes of agents to potentially gain a greater market share, if they are able to address the unmet needs both physicians and patients hope to see addressed. Most of these pipeline agents will compete for market share and will increasingly be prescribed in combination across classes for increasingly complex T2D patients with comorbidities.